While wealth planning encompasses a wide range of topics, the most significant one is trans-generational wealth transfer though estate and succession planning. The simplest way to execute estate planning is leaving a will, but even this not universally done. Given the multiplicity of succession laws applicable in India, and the inefficiency of the legal system, the implications of intestate deaths means years of disputes.

Most surveys of wealthy clients and advisers show that the most important aspect of wealth planning is the inter-generational transfer of wealth. Family assets need to be handed down to the next generation, structured and managed such that there is smooth transfer without too many disputes and transaction cost (including tax) leakages, and yet still able to be utilised for the common benefit of the family. It is not uncommon for the next generation of a family to pursue a more divergent approach, leading some members to move away from the family business but still demanding their share of the family wealth.

Bijal Ajinkya, partner at Khaitan & Co says, “Gen X thinks about wealth planning much before his older generations have thought about it. The top concerns for Gen X are; tax, expropriation of assets by government, irretrievable break down of marriage, asset protection, maintenance of a particular life style through their life, segregation of personal and business assets, etc.”

Hence, careful succession and estate planning can help maintain control and ownership of the family business in the hands of those who are interested and capable of running the business, while simultaneously addressing the finanical needs of those who wish to pursue their own course.

There are a number of ways of going about transferring wealth to the next generation. The best and commonly used option is a will. These are simple legal declarations stating how the person wants his or her estate divided after their demise.

Writing a will

Haribhakti of DH Consultants lists out steps to drafting a will. The first is for the person who wants to draft the will to do their homework in terms of identifying all their sources of income and inventory of assets, known and anticipated, with as much accuracy as possible, he said. This should include the net accumulation over the last two to three years, as well as what it is likely to be on an ongoing basis. The person also needs to lay out the structure of the family and identify the potential heirs.

People should take their time to discuss their wishes and desires with confidants and explore their true desires. The last step is then the actual drafting of the will and choice of executors to make sure that whatever is desired will be executed in complete harmony with their wishes and desires.

Indeed, technically the will is very simple. Anyone can write a will on a piece of paper and have two people to witness it. But as Shah of DSP Merrill points out, “a will is simple until disputed. The minute it is disputed, it becomes complicated.”

From a legal perspective, the will should overwrite any nominations made for financial assets such as share demat(erialised) accounts or mutual funds.

Revising and disclosing wills

Following the initial set-up, a yearly review of a will is important, according to Haribhakti, because it helps to take care of new needs or situations which might have arisen – for example, an unanticipated inheritance or a windfall.

The Barclays/Ledbury research showed that 78% of respondents from India had a will, which is in line with the global average, and higher than the Asian average. However, industry experts doubt this figure. In their experience, the figure is much lower.

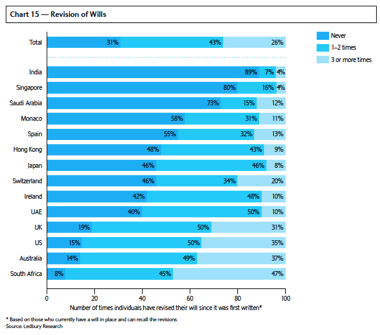

The research also highlights the extent to which wills get revised. The top four reasons for revising wills are – increase in wealth, tax efficiency/tax planning, marriage/new partners, and birth of a child. The importance of these factors changes with age; tax efficiency is most important for older respondents while the purchase of property and child birth are key triggers for younger ones.

Experts stress the importance of letting those who are affected by will changes know in advance of any revisions.

First is there will be always someone who will be unhappy and feel that the will is biased. Second is people ‘do not want to show their cards’ and last is people want to keep the option of changing the will open.

“It’s advisable that the patriarch involves other family members while drawing out his estate plan. This would reduce possibility of subsequent disputes. However, it depends on the family dynamics and in certain cases may lead to friction or disharmony.”

“No planning it not a solution and may lead to fragmentation and disintegration of wealth,” says Shah.

Desai says: “Management of wealth starts with the primary concern of tax in mind and not with a real or personal objective i.e. “to be happy, create happiness and leave happiness behind.” There are many risks which may jeopardize a plan. They may occur when the planning strategies are not well documented, when important tax issues are ignored, when the plan is not revised from time to time due to modifications in law, inefficiency of the people managing and executing the plan, when dishonest people gain access to the wealth or even an unwillingness to pay adequate fees to obtain excellent advisors, may impede the proper execution of the plan.”

The research showed that as many as 10% of the wealthy have disinherited someone or cut a family member out of their wills. The risk of this happening was slightly higher in India than the fairly similar likelihood across the world.

While there are valid reasons to change a will, including frequent changes of mind, further acquisition of properties, changes in marital or family status, people need to be careful when executing multiple wills though, as there is uncertainty around the validity of multiple wills when earlier wills have not been properly revoked.

