© All Rights Reserved

Terms

Hansi Mehrotra is the current editor of Money Management India. Hansi has been writing and editing investment content for over 20 years. She writes for CFA Enterprising Investor. She has also been a member of the CFA Institute since 1999.

Start researching mutual funds with AMC dossiers

30 August, 2022

by MMI Editor

Start researching mutual funds with AMC dossiers Some believe selecting mutual funds is easy. Just look at the short and long-term ‘track record’, perhaps relative to the relevant index and peers. Others use ‘risk-adjusted performance’ instead, which in practical terms means using a ratio like Sharpe Ratio, Information Ratio or Sortino Ratio. The sophisticated add

- Published in Advisory Process, Featured

50 shades of value investing in India

15 July, 2022

by MMI Editor

While everyone agrees that value investing is buying a stock for less than its intrinsic value, this is easier said than done. There is no one way to calculate intrinsic value. Over time Warren Buffet’s definition of value has changed from the ‘cigar butt’ approach that his mentor Ben Graham espoused to a more broader

- Published in Equities, Featured, Portfolio Construction

Big Data and ML in funds research

11 November, 2021

by MMI Editor

Fund Manager evaluation demands an assessment across multiple dimensions, including the investment process, risk management, operations, and the business model. We have compiled the latest research on using Big Data and Machine Learning (ML) in funds research. — In a live webinar organised by the CFA Society India in April 2021, Sabeeh Ashhar of Morningstar

- Published in Portfolio Construction

InCred Wealth

29 October, 2021

by MMI Editor

InCred Wealth is part of the InCred financial services platform that aims to leverage technology and data-science to ease many pain-points and disrupt many segments. The group founder, Bhupinder Singh, has been an investment banker with Deutsche Bank for more than 15 years. He set up an NBFC, InCred Finance in 2016 with the backing

- Published in Dossiers on wealth firms

Delivering private wealth services

28 October, 2021

by MMI Editor

Having decided which products & services will be offered and then done some high level marketing activities, private wealth firms deliver these services in a ‘high touch’ way – through very senior private bankers (PBs), wealth managers (WMs) and relationship managers (RMs). We now look at the ‘final mile’ – the sales, advice and relationship

- Published in Advisory Process

Marketing luxury advice

28 October, 2021

by MMI Editor

Private wealth caters to high net worth individuals, who are also consumers of luxury goods and services. So is private wealth/banking a luxury service? Does the private wealth industry use luxury marketing techniques and do they work? We explore. Defining luxury services Defining luxury services should be easy – ‘turns out it’s not. Apparently, the

- Published in Marketing

Private wealth product platform

28 October, 2021

by MMI Editor

Having decided on the value proposition, let’s look at the specific products & services (features in a tech context) that the Indian wealth management industry has decided to offer. Firms were very clear that they can help ‘manage and grow’ wealth, not ‘create’ wealth. Their clients, whether entrepreneurs, inheritors or professionals, were better able to

- Published in Advisory Process

High net worth investors – client segmentation & needs

28 October, 2021

by MMI Editor

Having established that there is a reasonably large, and growing, number of potential clients with wealth, we need to ask what their needs are. What does ‘managing wealth’ actually mean? Client segmentation – beyond source of wealth We can safely assume that all potential clients – the high net worth individuals – are not the

- Published in Advisory Process

Private wealth industry – size & players

28 October, 2021

by MMI Editor

As outlined in the value proposition article, it is hard to estimate the size of the private wealth management industry for a number of reasons. Some firms include their affluent customers in their publicly available figures for AUA and revenue which is a bigger and more crowded segment. Private wealth firms compete with numerous other

- Published in Business Issues

Hidden risks and opportunities in India

15 August, 2021

by MMI Editor

The Marsh McLennan group released a report ‘The Elephants in the Room: Hidden Risks and Opportunities in India‘ in July 2021. It’s a compendium of articles that represent key economic and social issues which organisations in India have to contend with. India recently regained the title of being the fastest growing major economy after a

- Published in Economy & Markets

ASK Wealth Advisors

15 June, 2021

by MMI Editor

Launched in 2007, ASK Wealth Advisors (ASK WA) was part of the first wave of launches of private wealth firms. The parent company, ASK Group had started in the early 80s and formed a joint venture with US-based Raymond James in the 90s to offer investment management services through a portfolio management service (PMS) structure.

