Trusts are a flexible tool to achieve most wealth planning needs. However, there are various types of trust structures available, hence it is vital that trusts are properly understood and used in the right ways.

Overcoming misconceptions, and eliminating mis-selling of trusts, combined with better education on the value and application of use these structures, are key elements of ensuring they get used effectively.

This applies to the entire process – from deciding to set up a trust in the first place, all the way through to ongoing reviews and conversations around a client’s potential need for multiple structures.

A number of trust companies interviewed for this guide mentioned that clients often ask how much is needed to set up a trust, but that’s the wrong question. Instead, they should be asking “will I get value out of a trust?” If the answer is “no” then they shouldn’t do it. “There must be demonstrable benefits worth paying for.” “So the starting point should be: ‘what do I want to achieve and what options do I have to achieve those objectives?”

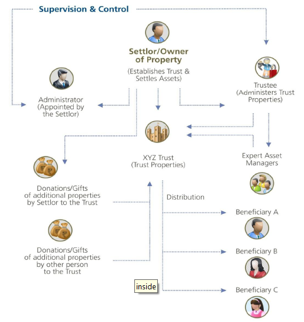

Once broader wealth planning objectives have been defined, the next step is setting up structures that help achieve these objectives. “Structures and documentation are the two integral parts of wealth planning. Structures comprise of trusts, LLPs, firms and documentation comprises family arrangements, trust deeds, wills, partnership deeds and shareholder’s agreements,” adds Sayta from EY.

Benefits of using trust structure

Most experts in the industry picked the trust as one of the most flexible structures, and hence would recommend its use provided there is complexity to warrants its use over wills.

Sonali Pradhan, managing director at RBS Financial Services, says: “the main objective for which a trust can be formed is the seamless transfer of wealth to intended beneficiaries. Be it a time consuming probate process, publicity to one’s last wishes or disputes amongst the legal heirs; all of these can be avoided or minimized with the set up of a trust. For family business owners it is important to separate the ownership of the business and the right to income from the business, and so a trust structure would be one of the best inter-generational wealth transfer mechanisms to prevent the erosion of family wealth by future generations and beneficiaries.”

Lack of awareness and complexity of Indian family structures have acted as major barriers while setting up trusts. However, there is a change in the way trusts are viewed and used in India. According to Bilawala from Wadia Gandhy, “trusts have been in use for a long time but the objectives they sought to meet earlier would be as simple as providing for a grandson’s education or leaving a bequest for a grandchild to be given to him/her when he/she reached the age of majority. Whereas now, the entire estate is being put into a trust.”

There are many benefits of using a trust structure including estate and succession planning, asset protection, education of future generations, care of special needs, managing multi-jurisdiction assets and tax planning.

“The key objective of setting up trusts in India is effective estate and succession planning. Asset protection is another objective which families look at in certain cases however, there isn’t much tax planning that one can do in India through a trust structure,” adds Shah of DSP Merill.

Benefits of using trust structure

Transfer of wealth without probate and contest

Asset protection

Wealth preservation

Separation of control and management

Education of future generations

Care of minors and special situations

Tax planning

While a will can achieve estate and succession planning aims, many people would prefer avoiding the probate process. Complicated family structures with interwoven cross holdings in the family business are common to many Indian families. This may lead to family disputes and will directly affect the performance of the business.

Even in cases where wills are formed, they are most likely to be contested. However, assets held in trust are not subject to a person’s will and probate process. Instead, ownership to them devolves in accordance with the trust deed. This can be extremely useful where the settlor owns assets in, or has family links with, multiple jurisdictions, as this can make probate complicated, time consuming and expensive. A trust can also help to avoid forced inheritance rules.

Wealth preservation is a key reason too. Bilawala of Wadia Gandhy says: “trust structures are commonly used to protect misuse of inherited wealth and to preserve wealth for future generations.”

The other major reason behind setting up trusts is asset protection. Assets held in a trust are safeguarded from being contested during litigation or claims from creditors. Trusts can be used for preservation of business assets as well as family wealth.

“Trust is the most appropriate tool which helps to ring-fence and consolidate your assets; it enables you to become one of the beneficiaries of your own trust so you can make full use of your own wealth while you are alive and pass it on to the next generation without getting into complications,” says Aboobaker.

Bilawala of Wadia Gandhy says, “A trust structure is most important when family business is involved and where the settlor wants to protect the business for the future generations, therefore he/she places the shares of the family business in a trust.”

Many a times, the management of a family run business is handed over to an external party. In such a situation, a trust can be used to separate economic benefits from management control.

“For business families, trust can help in segregation of management control (including voting rights) from economic interest while defining the succession plan.”