The Indian Succession Act provides that wills cannot be revoked otherwise than “…marriage, or by another will or codicil, or by some writing declaring an intention to revoke the same and executed in the manner in which an unprivileged will is hereinbefore required to be executed, or by the burning, tearing or otherwise destroying the same by the testator or by some person in his presence and by his directive with the intention of revoking the same.”

Leading law firm Amarchand & Mangaldas provides an interesting example of a case in the Bombay High Court, where a testator leaves behind a number of executed wills on different dates, without expressly revoking any of the previous wills. The Court held that all the wills must be read together, and the sum total must be treated as the final will of the deceased testator. However, in another case from the Supreme Court of India, the second or later will made the earlier/ previous will redundant, implying it was not necessary for the later will to carry a specific provision cancelling the earlier will. However, the final legal position on this issue still remains unclear.

To help deal with such problems which could arise, Rishabh Shroff,senior associate at Amarchand & Mangaldas recommends that wills are properly drafted with the help of professional advice, and that every will should carry an express clause revoking all previous wills and codicils. He also recommends that any previously executed wills be physically destroyed.

—————

Box

Process of Probate

Probate refers to the legal process of administering an estate after an individual’s death. It typically involves an executor (when there is a will) or a court-appointed administrator (when there is no will) verifying, managing and distributing the deceased person’s assets. The Indian Succession Act requires wills in certain Indian cities to be probated before the distribution under the will can be effected by the executor. Probate is the official evidence of the executor’s right to represent and dispose of the testator’s estate as per the terms of the Will. In the absence of an executor, the inheritors apply to the court for the appointment of an executor.

Executor is a person named by probate courts or wills to administer the estate of a deceased individual according to directions provided. The executor is thereafter asked to establish the, proof of death of the testator, proof that the will has been validly executed by the testator and proof that the will is the last will and testament of the deceased. Proof of death is usually shown by submission of original death certificate.

Letters of administration entitle the administrator to all rights belonging to the intestate individual. To obtain letters of administration, the beneficiary must apply to the court. The court on receiving satisfactory proof of valid execution of the will issues letters of administration to the executor or to the beneficiaries in the absence of the executor.

—————–

A foreigner owning assets in India is not required to create an Indian will for his Indian assets and can have all his Indian assets covered in a foreign will itself. The will needs to be probated/ certified by a foreign court that has appropriate jurisdiction over such and thereafter filed with the Indian court of appropriate jurisdiction for execution.

In the absence of a will

Intestate succession refers to when a person dies without leaving a valid will and the spouse and heirs will receive the possessions by the laws of descent and distribution and marital rights in the estate which may apply to a surviving spouse. Collectively these are called the laws of intestate succession.

Like everything about India, there are multiple laws that can apply, 45 according to Ashvini Chopra of Universal Trustees, in a situation where someone dies without a valid will.

The Indian Succession Act, 1956, is the main applicable law. It outlines the process and beneficiaries in case a person dies intestate. However, it does not apply in the case of the intestacy of a Hindu, Muslim, Buddhist, Sikh, Jain, Indian Christian, or Parsi.

Hindus have a unique concept of the ‘Hindu Undivided Family’ (HUF). A HUF or joint family is an extended family arrangement prevalent among Hindus, consisting of many generations living under the same roof. Essentially, the male members of the family continue living together, joined by their wives and unmarried daughters. The family is headed by a patriarch, usually the oldest male called ‘Karta’, who makes decisions on economic and social matters on behalf of the entire family. All money goes to the common pool and all property is held jointly. Different sects of Hindus, hailing from different parts of the country, follow different traditions on the issue of inheritance.

Muslims follow Sharia laws which have forced heirship, i.e. individuals cannot leave their entire estate according to their own wish. The rules require at least 2/3 of the deceased’s estate to be inherited by the line of succession. But again there are diffeent sects of Muslims or special instances, to which the forced heirship rule doesn’t apply. Parsis also have their personal laws which doesn’t allow inheritance to daughters who marry outside their community.

Intestate succession laws for Hindus and Muslims

| Males | Females | |

| Hindu Personal Laws | Class I heirs include son, daughter, widow, mother, son of a predeceased son, daughter of a predeceased son, son of a predeceased daughter, daughter of a predeceased daughter, widow of a predeceased son, son of a predeceased son of a predeceased son, daughter of a predeceased son of a predeceased son and widow of a predeceased son of a predeceased son. All these heirs inherit simultaneously. If heirs of Class I are not available, the property then goes to the enumerated heirs specified in Class II of the Schedule, wherein an heir in a higher entry is preferred over an heir in a lower entry. If there is no preferential heir of any of the two classes, then the deceased’s property passes to his relatives who are agnates (descended from the male line) and finally if there if there is no agnate, then upon his relatives who are cognates (descended from the female line). | Property will devolve to, firstly, upon her sons and daughters (including the children of any pre-deceased son or daughter) and her husband; secondly, upon the heirs of the husband; thirdly, upon the mother and father; fourthly, upon the heirs of the father and lastly, upon the heirs of the mother. However, any property inherited by her from her father or mother will devolve upon the heirs of her father, and any property inherited by her from her husband or father-in-law will devolve upon the heirs of her husband. |

| Muslim Personal Laws | Sharers will take a specified portion of the deceased’s estate irrespective of anything else. A Residuary will take whatever is left over, once the Sharers have taken their specified shares. Consequently, the rule of succession is – Spouse only (one-half of estate), descendants and spouse (two-thirds), descendants only (one-half or two-thirds, depending on number of descendants), ascendants and spouse (two-thirds), parents only (one-half), and other ascendants only (one-third). |

