Families typically invest their portfolio in ‘traditional’ investments such as equities, real estate, cash etc with the aim of maximizing returns, while allocating a small part of their wealth to philanthropy. However, they could look at following global institutional investors’ example and combining returns and impact through Responsible Investments and Impact Investments.

Wealth planning discussions invariably lead to families debating their role in society, which in turn leads to wanting to give back to society. Families usually allocate a small portion of their wealth towards philanthropy while keeping the majority in traditional investments, which focus on competitive returns.

However, more recently there has been discussion around impact investing, which leads to the broader discussion of incorporating the need for making an impact within the investments rather than allocating a smaller part to philanthropy. This approach of influencing change within the investment portfolio is more prevalent amongst institutional investors.

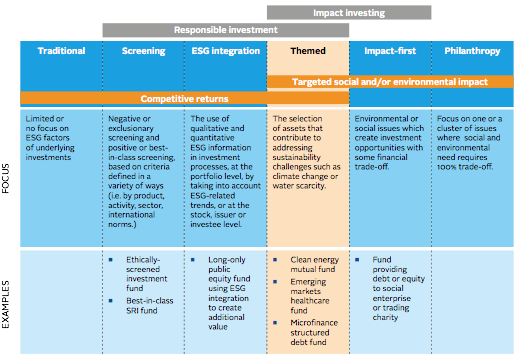

Traditional investments focus on finance only; philanthropy focuses on impact only. However, the new paradigm is the combination of the two. The following chart shows the continuum from traditional investments to philanthropy, covering screened (such as ethical investments), responsible or ESG funds (environmental, social and governance), themed, and impact funds.

Responsible Investments

Responsible Investment (RI) is an approach to investment that explicitly acknowledges the relevance to the investor of environmental, social and governance factors, and of the long-term health and stability of the market as a whole. It recognises that the generation of long-term sustainable returns is dependent on stable, well-functioning and well -governed social, environmental and economic systems.

RI can be differentiated from conventional approaches to investment in two ways. The first is that timeframes are important; the goal is the creation of sustainable, long-term investment returns not just short-term returns.

The second is that responsible investment requires that investors pay attention to the wider contextual factors, including the stability and health of economic and environmental systems and the evolving values and expectations of the societies of which they are part.

The belief is that these issues will be increasingly key drivers of industrial and economic change, and the most successful companies are likely to be those that respond most effectively to these challenges.

———

Responsible investment strategies

- In practice, investors have adopted a variety of responsible investment strategies which use ESG information in different ways

- Integrated analysis involves the proactive consideration of ESG factors in investment research and decision-making. This may involve considering these factors as part of top-down or bottom-up stock selection or in asset allocation. Integrated analysis can result, for example, in investments being over-weighted, under-weighted or avoided in the portfolio.

- Active ownership involves investors using their formal rights (e.g. the ability to vote shareholdings) and informal influence (e.g. their ability to engage) to encourage companies to improve their management systems, their ESG performance or their reporting. Engagement with public policy makers is increasingly seen as an integral part of active ownership.

- Negative screening involves excluding companies from the investment universe on the basis of criteria relating to their products, activities, policies or performance. This includes sector-based screening (where entire sectors are excluded) and norm-based screening (where companies are excluded if they are considered to have violated internationally accepted norms in areas such as human rights and labour standards). These approaches may be derived from legal obligations on an investor (e.g. in the case of some European pension funds) or from the need for the investor to align its activities with the needs and interests of its beneficiaries or clients.

- Positive screening involves preferentially investing in companies or sectors on the basis of criteria relating to their products, activities, policies or performance.

- Best-in-class involves preferentially investing in companies with better governance and management processes and ESG performance.

- Thematic investment involves selecting assets on the basis of investment themes such as climate change or demographic change.

——-

Institutional investors have adopted a global framework for responsible investment by becoming signatories to the UN Principles for Responsible Investments (UN PRI).

——————

UN Principles for Responsible Investments

Principle 1: We will incorporate ESG issues into investment analysis and decision-making processes.

Principle 2: We will be active owners and incorporate ESG issues into our ownership policies and practices.

Principle 3: We will seek appropriate disclosure on ESG issues by the entities in which we invest.

Principle 4: We will promote acceptance and implementation of the Principles within the investment industry.

Principle 5: We will work together to enhance our effectiveness in implementing the Principles.

Principle 6: We will each report on our activities and progress towards implementing the Principles.

In India, some asset management companies offer ethical and sharia compliant mutual funds but these remain very poorly supported.

