While everyone agrees that value investing is buying a stock for less than its intrinsic value, this is easier said than done. There is no one way to calculate intrinsic value. Over time Warren Buffet’s definition of value has changed from the ‘cigar butt’ approach that his mentor Ben Graham espoused to a more broader approach of ‘fair price for a good business rather than a bargain price for an average business’ helped by his partner Charlie Munger’s contribution.

How to measure value investing

Around the same time that value investing was catching on, academics discovered that low P/B and smaller market cap stocks outperformed higher P/B and larger. The lower P/B approach came to be known as ‘value’ style as it was similar to the ‘cigar butt’ approach. Index creators created value and growth style indices that divided the stock universe into value and growth stocks.

The performance of portfolios and funds were compared with the style indices – if there was high correlation the fund/portfolio was said to be of that style.

Once portfolio holdings were more widely available, a more direct approach developed – if the portfolio held more value stocks, the fund was said to be value. This is essentially what the ‘style boxes’ on MF fact sheets are.

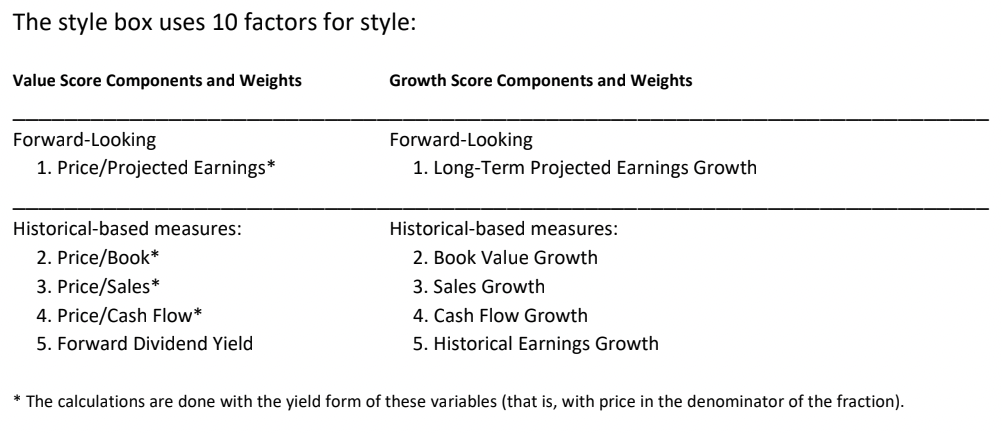

Morningstar has explained the methodology behind its style boxes here. In summary, it uses a range of factors when arriving at value and growth scores –

Institutional investors have been using tools such as MSCI Barra, Style Analytics etc that show more ‘style factors’ than just value and growth for individual stocks (and hence portfolios). Now such tools are available to retail investors. The most common factors tend to be size, value, quality and momentum. More on factor analysis here.

In India, OpenQ provides a free factor analysis tool on its website. Sujit Modi, the co-founder and CEO of OpenQ, spent a few years working at MSCI before developing this tool which is adapted for Indian market conditions. He confirmed that factor analysis is a more detailed version of style analysis, as a broader set of factors are included. OpenQ shows Size, Momentum, Volatility, Yield and Value.

How do Indian MFs stack up on value investing

Most advisers and retail investors refer to Morningstar fact sheets, in which the style box is a snapshot in time. Ideally one should do this analysis over time to see variations over a business cycle. So we approached Morningstar and OpenQ to help with a time period analysis; both used data over the past 2-3 years only, hence, even this study is a starting point for further research.

