Making information flow more efficient

Finance is the nervous system of the world. However, many parts of the finance industry are inefficient, which has significant repercussions. The world gets major mood swings, at times throwing up excesses. I believe we could alleviate some of the symptoms by making some information more transparent so that it travels more efficiently.

Let me explain, by first going back to basics.

The finance eco-system

We need finance. Households manage cash flows through their lifetimes, sometimes borrowing and other times investing surpluses through investment products. They manage risks through insurance products. They transact with one another, and other market players, through payment systems.

Businesses use finance for the same purposes. Hence, the four main functions of the finance are – to pay, to connect borrowers and savers, to manage risks, and to manage savings across lifetimes and between generations.

Savings are invested in businesses, real estate and governments through financial markets.

Since there are too many savers and businesses, we need intermediaries to help identify opportunities, seek out the best value options, supply and manage the logistics. We also need intermediaries to help us with information.

The finance industry basically acts as an intermediary.

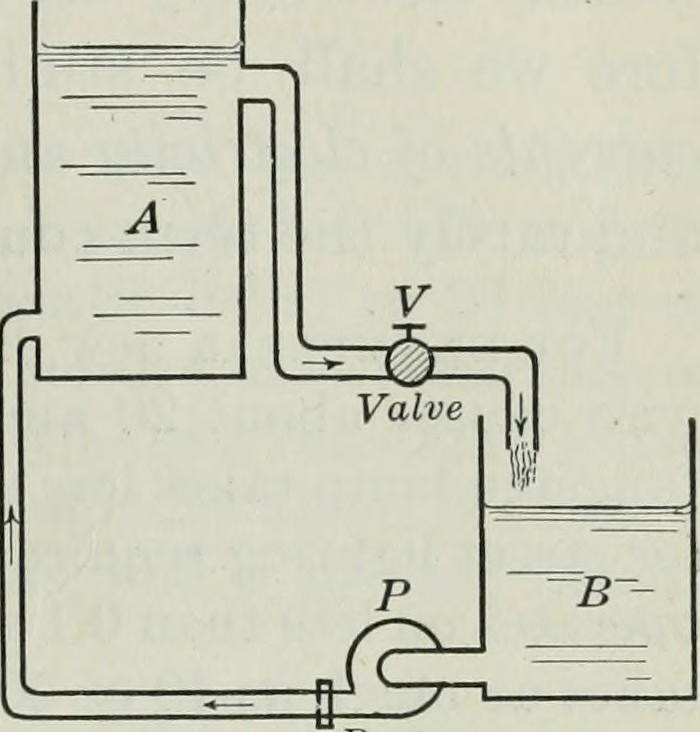

To facilitate the flow of savings between households and businesses, the finance industry created ‘financial securities’ such as stocks and bonds. Securities are essentially claims against tangible or intangible assets, which in turn, represent future income.

The securities are ‘listed’ on various marketplaces called exchanges, where the bids/offers and last transaction prices are visible to all market participants. Indeed, any information that may affect the market prices of securities is made available widely so that it is reflected as quickly as possible. This is why markets are said to be ‘efficient’.

Financial products and services

The finance industry then builds financial products and services on top of the financial securities and exchange structure, including –

- Insurance products allow households to manage risks. They pool small amounts of money from a wide range of households to help the small group of households for whom the risks eventuate.

- Savings and investment products help households grow their savings by investing in more productive uses, either through debt or equity securities. Savings products tend to be offered by banks. Investment products include pension funds, mutual funds, and alternative funds. Funds tend to be trust structures with separate trustee and manager functions.

- Service providers include stockbrokers and financial advisers who help savers select investment products

The accompanying chart shows the list of financial products and services that a typical household will come across in India –

These financial products and services make it easier for households to participate in the securities markets by acting as packaging intermediaries.

Finance is information

The core of finance is information. All participants in the financial eco-system have access to information, albeit to different degrees. They then analyse the information differently and then transact based on their goals and behavioural preferences.

The securities markets have been around for much longer, so the information flow tends to be reasonably efficient. Market participants have similar access to information, although the speed of technology may be giving some participants an edge over others. Over time, more ‘professionals’ have entered the market who have been trained in similar analytical tools and processes, hence are coming to similar conclusions. This is probably why it’s getting harder to outperform market indices.

In comparison, the financial products and services built on top of the securities markets are a lot less transparent and the information flow is a lot less efficient. This seems counter-intuitive since these products, such as mutual funds, are meant to package the underlying securities markets in an easier-to-handle form for the households.

For example, to select securities from within a sector, an individual can study the competitive landscape of that sector, and then read the financial statements of various companies in that sector to understand the strategy and relative positions. She can also watch interviews, or read transcripts of any interviews, with the managements of companies. She can be assured that the companies can’t change industries or strategies overnight.

On the other hand, when selecting mutual funds, investors don’t need to analyse individual sectors or companies; they need to assess the relative ‘skills’ of fund managers managing the wide range of mutual funds available. They are given one-page fact sheets summarizing fund objectives, historical performance, risk statistics (based on historical performance), holdings etc. Sometimes, these include qualitative analysis of the fund managers’ investment philosophy and skills. However, investors need the help of financial advisers to understand such fact sheets.

The information gets even less transparent when it comes to alternatives funds.

Influx of more information providers

As the Indian industry grows in size and complexity, there are more research providers entering the industry to help with organizing and disseminating of information, both at the underlying securities markets and the financial products and services levels.

- Fintech marketplaces – lending platforms that compare loans offered by a range of banks and non-banking financial institutions

- Fintech aggregators – eg. BankBazaar, PolicyBazaar etc that compare savings and insurance products

- Fintech in securities – stock execution services eg. Zerodha, Upstox and technology layers facilitating portfolios eg. Smallcase, WealthDesk

- Fintech in wealth management – plethora of robo-advice platforms that compare mutual funds

- Aggregators of information on alternative products such as PMS and AIF for the benefit of high net worth investors

Let’s make b2b information flow more efficient

We believe the way the finance industry communicates with one another has room for more efficiency.

For example, when a PMS or AIF is launched, the providers have to seek out distributors and advisers individually to tell them about the product. While mutual funds can use broader media, alternatives funds are barred from doing so.

Similarly, there are many ancillary service providers in the industry such as in technology, marketing/public relations, education, legal, placements, etc that have trouble finding one another.

In a bid to make information flow a little more efficient in some select pockets, we are launching Money Management India (MMI) as a research marketplace.

MMI will focus on –

- Economy and markets – academic papers and insights into the Indian economy and markets from a longer-term perspective (no short term market forecasts)

- Asset classes – analysis on various asset classes such as listed equities, debt, real estate, private equity, private debt, infrastructure etc

- Fund research – interviews with fund managers, especially alternatives and PMS managers, to summarise their investment philosophy and strategy

- Other investing insights – such as behavioural finance, communication, learning etc

We will not host any sensitive information such as views on listed securities.

The formats will range from simple blog posts with innovative ideas to detailed discussion papers by global consulting firms. The site will link to and host original multi-media (audio and video) interviews with fund managers and other market participants.

Contributions are welcome provided they follow editorial guidelines.

We hope we can contribute to making finance a more efficient nervous system.

You must be logged in to post a comment.