50 shades of value investing in India

15 July, 2022

by MMI Editor

While everyone agrees that value investing is buying a stock for less than its intrinsic value, this is easier said than done. There is no one way to calculate intrinsic value. Over time Warren Buffet’s definition of value has changed from the ‘cigar butt’ approach that his mentor Ben Graham espoused to a more broader

- Published in Equities, Featured, Portfolio Construction

How active and skilled are Indian equity funds?

22 June, 2022

by Devasri Davey

While retail investors and advisers track various performance-based quantitative parameters such as excess returns and Sharpe ratio on mutual fund fact sheets, the professional investment consulting industry uses more advanced measures such as tracking error and information ratio to evaluate active funds. We calculated and analysed these measures for the Indian equity fund universe with

- Published in Equities, Featured, Portfolio Construction

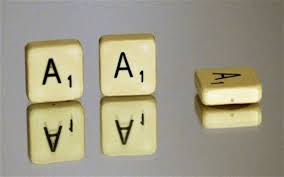

Do mutual fund ratings work?

16 February, 2022

by MMI Team

Investors and advisers often use ‘star ratings’ to select the ‘best mutual funds’. They assume that the mutual fund ratings, whether denoted by stars or numbers (1 to 5) or alphabets (A, B etc) or metals (gold, silver etc), would be helpful in their selection of funds that will outperform in the future. We have

- Published in Advisory Process, Featured, Portfolio Construction

Big Data and ML in funds research

11 November, 2021

by MMI Editor

Fund Manager evaluation demands an assessment across multiple dimensions, including the investment process, risk management, operations, and the business model. We have compiled the latest research on using Big Data and Machine Learning (ML) in funds research. — In a live webinar organised by the CFA Society India in April 2021, Sabeeh Ashhar of Morningstar

- Published in Portfolio Construction

Global investment consultants eyeing India?

10 September, 2020

by MMI Team

India has been wooing foreign investments, both directly as foreign direct investments (FDI) into companies as well as indirectly as ‘foreign institutional investors’ (FIIs) or ‘foreign portfolio investors’ (FPIs) into its capital markets and alternative investment funds (AIFs). FIIs already hold a significant portion of India’s listed equity market, affecting daily market fluctuations. However, the

- Published in Portfolio Construction

Factor investing 101

05 August, 2020

by Girisa Medh

Global markets are made up of dozens of asset classes and millions of individual securities, making it challenging to understand what really matters for your portfolio. But, there are a few important drivers that can help explain returns across asset classes. These ‘factors’ are broad, persistent drivers of return that are critical to helping investors

- Published in Portfolio Construction

How to analyse MF portfolio and performance

05 August, 2020

by Girisa Medh

There are a number of attractive mutual funds and fund managers that have performed well over both long-term and short-term horizons. All mutual funds have a stated investment mandate that specifies whether the fund will invest in large companies or small companies, and whether those companies exhibit growth or value characteristics. It is assumed that the mutual fund manager will adhere to the

- Published in Portfolio Construction

Does ETF liquidity matter for investors?

03 June, 2020

by MMI Admin

The Indian asset and wealth management industry laments the lack of liquidity in ETFs, encouraging investors to buy passive funds instead. But what is liquidity and does it matter? In the recent past, two papers have been issued to address this topic – The CFA Society India issued a report on ETFs generally with some recommendations

- Published in Equities, Portfolio Construction

Do you need an investment philosophy?

03 February, 2019

by MMI Editor

Recently, I was invited to participate in a panel discussion on the ‘Art & Science of Stockpicking’. I was fascinated by the topic because I had studied both art and science (actually literature and biology) at undergraduate level and then had chosen finance as a career. I had researched investing somewhat (remember this was 25

- Published in Portfolio Construction

Fund categorisations: confusing segments and style

07 November, 2017

by MMI Editor

The Indian media has been discussing SEBI’s circular on categorisation and rationalisation of mutual funds ever since it came out in October 2017. I had written about the need for better fund classifications last year, so I didn’t comment further. But the news that AMFI has asked SEBI to reconsider has prompted me to share

- Published in Portfolio Construction

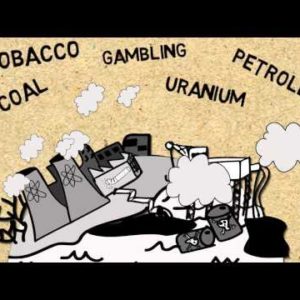

Can better fund research fix capitalism?

