about us

Money Management India is a professional knowledge network

In summary, we aim to be –

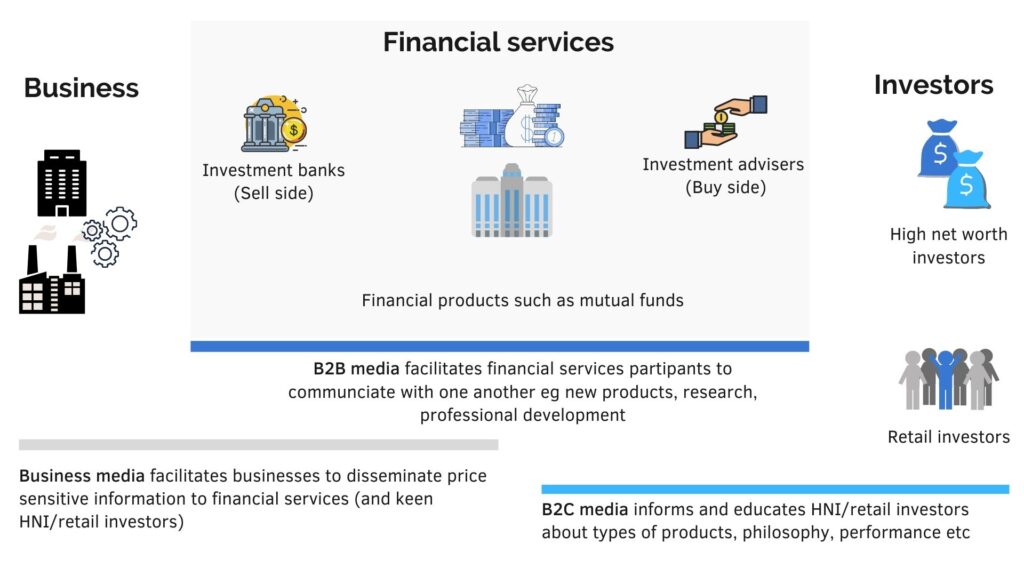

trade (b2b) media

for the asset & wealth ie professional money management industry in India (and globally)- Curation-as-a-service with compilation of the best content on the chosen topics

- Original articles by MMI editor & team on various topics and asset classes

- Blog posts by selected industry leaders

- Outlet for thought leadership for brands to reach others within industry

networking marketplace

- Directory of providers, organised by type with appropriate list of services, tags etc

- Internships for freshers to get hands-on experience and exposure to all asset classes

research & education

- Research on all kinds of money management (mutual funds, pms, aif, wealth)

- Upfront and Continuing Professional Development (CPD) on mutual funds, alternatives, wealth

who this site is for

Designed as a B2B portal, Money Management India aims at professionals in the Indian financial services industry who are involved in retail or institutional savings (i.e. the buy side). It will also serve as a central resource for overseas investors investing in India.

In particular, we hope to serve –

• Investment advisers or portfolio construction practitioners – those who design, build and/or manage investment portfolios (or who must understand how others do so)

• Wealth managers and top IFAs, distributors/brokers/agents – those who advise or sell to individual investors, such as mutual fund distributors, insurance agents and brokers, stock brokers, real estate agents and brokers etc

• Ancillary advisers – those who advise individual or institutional investors on other issues, such as tax and legal, which affect investments (such as accountants, lawyers, media advisers, academia etc)

• Overseas investors investing in India – those who advise, or are themselves, individual or institutional investors on investing into India (such as investment consulting, pension funds, family offices, or any of the above categories)

• Product manufacturers – those who offer financial products to any of the above (such as asset management companies, alternative investment funds, insurance companies, investment banks etc)

how we will get paid

We will partner with relevant industry associations and sponsors who share our commitment to research, education and knowledge exchange. Their support enables us to cover costs and publish the website without charge to its readers. We retain the site’s content and editorial independence at all times.

We also plan to launch a paid subscription/membership service for research & education.

who we are

The logo represents our aim – better investment products, advice and communication. The dot in the middle represents the investor we are all serving. We aim to increase investors’ financial well-being by promoting better design of investment products, better delivery of wealth management advice and better communication.

The founder, Hansi Mehrotra, brought Mercer’s investment business to India in 2008 and then set up Hubbis in India in 2012. She has been blogging on LinkedIn, where she has been named TopVoice and PowerProfile a number of times, and now has ~280k followers. She is now combining her research and publishing experience to launch this multi-media initiative. More info at (https://www.linkedin.com/in/hansimehrotra)