- Published in Dossiers on wealth firms

Alpha Capital

02 June, 2021

by MMI Editor

About Alpha Capital is a wealth management and MFO boutique firm set up in xx. The website mentions offices in five locations – Mumbai, Gurgaon, Kolkata, Coimbatore and Siliguri. It does not mention which SEBI license the firm holds. The firm was included in the Asian Private Banker 2020, 2019 and 2018 lists of top

- Published in Dossiers on wealth firms

Axis Bank Burgundy Private

12 May, 2021

by MMI Editor

While late to the party, Krishnamurthy is upbeat about its progress and future prospects, citing ‘One Axis’ as its USP. Due to its various divisions – securities/investment banking, asset management etc – being under one umbrella and control, he feels Axis Bank is able to offer a much more cohesive service to its affluent and

- Published in Dossiers on wealth firms

Cervin Family Office

12 May, 2021

by MMI Editor

About Cervin Family Office was founded by Munish Ramdev who is presently the founder & CEO of the company. The firm holds the RIA license from SEBI. The team used to work together at Waterfield Advisers and hence, has experience advising over 70 family offices and UHNV individuals with over USD 3.5 billion in financial

- Published in Dossiers on wealth firms

Entrust Family Office

12 May, 2021

by MMI Editor

About Established in 2013, the firm helps in providing advice on both investment and non investment activities. Entrust has offices in Bangalore, Delhi, Mumbai, Chennai. Key staff Rajmohan Krishnan- Principal founder & managing director – he has a good knowledge about financial services industry and a great advisory experience. Shashank Khade- Co-founder & director –

- Published in Dossiers on wealth firms

Edelweiss Private Wealth

10 March, 2021

by MMI Editor

Established in 2010, Edelweiss Private Wealth was a step behind some of its counterparts which started in 2007. But it has made up for lost ground by growing faster than almost all its competitors. At an AUA figure of USD 15 billion, it’s among the top three in the industry. In 2020, private equity

- Published in Dossiers on wealth firms

What can financial advisers call themselves?

15 October, 2020

by MMI Editor

I used ‘educator’ on my LinkedIn heading before being told it sounds like a professor. Not that there is anything wrong with being a professor – I would love to be one, in fact – but it just intimidates my audience of mostly women and young people (for The Money Hans initiatives). I could tell

- Published in Business Issues

Making information flow more efficient

30 March, 2020

by MMI Editor

Finance is the nervous system of the world. However, many parts of the finance industry are inefficient, which has significant repercussions. The world gets major mood swings, at times throwing up excesses. I believe we could alleviate some of the symptoms by making some information more transparent so that it travels more efficiently. Let me

- Published in 3_Communication

Do you need an investment philosophy?

03 February, 2019

by MMI Editor

Recently, I was invited to participate in a panel discussion on the ‘Art & Science of Stockpicking’. I was fascinated by the topic because I had studied both art and science (actually literature and biology) at undergraduate level and then had chosen finance as a career. I had researched investing somewhat (remember this was 25

- Published in Portfolio Construction

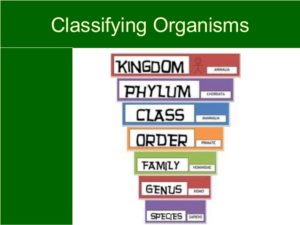

Fund categorisations: confusing segments and style

07 November, 2017

by MMI Editor

The Indian media has been discussing SEBI’s circular on categorisation and rationalisation of mutual funds ever since it came out in October 2017. I had written about the need for better fund classifications last year, so I didn’t comment further. But the news that AMFI has asked SEBI to reconsider has prompted me to share

- Published in Portfolio Construction

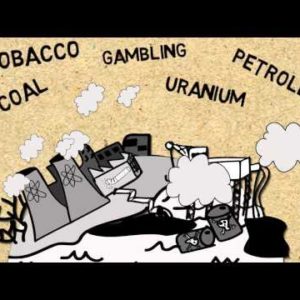

Can better fund research fix capitalism?

21 October, 2017

by MMI Editor

“We have met the enemy and he is us.” — Walt Kelly We blame capitalism for most of our modern ills, from climate change to iPhones that die every two years. Yet we rarely bother to read the sales pitch our accountant, banker, or adviser gives us for the mutual funds to invest our hard-earned

- Published in Portfolio Construction

The value of dumb questions

24 April, 2017

by MMI Editor

Being an outsider, as I have been for most of my life, brings with it a feeling of inadequacy. To hide this feeling, I did what many others do – I would preface questions with ‘Hey, I am new here….may I ask a dumb question?’ Today, I care less about what people think of me,

- Published in 3_Communication

Has goal-based investing ruined Modern Portfolio Theory?

18 November, 2016

by MMI Editor

Modern or mean-variance portfolio theory (MPT) is an important financial concept. But it has little practical value for retail investors when it to comes to asset allocation. Recently, goals-based investing has grown popular with both financial advisers and robo-advice tools. Financial advisers continue to apply an ‘”asset allocation overlay” check to ensure goals-based portfolios are

- Published in Portfolio Construction

What can blow up in your portfolio?