Rajesh Narain Gupta, managing partner, SNG & Partners highlights the importance of asset protection “Asset protection and right tax planning has assumed great significance in global context. Worldwide, indirect or vicarious liability has become an order of the day. In developed nations the professionals like doctors, lawyers, and accountants prefer to create a trust structure to protect their wealth in the event of any claim owed to professional negligence. Similarly, from India’s context the businessmen and industrialists who have given their personal guarantees or hold any position as a fiduciary may be exposed to unknown risk of attachments of assets in the event of any invocation of guarantees or negligence.”

Families which have heirs residing overseas would also find the trust structure useful. In an era of increased tax and transparency, any beneficiaries living overseas, especially the US, may attract taxes when inheriting and passing on themselves.

For example, if an NRI residing in the US had to inherit Indian assets, he would have to declare it as global wealth which would attract a heavy estate duty. Alternatively, a trust could be set up in India where the NRI could become a beneficiary and the assets to be inherited could be placed in the trust. The advantage here is that you will only be liable to pay taxes on your beneficial interest as opposed to the entire value of the assets.

Trusts are the most effective way to care for a special child or senior citizens of the family, if their concerned family members are not present.

One of the more traditional reasons for using trusts is to provide for education for the future generations. Education in a good global university has become very expensive and “perhaps the best instrument to do that through is a trust – is a specific purpose trust” points out Haribhakti. Here, specific trust structures help in ensuring that the needs of the future generations are not compromised on.

Trusts can be used for tax planning. The talk of a reintroduction of inheritance tax has stirred up lot of debate amongst Indians. Even though there are various options available while structuring wealth, like forming a holding company, trusts are the only tools that will help mitigate inheritance tax and protect your assets.

Looking at it from a broader perspective, “tax regulations will keep changing, where as trust structure can be made flexible enough to incorporate any changes as per new regulations” adds Aboobaker from Amicorp.

Sayta from EY highlights the importance of tax planning as a driver for wealth and succession planning. “Tax laws play an important role while devising a structuring plan. Taxes could be in form of income tax on transfer, gift, etc, wealth tax, estate duty, inheritance tax – the latter two we do not have in India at present but we cannot rule out the possibility of it being introduced. Other levies such as stamp duty-are important to be factored, especially when transfer of properties is involved. All these are critical issues and these need to be kept in mind in terms of wealth and succession planning.”

According to Haribhakti, “one has to study all the relevant regulations and treaties of the different countries involved to make determinations on what happens in certain scenarios.” For example, he said it is very important to know the exact import of double tax avoidance treaties and related factors because if there is one nation in which someone has assets that incur estate duty or death tax and another which doesn’t, then there are planning opportunities.

Trusts can add value to family governance process. According to Navita Yadav, chief executive officer, IL&FS Trust Company, “a lot of things in family communication are not enforceable, but incorporating a list of best practices on family communication and governance in a trust document makes is enforceable as it is a legal document.”

While trusts are generally set up by families with family businesses, Gavankar of Kotak Wealth Management, highlighted that has seen a new trend of professionals increasingly seeking advice on setting up trusts. “This is because their families are unaware of how and the where is the family money invested. By having a structure in place they may want to ensure that there is proper and disciplined financial planning undertaken for the assets in the trust to take care of any unforeseen eventualities and for any family liquidity requirements,” says Gavankar.

A trust can also appoint a protector, such as a close friend or lawyer, whose job is to ensure the trustees carry out the wishes of the settlor. The protector has veto over specific trustee powers and can remove and replace trustees.

Kotak

——-

Types of trusts

In India, trusts can be mainly private, public (charitable or religious), foreign, or mutual funds. Private trusts are created and governed by the Indian Trusts Act, 1882, whereas charitable trusts are beyond this Act and have not been defined by law, according to Gupta of SNG & Partners. An Indian can set up a foreign trust to hold foreign assets acquired when residing overseas or inherited from an overseas resident.

Living trusts

Living trusts are created when the settlor is still alive, “and is a more effective way of estate planning as compared to as testamentary trust,” adds Shah. These trusts are created through a trust agreement or a declaration of trust. They are legal documents that partially substitute for a will. The creator of the trust can also be a beneficiary.

“They are best suited for couples with no children or in cases where the help would not be easily available in their silver and golden years. A person setting up the living trust would manage the trust fund and expenses during their able days,” adds Pradhan of RBS.

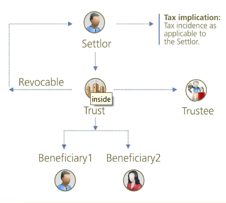

Living trusts can either be revocable or irrevocable. Revocable trusts can be revoked or amended at any time by the person instating it. The settlor has the power to reassume control directly or indirectly over the income and assets of the trust.

