While a lot of the discussion on wealth planning is focused around the legal structures and documents, a crucial area that could make or break the intent of these structures is the governance. Families are starting to discuss governance, not only related to succession planning in the family business, but also in the management of family wealth through family constitutions and family councils.

Governance is the framework for decision-making. It comprises rules and practices to guide all stakeholders’ behavior such that there is accountability, fairness and transparency.

Usually when talking about family wealth, people think about their financial assets. But the key is trying to guide them through the whole gamut of family wealth assets – from where they built their wealth through to protecting it for future generations. This also includes their social capital – how they appear in society – as well as the development of the human capital. Given that the process is composed of many types of assets, therefore, it is complex to tackle.

Very often people equate governance to writing a family constitution. However, the value comes from answering the more emotional questions and, more importantly, engaging the next generation in the process.

As Professor Ramachandran, Thomas Schmidheiny Chair and Professor of Family Business and Wealth Management at the Indian School of Business says, “the constitution is means to an end. The discussion around the constitution is more important than the constitution itself.”

When it comes to dealing with succession planning for families who are widely dispersed geographically, the challenge is to engage in in-depth discussion.

First, this means finding a way to get all family members at one table, which involves convincing them that it makes sense to meet as a family with a formal agenda to discuss the key issues they face. At the same time, it is important to combine formal discussions with a social event.

“A governance discussion will help them understand the multiple dimensions and inter-connectedness of retirement, remuneration, succession and management,” adds Ramachandran.

Rising awareness

The concept of family governance is now being discussed at various forums. According to family business governance consultant, Sunil Shah, Director – Evergreen Family Business Advisors, “India has had an explosion of wealth creation, and with wealth comes different types of concerns. The main one is around succession. Simply put, what happens if something happens to me? If the amount is large or if the business is in multiple countries, people are starting to feel the need to take advice. The other issue is that of transfer of wealth from one generation to the next.”

According to most experts, the triggers for wealth planning generally, and governance discussions specifically, were the GMR and Ambani. In the case of GMR, it was a positive trigger with the family sharing their journey of writing a family constitution. The Ambani case was an example of how family wealth could be split up if the family doesn’t discuss succession and governance.

In recent years, the Hyderabad-based Indian School of Business has held a biannual conference with international speakers. The Confederation of Indian Industry (CII) also holds annual conferences in association with the Family Business Network (FBN). The Young Presidents Organisation (YPO) has started hosting some interactive sessions on the subject. So there are multiple bodies that are raising awareness about the subject, providing a platform for families to share experiences.

People are realizing that issues faced by them are common and there in increased comfort in people to openly talk about issues in public, says Anil Sainani Chief Advisor Family Businesses Grant Thornton India LLP, a family governance consulting firm.

Professor Ramachandran categorises people into four groups. The first is people who are not at all aware about any of the possibilities (of governance) and so they go ahead and divide the business and property. The second group is people who are aware of some of the options and possibilities, but don’t know what to do. Third is people who know what to do but don’t know how to do it, and there is also another sub-group of people who know how to do but don’t do it. “And lastly, there is a small fraction of people which actually goes about doing it,” he adds.

He explains that the ISB’s annual conference and training programs cater to the second and third groups respectively i.e. the conference for people who are aware but are not sure, and the training for people who want to learn how to implement a governance program.

According to some experts, families need to be clear about whether they define themselves by their business, or whether the business is a way for them to generate financial assets which can be used for wider family purposes – effectively building the business to sell it.

In the West, for example, people tend to build businesses to sell them, with very few of the next generation involved running the business. But in Asia, people build the business to hand it over to the next generation.

Sunil Shah explains that Indian families are asking a root question which was unheard of until recently – “Should we run the business or sell it off? People are starting to think about the business as an asset. So it’s no longer an heirloom.”

“In the west, succession is an opportunity; Indian families see business continuity as a problem,” he quips.

Governance framework for family business

Since the majority of family wealth is tied up in family businesses, the main area of discussion tends to be succession planning for the family business.

There are two important facets to any succession planning process: ownership succession and management succession. This distinction is important because of the important differences between ownership of the shares in the business and the day-to-day management roles that enable the business to continue to function on a daily basis.

Both are important but they are different roles and should be treated differently. All too often the succession planning process fails to distinguish between the two and the optimal plan for the future is not identified which can cause problems later on.

It may be, for example, that the best solution is for ownership of the business to remain within the family but the management is left in the hands of outside professionals who are engaged to perform roles within the business that the family cannot do to the same level due to lack of experience and expertise. Whatever the outcome, it is important that the business decisions are taken for business reasons, not family ones, as often happens.

—

Succession planning

When undertaking the succession planning process there are some key things to consider:

- Ownership succession

- Is there an ownership succession plan in place and is it fully understood and accepted by everyone?

- Do the next generation want to own shares in the business?

- Are the next generation properly prepared and ready to take on the responsibilities of becoming shareholders?

- If shares are only going to be given to those working in the business, how can you be fair to those who do not?

Ownership policies deal with ownership, and transfer thereof, of the family wealth and family business. How to transfer share ownership from one generation to the next? How to treat family members fairly even if that doesn’t mean equally? How to motivate and incentivize non family executives? Should shares remain with those working in the business?

Management succession

- Is there sufficient experience within the family to take over the running of the business?

- Must there always be a family leader and/or a family member on the Board?

- Is the next generation prepared to take over the business, and if not, what can be done to address this?

- What can be done to ensure that siblings/cousins will work well together when the older generation are no longer around?

- How do you balance the needs and requirements of working family members versus non-working?