21 October, 2017

by MMI Editor

“We have met the enemy and he is us.” — Walt Kelly We blame capitalism for most of our modern ills, from climate change to iPhones that die every two years. Yet we rarely bother to read the sales pitch our accountant, banker, or adviser gives us for the mutual funds to invest our hard-earned

- Published in Portfolio Construction

Has goal-based investing ruined Modern Portfolio Theory?

18 November, 2016

by MMI Editor

Modern or mean-variance portfolio theory (MPT) is an important financial concept. But it has little practical value for retail investors when it to comes to asset allocation. Recently, goals-based investing has grown popular with both financial advisers and robo-advice tools. Financial advisers continue to apply an ‘”asset allocation overlay” check to ensure goals-based portfolios are

- Published in Portfolio Construction

What can blow up in your portfolio?

30 July, 2016

by MMI Editor

That’s the question investors should ask when assessing portfolio risk, rather than focusing on volatility. Speaking at a speaker event organised by Indian Association of Investment Professionals (IAIP), Raj Manghani, the Managing Director – Financial Analytics for MSCI, explained scenario analysis and stress testing. Testing the ability of a portfolio to withstand shocks in liquidity, markets and

- Published in Portfolio Construction

Classifying funds

24 April, 2016

by MMI Editor

Investment decisions rely on performance of funds universe including that of the median and various quartiles. Hence, the universe category definitions and classifications are very important. Unfortunately, AMCs have multiple funds in the same category with significant dispersion in returns. To make it worse, leading rating houses have different classification methodologies resulting in different classifications.

- Published in Portfolio Construction

Funds research…deconstructed

18 February, 2016

by MMI Editor

I love watching cooking shows. It doesn’t matter that I don’t cook. I watch for enjoyment sake, and perhaps for the comfort of knowing that in a cooking emergency, I will be able to put something together. One concept that I always get fascinated by is that of ‘deconstructed’. Chefs separate or deconstruct the ingredients

- Published in Portfolio Construction

Why we need active funds

03 February, 2016

by MMI Editor

The active versus passive debate rages on. The passive camp points out that active funds, in general, don’t do what they are supposed to do – outperform the passive benchmark. They charge high annual management fees, even in the years they underperform. They encourage intermediaries to charge fees or commissions to select amongst them (or

- Published in Portfolio Construction

Why good mutual fund research is hard to find

12 January, 2016

by MMI Editor

There are many brilliant books on stock picking, from simple beginners’ guides to classic textbooks like Ben Graham’s Security Analysis and The Intelligent Investor. I could find only one credible book on mutual funds: John Bogle’s Common Sense on Mutual Funds. Bogle’s advice? Investors should put their money in index funds. A number of finance luminaries — Warren Buffett,

- Published in Portfolio Construction

Why you shouldn’t invest in 5-star rated mutual funds

18 December, 2015

by MMI Editor

Ask any investor how they select mutual funds (MF) – the most common answer tends to be on the basis of star ratings. Such is the allure of stars that it doesn’t appear to matter whose stars. I know so, because I spent my career in fund research. And no matter how different my firm’s

- Published in Portfolio Construction

Role of financial ratings

30 October, 2015

by MMI Editor

When people hear the leader of a country comment on how a credit rating agency should rate its debt, they realise credit ratings are important. When they read about the role of credit ratings in the global financial crisis, they get angry about the finance industry being responsible for their misery, but figure they must

- Published in Portfolio Construction

How Nobel prize winners invest

30 October, 2015

by MMI Editor

Everyone in finance would know about the efficient frontier… it’s a concept from Modern Portfolio Theory put forward by Harry Markowitz in the 1950s. So Markowitz is like God in the world of portfolio management. I was always curious about how Markowitz invests his own portfolio. Imagine my delight when I found the answer in

- Published in Portfolio Construction

Making sense of too many products

03 October, 2015

by MMI Editor

Like in many other markets, the mutual fund industry the world over seems to have a dazzling choice of products, but with the top few dominating assets under management and inflows. In the US, there are more funds than stocks. Even in a nascent market like India, there are more than 1,000 choices, and that’s

- Published in Portfolio Construction

Fund managers need the right temperament

09 June, 2015

by MMI Editor

What kind of people make good fund managers? While everyone should be interested in this question, there is surprisingly little research on this topic. Dr Jack Gray talks to Hansi Mehrotra about his efforts and findings. While the general perception may be that investments is about numbers, investment professionals everywhere agree that money management is

- Published in Business Issues, Portfolio Construction