There is no restriction on a non-resident person being an heir under an Indian will or in the event of intestate succession, regardless of citizenship. Further, a non-resident person can receive and own any kind of property in India by virtue of such inheritance.

However, there could be issues arising mainly from the following situations:

- a deceased citizen of India having foreign residents/citizens of Indian origin or non-Indian origin as inheritors;

- a non-resident Indian (NRI) dying intestate with immovable property in India, leaving foreign residents/ citizens as inheritors;

- a foreign citizen, Indian resident or otherwise, dying intestate owning estate in a permissible area of India with non-Indian origin foreign residents/ citizens as inheritors; or

- foreign inheritors claiming their inheritance on the death of an Indian citizen who was an owner of inherited estate in India.

Assets and/or sale/maturity proceeds of assets acquired by a non-resident by way of inheritance can be repatriated by such non-resident to a maximum amount of USD 1 million per financial year after providing for all statutory, tax and other liabilities of the estate (remittances in excess of $1 million USD can be made only with prior permission of the Reserve Bank of India).

Issues with wills

According to Shah, “writing a will is a traditional and simple method of estate planning. Trust on the other hand is a more systematic and effective method. As compared to a will, creation of trust eliminates the legal requirement of probate which at times, in cases where the Will is challenged or when the beneficiaries are residing abroad, can be very time consuming.”

Wills are private documents only until the time they need to be executed. The executor needs to file the will in court as part of the probate process, at which point the will becomes a public document. Apart from the confidentiality aspect, families may also want to consider the time and process it takes for the probate process to be completed.

Most experts interviewed also point out that wills could be very easily challenged in authenticity by estranged or unhappy heirs leading to long-drawn and expensive litigation.

It was in light of this situation that living trusts became very popular with Indian families since they helped bypass the probate process and were not vulnerable to the whims of the family members. Pathak of DSP Merrill says, “Trust is a more efficient tool of estate planning as compared to a will as it eliminates the requirement of legal procedures like probate and also minimizes the possibility of disputes on the demise of the patriarch of the family. They are used for different objectives like for the benefit of spouse and minor children who may not have the right knowledge / skill set or maturity to handle assets in case of untimely demise of the patriarch. It helps NRI beneficiaries in inheriting the assets seamlessly without going through the legal procedures of probate or obtaining the succession certificate.”

Aboobaker from Amicorp says: “trusts run parallely with you.” While wills can be used for succession and estate planning, trusts also ensures that, “the estate is used by you while you are there and then talking about passing.”

—————

Wills versus trusts

| Wills | Trusts |

| Will is a legal declaration of a person’s intention with respect to his property, which he desires to be carried into effect after his death. Thus a will operates only after the death of the person. | Trust involves transferring of one’s estate to a trustee for the benefit of certain beneficiaries. Trust provides for management of the estate during one’s lifetime and also provides for distribution and management of one’s wealth post demise. |

| Wills can be made by individuals. | Trusts can be formed by any entity who owns property viz. individuals or corporate. |

| Wills do not provide for longer-term management of property. | Trusts can prepare a plan for administration, growth and disposition of the estate during lifetime and after. |

| Probate may be required to be obtained for establishing the rights of the executor or the beneficiaries in certain cases. | Trust does not need any probate. |

| Wills may be easily contestable on various grounds and may lead to family disputes after the death of the client. | It is difficult to contest a validly created trust. |

| The will can be modified or revoked during the life time of the client any number of times. | A trust cannot be revoked unless the power of revocation is reserved in the trust deed or all the beneficiaries competent to contract consent to such revocation. |

| Wills can be kept confidential up to the death of the client but becomes public during probate and/or any contestation of the will. | Trust document can be kept confidential except where disclosure is required whilst dealing with third parties. |

| If the client becomes insolvent the will cannot be given effect as there may be no property left. | Client has transferred the property to the trustee. There are no provisions for winding up or declaring a trust as insolvent, hence insolvency of the clients two years after the transfer would not have any effect on the trust property. |

| Will does not require registration or stamping though it would be advisable to register the same but probate fees are required to be paid. | Trust deed is required to be stamped, and if it relates to immovable property, also is required to be registered. |

| Wills can be mutual, which means two persons confer reciprocal benefits upon each other. Mutual wills become irrevocable after death of one of them if the person living has taken advantage of the benefits conferred by the will. | There is no concept of mutual trust. |

You must be logged in to post a comment.