30 July, 2016

by MMI Editor

That’s the question investors should ask when assessing portfolio risk, rather than focusing on volatility. Speaking at a speaker event organised by Indian Association of Investment Professionals (IAIP), Raj Manghani, the Managing Director – Financial Analytics for MSCI, explained scenario analysis and stress testing. Testing the ability of a portfolio to withstand shocks in liquidity, markets and

- Published in Portfolio Construction

Classifying funds

24 April, 2016

by MMI Editor

Investment decisions rely on performance of funds universe including that of the median and various quartiles. Hence, the universe category definitions and classifications are very important. Unfortunately, AMCs have multiple funds in the same category with significant dispersion in returns. To make it worse, leading rating houses have different classification methodologies resulting in different classifications.

- Published in Portfolio Construction

Funds research…deconstructed

18 February, 2016

by MMI Editor

I love watching cooking shows. It doesn’t matter that I don’t cook. I watch for enjoyment sake, and perhaps for the comfort of knowing that in a cooking emergency, I will be able to put something together. One concept that I always get fascinated by is that of ‘deconstructed’. Chefs separate or deconstruct the ingredients

- Published in Portfolio Construction

Why we need active funds

03 February, 2016

by MMI Editor

The active versus passive debate rages on. The passive camp points out that active funds, in general, don’t do what they are supposed to do – outperform the passive benchmark. They charge high annual management fees, even in the years they underperform. They encourage intermediaries to charge fees or commissions to select amongst them (or

- Published in Portfolio Construction

Why good mutual fund research is hard to find

12 January, 2016

by MMI Editor

There are many brilliant books on stock picking, from simple beginners’ guides to classic textbooks like Ben Graham’s Security Analysis and The Intelligent Investor. I could find only one credible book on mutual funds: John Bogle’s Common Sense on Mutual Funds. Bogle’s advice? Investors should put their money in index funds. A number of finance luminaries — Warren Buffett,

- Published in Portfolio Construction

Why you shouldn’t invest in 5-star rated mutual funds

18 December, 2015

by MMI Editor

Ask any investor how they select mutual funds (MF) – the most common answer tends to be on the basis of star ratings. Such is the allure of stars that it doesn’t appear to matter whose stars. I know so, because I spent my career in fund research. And no matter how different my firm’s

- Published in Portfolio Construction

Role of financial ratings

30 October, 2015

by MMI Editor

When people hear the leader of a country comment on how a credit rating agency should rate its debt, they realise credit ratings are important. When they read about the role of credit ratings in the global financial crisis, they get angry about the finance industry being responsible for their misery, but figure they must

- Published in Portfolio Construction

How Nobel prize winners invest

30 October, 2015

by MMI Editor

Everyone in finance would know about the efficient frontier… it’s a concept from Modern Portfolio Theory put forward by Harry Markowitz in the 1950s. So Markowitz is like God in the world of portfolio management. I was always curious about how Markowitz invests his own portfolio. Imagine my delight when I found the answer in

- Published in Portfolio Construction

Making sense of too many products

03 October, 2015

by MMI Editor

Like in many other markets, the mutual fund industry the world over seems to have a dazzling choice of products, but with the top few dominating assets under management and inflows. In the US, there are more funds than stocks. Even in a nascent market like India, there are more than 1,000 choices, and that’s

- Published in Portfolio Construction

Choose your value proposition

03 July, 2015

by MMI Editor

Unlike medicine where there is a clearly defined distinction between the general practitioner and various specialists, wealth management is a grey area the world over. While global regulators are increasingly separating brokers/distributors from advisers based on compensation source, wealth managers can still choose their own business model and area of focus based on their own

- Published in Advisory Process

Fund managers need the right temperament

09 June, 2015

by MMI Editor

What kind of people make good fund managers? While everyone should be interested in this question, there is surprisingly little research on this topic. Dr Jack Gray talks to Hansi Mehrotra about his efforts and findings. While the general perception may be that investments is about numbers, investment professionals everywhere agree that money management is

