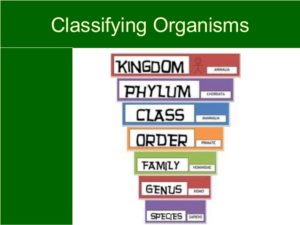

Investment decisions rely on performance of funds universe including that of the median and various quartiles. Hence, the universe category definitions and classifications are very important.

Unfortunately, AMCs have multiple funds in the same category with significant dispersion in returns. To make it worse, leading rating houses have different classification methodologies resulting in different classifications. This is confusing and time-consuming for stakeholders.

MMI proposes a new set of classification methodology in line with global best practice, that is transparent and can be used by anyone. This analysis is to highlight performance of categories; MMI will NOT provide ratings or opinions on individual funds.

The following document provides the proposed classifications. Any suggestions are welcome.

You must be logged in to post a comment.