insights

articles, blog posts about investments, wealth management, communication

Sundaram Multi Cap Fund – Direct Plan – Growth (Adjusted NAV)

ISIN Overall analysis 3-yr rolling excess returns remains below minimum and has not given good performance and TE against benchmark ...

SBI Multicap Fund – Direct Plan – Growth

INF200KA18E2 Overall analysis 1-yr rolling excess returns remains below the lower quartile and has given good performance and TE against ...

Sundaram Multi Cap Fund Series II – Direct Plan – Growth

INF903JA1EF4 Overall analysis 3-years rolling excess returns of the fund has declined by underperforming its benchmark as well as its ...

Sundaram Multi Cap Fund – Direct Plan – Growth

INF173K01FQ0 Overall analysis 1-yr rolling excess returns of the fund is negative to the index. Overall, this fund has moderate ...

Sundaram Multi Cap Fund Series I – Direct Plan – Growth

INF903JA1DT7 Overall analysis 3-years rolling excess returns of the fund has declined by underperforming its benchmark as well as its ...

Quant Active Fund – Direct Plan – Growth

INF966L01614 Overall analysis 1-yr rolling excess returns of the fund has raised, currently generating maximum returns compared to its benchmark, ...

Nippon India Multicap Fund – Direct Plan – Growth

INF204K01XF9 Overall analysis 3-years rolling excess returns of the fund has outperformed its benchmark and its peers. Overall, this fund ...

Kotak Multicap Fund – Direct Plan – Growth

INF174KA1HV3 Overall analysis 1-yr rolling excess returns of the fund is sustained between maximum and upper quartile (green) line. Fund’s ...

Mahindra Manulife Multi Cap – Direct Plan – Growth

INF174V01341 Overall analysis 3-years rolling excess returns of the fund was good in the past, but in recent phases its ...

Kotak India Growth Fund – Series IV – Direct Plan – Growth

INF174K019S9 Overall analysis 3-years rolling excess returns of the fund has crossed down the maximum line, it gave the maximum ...

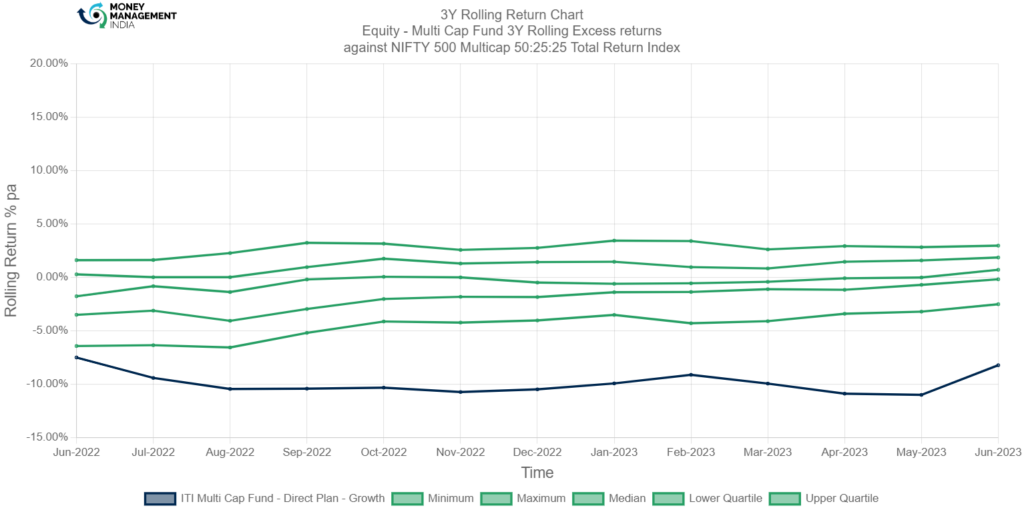

ITI Multi Cap Fund – Direct Plan – Growth

INF00XX01168 Overall analysis 3-years rolling excess returns of the fund is negative throughout the year. Overall, this fund TE has ...

IDFC Multicap Fund – Direct Plan – Growth

INF194KB1CL0 Overall analysis 1-yr rolling excess returns of the fund is constant. Overall, this fund has good TE, it is ...