An irrevocable trust once created survives till the dissolution of the trust and the settlor cannot reassume power directly or indirectly over the income or assets of the trust. The settlor, however, can retain certain rights like amendments to the trust deed, requirement of consultation prior to any investment, sale or disposition of trust assets. According to Shah, “an irrevocable trust can be created for asset protection. However, there are certain checks that one has to maintain in order to make the structure tight so that it stands the test of time.”

“Mostly doctors, angel investors or people involved in the riskier profession set up these trust to ring fence personal assets from professional liabilities. Historically this form of a trust has been used to save inheritance taxes,” adds Gupta.

An irrevocable structure can be again set up in two different ways. An irrevocable determinate structure is where both the beneficiaries and beneficial interests are defined; hence the trustees have no discretion. An irrevocable trust can also be discretionary where the beneficiaries and their beneficial interests are not defined. Here, the trustee may choose from time to time who among (if anyone) the beneficiaries is to benefit from the trust, and to what extent.

The main difference in applicability while deciding upon a particular trust structure is with regards to the tax liability on the settlor. A revocable trust attracts taxes where as an irrevocable trust is primarily used to reduce the settlor’s tax liability.

An irrevocable determinate structure allows the income tax department to treat the trustee as a representative assessee and the beneficiaries are taxed as per their respective slabs. On the other hand, the trustee is taxed at maximum marginal rate in case of an indeterminate structure.

Testamentary trusts

Pradhan adds, “these trusts become effective upon the demise of a person. They are executed through a will and all the necessary guiding principles for running the trust (trust deed) such as names of the trustees and beneficiaries, what expenses can be made by the trustees, and when the trust assets will be given to the beneficiaries etc. are listed as an annexure to the will. It is useful in a case where beneficiaries are either minor, or are differently-abled, for example. This kind of a trust also offers certain income tax benefits, hence clients may make use of these trusts for bequeathing real estate to the next generation.”

These kind of trusts come into effect on the demise of the testator through his will for objectives like keeping the estate of the deceased in the trust till the minor beneficiaries reach a certain age. However, the will in these cases still requires a probate.

Common misconceptions

Overcoming misconceptions regarding relevant issues is critical to the effective application of trust structures. The most common issues are lack of awareness and the belief of loss of control over assets.

Most people don’t understand how trusts work. Hence, it goes into the ‘too hard’ basket like with anything else that appears complicated. However, this is changing.

Maintaining control

The most frequent misunderstanding clients have is that they will lose control. This perception arises from the fact that legally, ownership of the trust assets passes from the client, who creates the trust, to the trustee who will be the legal owner of the assets, and will also hold them for the benefit of the beneficiaries.

Most of the Indian families still remain uncomfortable with the fact of letting go the ownership of their wealth even though with indirect control, says Sarin of Client Associates.

“Indians have this control issue which primarily means that they really don’t want to own assets in any way other than in individual names. As Indians we always think that the real estate has to be in my name, the shares have to be in my name or in my child’s name,” explains Yadav from IL&FS.

According to Shefali Goradia, partner at BMR Advisors: “it’s just a mindset; generally Indians don’t trust outsiders with their assets and hence prefer to retain some control rather than handing it over entirely to be managed by corporate trustees.”

Today, however, there are many different types of trust structure, which, while preserving the transfer of legal ownership to the trustee, permit the settlor who establishes the trust, or a third-party designated by the client, to retain significant influence and control over the management of assets.

“One can also retain complete control by forming a “non discretionary” trust where one may appoint professional trustees for the predefined activities. Alternatively one may retain a partial control by joining the board of trustees, or forming a private trust company,” adds Pradhan.

The issue of retaining control can be managed by choosing the appropriate trust structure. “People are not comfortable with an irrevocable trust as the creator of the trust cannot be a beneficiary of the Trust and has to give up control of their wealth,” mentions Gavankar from Kotak Mahindra trusteeship services limited.

But more recently, there is a trend of setting up irrevocable structures for the purpose of asset protection and avoiding the proposed estate duty.

Ashvini Chopra, managing director and chief executive officer, Universal Trustees talks about what are some of the ways you can address the concern clients have about losing control. One of the clearest ways to address that is to make a revocable trust which becomes irrevocable at the press of a button. That means that practically there is an enabling provision in the trust deed. Also, when the settlor dies it becomes irrevocable.

A second way is to constitute a protection or a management committee, which is tasked with running the business and managing the assets underneath that. A trustee is there to look at the trust assets from one perspective only – protection of interest of beneficiaries.

So to an extent, the issues around control are addressed in both the structures. Depending on family requirements further structures can be planned and implemented.

Customisation is important

Trusts shouldn’t simply be viewed as a single, one-size-fits-all solution.