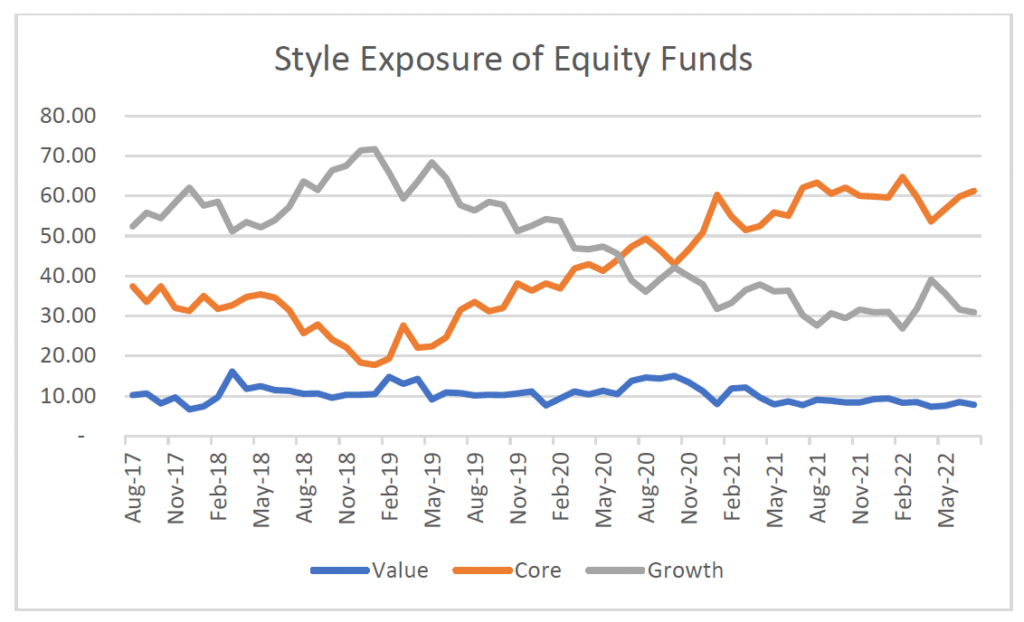

Morningstar’s analysis showed that the majority of Indian equity funds have a bias towards growth and core stocks over the past couple of years. As the valuation of high growth stocks moved up in the period of 2018-20, many funds cut exposure to the growth and moved into the more reasonably valued ccre stocks. Therefore, it can be said that that the majority of Indian equity funds follow a ‘growth-biased approach’ with many following a ‘growth at a reasonable price’ (GARP) style, said Kaustubh Belapurkar of Morningstar.

We also used the OpenQ tool to chart the factor analysis of all equity funds; most funds in the large-cap, multi-cap and flexi-cap appeared to be holding growth stocks over the past 3 years.

Is this even possible? Yes. The 500 stocks listed on the Indian stock exchange add up to a market cap adding to about USD 3 trillion. Since the whole Indian MF industry only holds only about ~USD 250 billion, with the PMS segment adding another USD 50bn, this adds up to less than 9% of the whole market. So while the overall market could be divided into growth and value, it is possible that professional investors, such as Indian mutual funds, are skewed towards value stocks.

