research

MMI intends to publish tools to allow financial advisers and investors to manage their research process and library.

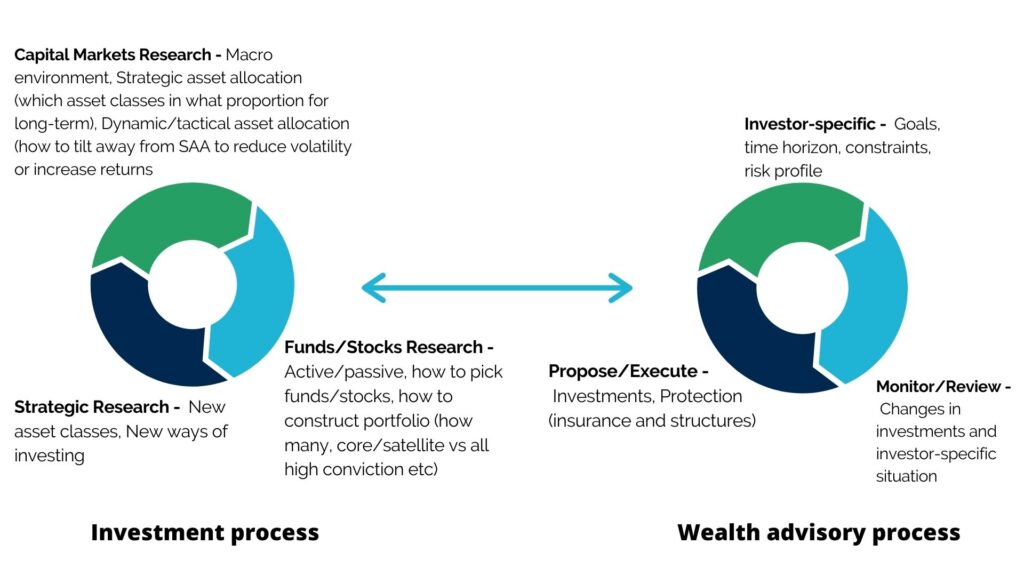

We believe advisers are right to focus on the ‘wealth advisory’ or ‘financial planning’ process which deals with investor-specific issues. Advisers rely on research/rating houses to provide research on funds. However, they might miss the understanding of what went into the fund selection process.

The investment research process is, in fact, an amalgamation of at least three areas – strategic, capital markets and fund research.

levels of research

strategic research

- What asset classes should we include and why?

- Are there any new asset classes or are old ones being re-packaged into new product structures?

- Are there new ways of investing in existing asset classes?

capital market research

- What is the current macro and inflation environment and how does it compare with history?

- How to construct a strategic asset allocation for the long-term that maximises returns for a given level of risk?

- Is it worthwhile to predict market over/under-valuations and tilt away from the strategic asset allocation in the medium or short-term to reduce volatility?

fund research

- Does active management add value?

- If so, how does one identify such active managers in advance?

- How many funds to include and how to combine funds – core/satellite or all high-conviction funds – into a portfolio?