- If external management is required, what can you do to recruit, retain and motivate the individuals concerned?

Adding the family dimension to the business

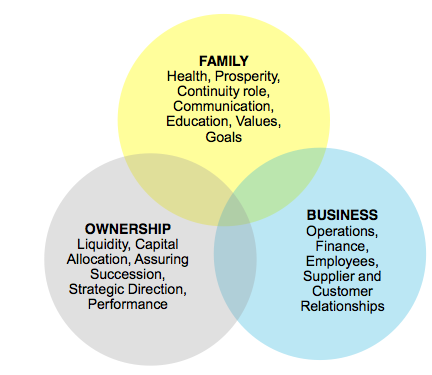

Expanding the governance discussion from just succession planning to include the family, experts tend to use a three-dimensional framework – family welfare, share ownership and business continuity.

Documenting family constitutions

Family businesses that want to take governance seriously will often record their governance mechanisms in a formal document. Family businesses will use different names for this document: family charter, statement of intent, and value charter have all been used by entrants. Perhaps the most common label is ‘family constitution’.

Even though family constitutions are rarely legally enforceable, their existence helps to foster clarity and reduce the potential for dispute.

There is no standardised form for a family constitution, but comprehensive family constitutions include:

- The family’s agreed long-term vision and goals for the business.

- The family’s values and management philosophy.

- Equity ownership policies, clarifying the rights and responsibilities of owners.

- Rules governing how family members join and leave the business, and acquire and sell shares.

- Rules about family employment, including reward, appraisals and reporting lines.

- The relationship between the family shareholders and the board.

- The agreed criteria for management succession.

- Relationships within the family, including the responsibilities of family members towards each other, how communication is promoted, and how conflicts and differences are settled.

The constitution also needs to be regularly reviewed and updated as the family and business change; but creating a constitution in the first place sends a powerful message to stakeholders about how seriously the family is taking its governance; and that it is planning for success for many more generations.

—

Family Constitution

According to Sainani, the constitution has four parts.

- One is the philosophy, wherein the people you know go back in their life and history and identify the values that are important to them individually, and come together on a common set of family values, what these family values in actual behavior would mean, what is the purpose of we being together, what is the purpose of our family and what is the purpose of our business, what are our family business goals. So this is the first part, both for the family and the business. And it’s important for every member to know their own values.

- The second part of the constitution is policies. Policies like – privileges & responsibilities of family members, employment, induction, compensation, performance evaluation, family fun, family philanthropy, ownership succession etc.

- The third section is processes, which includes the process for identification of the next business leader, the conflict resolution mechanism and the process to change the policies themselves.

- The fourth part of the constitution is the various structures – the family council, the family business board, family fund, family office, detailing various positions like Chairperson and Secretary of Family Council, Chairperson and Secretary of Family Business Board. Then there are different committees – the family fun committee, the family philanthropy committee etc and the coordinators for each of these committees.

And apart from these four things, most families include a message from the founding fathers, family prayer, family meeting rules etc.

—-

Sainani outlines the typical process of setting up a constitution. The first stage is bringing all family members at a broad similar understanding of the subject through a one-day educational workshop. Once the rapport has been built with the family through the workshop, Sainani meets all stakeholders in a one to one session for ‘diagnostics’. In these sessions, he aims to get to know key concerns and perspectives of different members at individual, family and business contexts.

The process for drafting the family constitution often acts as an outlet for many family members to air their issues and concerns. As Sunil Shah points out, the respect for elders in India is so ingrained that younger members don’t have forums to express themselves. “But they might be able to speak when given a platform like an external consultant,” he says.

Ramachandran said while families can be logical when writing constitutions, they become emotional when implementing the same. He cited an example of an employment clause in a constitution where the next generation members needed at least two years outside work experience when joining the family business. But within months, a family member called wanting his son to join without the requisite experience. The real issue turned out to be the son’s marriage prospects. So people find ways to flout the in spirit of agreement.

Constituting decision-making bodies

Management, board and corporate structures, together with clearly defined reporting lines, are vital components of effective family business governance. Some family businesses, particularly larger ones, also create structures to manage the relationship between the business and the family. These help improve communication and ensure that the expectations of all stakeholders are managed.

Family councils

A family council represents the interests of all generations and branches in a business-owning family. It works as a bridge between the board of directors and the shareholders. It can be a means for individual family members to influence the business’s vision and culture without having too many shareholders in the boardroom.

For smaller families, the council may be made up of all the family shareholders. In complex, cousin- owned businesses, with large numbers of family shareholders, representatives of the various branches or generations of the family are often appointed.

As the business expands and the family becomes more dispersed, the family council will often switch its focus to communication, social, education and charity issues. A family council usually has no formal business authority – but it encourages the family to speak with one voice to the board and gives the board a clear channel to communicate with its shareholders.

Family assemblies

Particularly large family businesses may have family assemblies as well as councils. Assemblies give opportunities for wider family representation. One of the entrants has two family events a year which are attended by up to 120 family members. Another spoke of attaching a family shareholder meeting to the end of an AGM to encourage wider family discussion.

However, many of the larger entrants talk more about the informal ways the family meets. It is important that not too great a reliance is placed on these mechanisms or there is a risk that governance issues will not be properly addressed. One entrant notes that the family meets ‘7 days a week’ for example through daily visits to the pub. However, this family business also reports that the company’s top managers meet every month with an external consultant, suggesting that governance is not entirely an informal matter. Taking an informal approach may also lead to business discussions impacting on family time – and several entrants suggest this might indeed be the case.

You must be logged in to post a comment.