—————-

Impact Investing

Impact investments are defined as: “…investments made into companies, organizations, and funds with the intention to generate measurable social and environmental impact alongside a financial return. Impact investments can be made in both emerging and developed markets, and target a range of returns from below market to market rate, depending upon the circumstances. Impact investors actively seek to place capital in businesses and funds that can harness the positive power of enterprise.” (Global Impact Investing Network, 2012)

Within impact investing, a distinction is made between “financial first” and “impact first” investors. “Impact first” investors seek to optimise social or environmental returns while agreeing the minimum target financial returns (a financial ‘floor’) while “financial first” investors seek to optimise financial with a floor for social or environmental impact (Rockefeller Philanthropic Advisors, 2009).

Investors may choose to dedicate a small percentage to investments in social and/or environmental areas, via a dedicated team. Alternatively, they may seek environmental and/or social themed opportunities across asset classes and investment teams. Allocations are usually small in comparison to investors’ total assets under management.

Investors also have the opportunity to invest in impact investment funds or directly as angel investments. Funds like Aavishkaar, or more recently an alternative investment fund launched by Varhad Group, invest in small businesses that create positive social impact.

The Aavishkaar group recently launched the Intellecap Impact Investment Network (I3N), India’s first angel network focusing on funding impact enterprises. I3N is an exclusive network of ~40 investors including some influential individuals and early stage funds, who come together to co-invest into deals.

I3N offers sourcing of impact enterprises, screening them to identify the most promising and scalable ones, showcasing these to investors, and aiding in the entire transaction process, post investment monitoring, and support. Investors join the platform for the love of supporting promising high-growth high-impact businesses, and mentoring young entrepreneurs to help them grow.

————

Examples of environmental and social themed investments

| Theme | Definition | Asset class characteristics |

| Cleantech | Investments in companies that offer products, services or processes aimed at reducing or eliminating the consumption of natural resources and achieving higher energy efficiency with lower cost. Cleantech is present in the energy, agriculture, transport, manufacture, air and water quality sectors. Cleantech companies work in some of the following industries: Renewable energy, energy efficiency, waste management and materials recycling. (PRI) | Infrastructure, private equity, listed equities, fixed income. |

| Green buildings | Green building is the practice of creating structures and using processes that are environmentally responsible and resource- efficient throughout a building’s life-cycle from siting to design, construction, operation, maintenance, renovation and deconstruction. This practice expands and complements the classical building design concerns of economy, utility, durability, and comfort. A green building is also known as a sustainable or high performance building. | Listed and unlisted real estate. |

| Sustainable forestry | Investment strategies that focus on sustainable forestry investments that enshrine the protection of local economic, social and natural interests. | Unlisted real estate, private equity, listed equities, fixed income, commodities. |

| Sustainable agriculture | There is no universally accepted definition of sustainable agriculture, but one commonly cited is from the Sustainable Agriculture Initiative: “Sustainable agriculture is a productive, competitive and efficient way to produce safe agricultural products, while at the same time protecting and improving the natural environment and social/economic conditions of local communities.” | Unlisted real estate, private equity, listed equity, fixed income, commodities. |

| Microfinance | Investment strategies that involve debt or equity investments in microfinance institutions. The microfinance institutions provide financial services such as loans, savings, insurance and other basic services to low-income clients who run productive activities and who traditionally lack access to banking and related services. (PRI) | Private equity, fixed income. |

| SME financing | SME financing here refers to providing financial services to small- and medium-sized enterprises that would not normally have access to banking and related services. | Private equity, fixed income. |

| Social enterprise/ community development | Social enterprise development is defined as creating and nurturing businesses that aim for positive social or environmental outcomes while generating financial returns. Community development investments are similarly designed to specifically benefit lower- income neighbourhoods and populations, for example by providing access to affordable housing, supporting small businesses, and, by extension, job creation. | Private equity, fixed income. |

| Affordable housing | Affordable housing has different definitions depending on the country, but can be broadly categorised as that which is affordable to the average household. It covers a spectrum from emergency shelters, through to non-market rental (also known as social or subsidised housing), formal and informal rental and ending with affordable home ownership. | Listed real estate, unlisted real estate, private equity, listed equities, fixed income. |

| Education | Investments in education include investments in schools, social enterprises and any other industries related to the advancement of education. | Private equity, listed equities, fixed income, infrastructure. |

| Global health | Investment strategies that focus on the healthcare market and health systems, e.g. pharmaceuticals, biotechnology, healthcare services and medical technology/suppliers with the objective to decrease the global burden of diseases, including non- communicable diseases (cancer, diabetes, and cardiovascular diseases) and/or communicable diseases (e.g. HIV/AIDS, tuberculosis, and malaria) in both (developed and in emerging and developing countries). This may also include investments that improve the global access to healthcare services and/or with products/services with potential and interest to improve global health. (PRI) | Private equity, listed equities, fixed income. |

You must be logged in to post a comment.