- Published in Business Issues, Portfolio Construction

Intro to Modern Monetary Theory

06 June, 2014

by MMI Editor

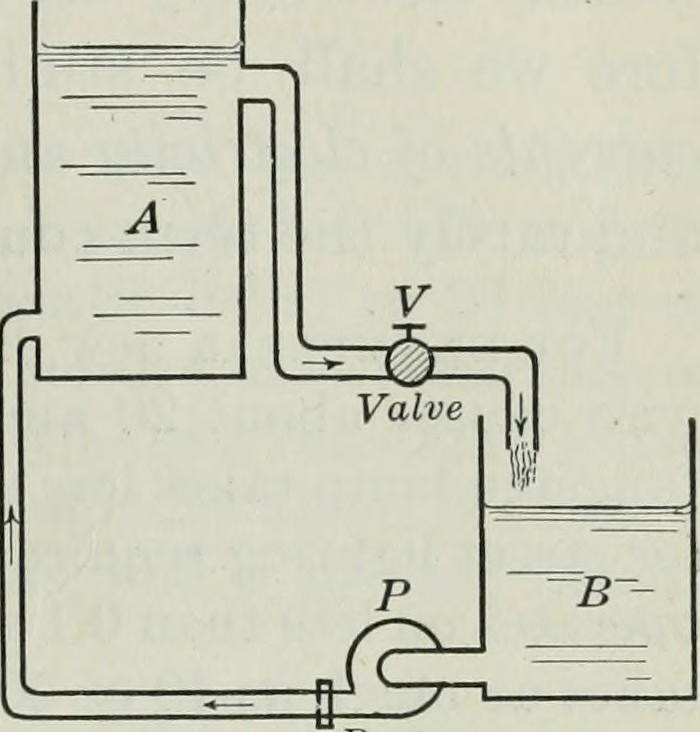

Being a professor in risk management, Professor Frank Ashe had to explain the biggest risk event in recent history – the global financial crisis. He went back to basics to understand the genesis of the credit bubble, in the process discovering Modern Monetary Theory and how government deficits are not as bad as people think.

- Published in Economy & Markets

Role of credit rating agencies

15 April, 2014

by MMI Editor

Credit rating agencies have been criticized for their role in the 2007 sub-prime crisis, which led to the global financial crisis, but it wasn’t until a recent lawsuit exposed their internal emails that it became clear to what extent they were responsible. While the global financial crisis can’t be blamed on any one in particular,

- Published in Business Issues, Economy & Markets

Philanthropy getting organised

21 December, 2013

by MMI Editor

While Indians have had a long history in philanthropy, the space has not been organized. However this is changing, probably not co-incidentally, with the transfer of wealth to the younger generation which is more technologically savvy and wants more transparency. Philanthropy has a deep and broad foundation in Indian society, though it’s only recently being

- Published in Wealth Planning

New paradigm – blending returns and impact

21 December, 2013

by MMI Editor

Families typically invest their portfolio in ‘traditional’ investments such as equities, real estate, cash etc with the aim of maximizing returns, while allocating a small part of their wealth to philanthropy. However, they could look at following global institutional investors’ example and combining returns and impact through Responsible Investments and Impact Investments. Wealth planning discussions

- Published in Wealth Planning

Family wealth governance

21 December, 2013

by MMI Editor

While a lot of the discussion on wealth planning is focused around the legal structures and documents, a crucial area that could make or break the intent of these structures is the governance. Families are starting to discuss governance, not only related to succession planning in the family business, but also in the management of

- Published in Wealth Planning

Investing in a multi-jurisdiction maze

21 December, 2013

by MMI Editor

Wealthy families rarely have all their wealth in their home country – they tend to accumulate and invest in multiple places around the world. This means navigating a maze of regulatory and tax environments. Indians are living and investing overseas Wealthy Indians spend a lot of time outside of India, whether it is for business,

- Published in Wealth Planning

Managing trusts

21 December, 2013

by MMI Editor

Once a family decides to set up a trust, it has to select service providers to help set up the trust and also to help manage the trust. The ongoing management is done by the trustee, protector and administration provider. Families can appoint family members or friends as individual trustees, or a corporate trustee –

- Published in Wealth Planning

Demand for wealth planning

15 December, 2013

by MMI Editor

There is an undisputed need – and opportunity – for wealth planning structuring in India for the ever-growing number of wealthy entrepreneurs, families, and other individuals. The challenge for wealth managers continues to be how to make the most of this new “once in a lifetime opportunity”. There are numerous drivers for the increasing importance

- Published in Wealth Planning

Practical estate planning

06 December, 2013

by MMI Editor

While wealth planning encompasses a wide range of topics, the most significant one is trans-generational wealth transfer though estate and succession planning. The simplest way to execute estate planning is leaving a will, but even this not universally done. Given the multiplicity of succession laws applicable in India, and the inefficiency of the legal system,

- Published in Wealth Planning

Forget track records for responsible investing

09 December, 2009

by MMI Editor

The United Nations Principles for Responsible Investment now claims over 550 signatories with more than USD 18 trillion in assets. UNPRI provides a framework for institutional investors to integrate environmental, social and governance (ESG) factors into investment processes. Also, the International Finance Corporation has sponsored a study on the prevalence of RI in emerging markets.

- Published in Equities