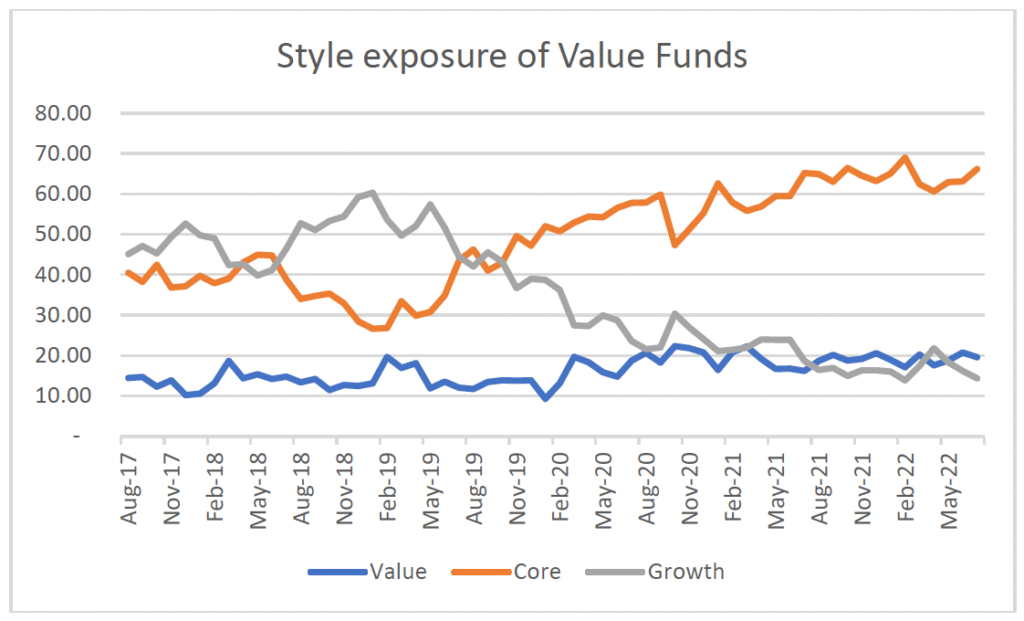

When value funds are not really value

According to Morningstar’s analysis, there were only a few true to style value funds prior to 2018 recategorization. According to Morningstar’s analysis, Post 2018, several funds reclassified into the value category, with their portfolios also showing a drop in growth stock holdings and moves largely into core stocks and slighter increase to value stocks. Hence, Belapurkar agrees that many so-called value funds follow a ‘relative value’ approach.

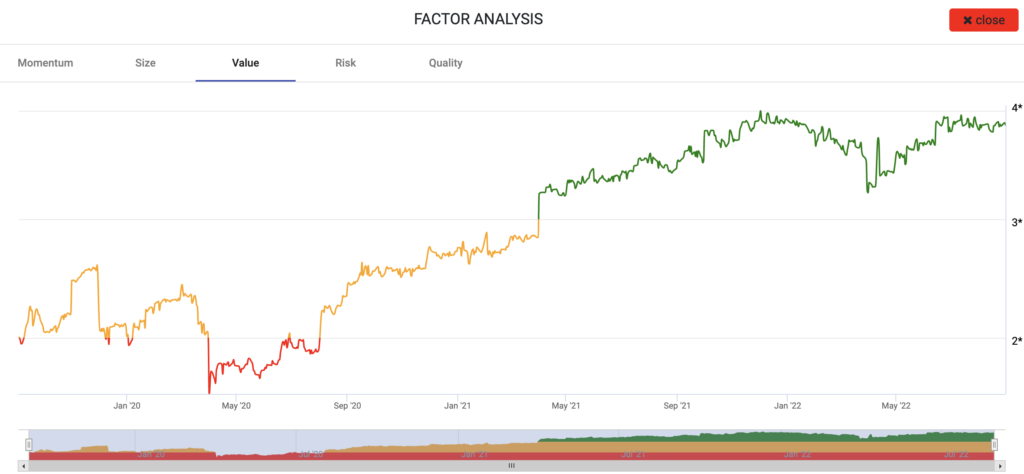

OpenQ had not done such a study, but our own analysts studied the 3-year chart of all Indian equity funds. Our analysis led us to a similar conclusion; most value funds did not show high value factor scores. The notable exception we found was the ICICI Prudential Value Discovery Fund, as is shown in the following chart.

Should investors care about style at all?

Yes. Advisers regularly point out that many funds have ‘overlap’ of stocks so they are not truly diversified. This overlap analysis is basically a rudimentary way to do style diversification. The factor analysis way is a more comprehensive way to do this. So investors should look at the rolling factor analysis charts over time and ensure that the funds they are picking are not too similar – if they want diversification.

Conclusion

Some investors like studying investing, may choose a particular mindset, reflected as a style, and then have the capacity to handle the ups and downs in performance that all styles have. Most retail investors don’t have the skills (nor should they need to) to decide whether they want to choose value or growth style; they want a portfolio of funds that, in aggregate, outperform the index consistently. The aggregate may hide the fact that the under-performance in one fund is counterbalanced by the outperformance in another; over time the whole portfolio should outperform the index by 2-3 percent.

However, it appears that the most popular categories of the 50-odd Indian MFs don’t offer this variety to allow investors to diversify properly. Even in the value category, there appear to be more growth-biased funds – as measured by ‘factors’ of course.

The notable exception is the ICICI Prudential Value Fund.

So investors who want well diversified portfolios should include at least one of these in their portfolios.

We would encourage the other AMCs to 1) reconsider the value label 2) consider offering true value funds.

You must be logged in to post a comment.