According to Sarin, “there are huge socio-economic differences between the western and the Indian societies due which the fitment of this solution with Indian psyche will take a while. For example, while in the western world a child and the parent become fairly independent of each other when in teens in India on the contrary parenting never ends and so would any transition of rights till the parent is around. India, like most Asian economies, is a conservative society with a preference over control than letting go. “

“A trust is a customised document in India. Unlike in offshore jurisdictions, there is no single standard template,” says Chopra of Universal Trustees.

Sharing sensitive details regarding asset holdings of the family business, financial structures, shareholding patterns, is extremely important while deciding the type of trust structure. What investors fail to understand is that non disclosure of information can harm them more in the long run. This is because, Indians have assets oversees and beneficiaries of different citizenships.

“Not only are people unaware, but they are creating more trouble for themselves by forming trusts as they are letting go of control over assets without realizing it,” says Haigreve Khaitan partner at Khaitan & Co.

Ranging from the appropriateness of estate and succession planning structures to the ability of advisers to service clients’ needs in relation to wealth transfer effectively – private banks and wealth management organisations in Asia are grappling with how to address these and other challenges.

Ultimately, the pitfalls relate to there not always being enough care taken, nor advice given to a client. The focus must therefore be on ensuring the most appropriate solutions are found and then implemented for each client.

Viewing trusts in the right way

Essentially, wealth management professionals shouldn’t simply equate the succession planning process with setting up some type of trust structure. If they do so, they will overlook some of the pitfalls to using trusts as a tool for wealth planning for families.

These pitfalls include the fact that trusts can create a false sense of security. For example, family wealth might fail as a result of family conflict, and putting the business into a trust won’t automatically protect against this.”

The danger with trust solutions, therefore, is that they might be too simple.

According to experts, to use trusts as effective succession planning tools, the first rule is to be transparent with the entire family about setting up the structure. In many cases, the trust expert only talks to the patriarch or founder, so only gets that individual’s perspective and ideas on how succession will play out, and how ownership should be structured in the future.

However, says Roselli, there is often no testing in reality with the family about whether this is acceptable. “It is therefore crucial to have family meetings involving the wealth manager, lawyer and business founder, to identify commonly shared objectives and priorities that will drive any structure in the future and whether this will work in practice.”

A common characteristic of Asian family firms which have lasted for 100 years is some sort of consolidation of the share ownership.

According to Sarin, “most of the first generation wealth owners in India, and there are many of them, are uncomfortable with a situation where the younger children are to inherit the responsibility of a legacy on account of a sudden eventuality. The solution which is finding acceptance amongst them is to set up a revocable testamentary trust which comes into existence only in case of the eventuality and then the wealth gets transferred back to within the family when children attain the desired age. This way the ownership of the wealth gets transitioned out of the family only when required and that too for a defined period of time.”

A further lesson relates to third-generation families, and how many people this actually refers to. These could involve anywhere between 20 and 30 different individuals. Without a trust, issues arise relating to how these people can make decisions together.

And even if the family business is put into a trust, which might be the sole shareholder in the business, there could still be 20 to 30 beneficiaries and the mechanism for them to make joint decisions is still missing. There is still a need for some kind of governance structure, therefore, to enable all the beneficiaries to work together.

It is also important to ensure there is flexibility in trust structures, such as the use of widely-drafted variation clauses. “Tax regulations will keep changing, whereas trust structure can be made flexible enough to incorporate any changes as per new regulations,” Aboobaker explains.

Trusts as a relationship

An increasingly relevant idea in Asia is the role of a trust as a relationship. In this way, the trust is designed and set up by the settlor and the beneficiaries are educated about their role and what is expected of them, as well as the role of the trustee and how the overall relationship is meant to work.

Much of this relies on clients getting the right advice in the first place, which goes back to RMs asking their clients the right questions to ensure they choose the most suitable trust structure for them.

First and foremost, it is very important for the adviser to talk with the client and figure out what outcomes they are looking to achieve and what matters are important to them. For instance, is day-to-day management and control of the underlying trust assets important? Are the restrictions on what the trust can invest in important?”

Beyond that, questions about the client’s particular circumstances are important – for example, if the client is clearly looking to benefit family members who will be among the class of beneficiaries, are those beneficiaries adults or are they minors? And are those beneficiaries independently wealthy, or are they relying on the trust or income and capital?

A third important element, is knowing what sorts of assets the trust is going to hold. Related to that, issues around investment decision-making.

Costs of setting up trusts

According to many experts, clients often ask how much is needed to set up a trust, but that’s the wrong question. Instead, they should be asking “will I get value out of a trust?” If the answer is “no” then they shouldn’t do it.

Yadav from IL&FS shares her experience as she is asked this question repeatedly. “I always say that when it comes to your wealth, we want our wealth to grow in a certain way but we are not bothered to ensure to a smooth transition of wealth. What you really need to do is, pay one time, like a onetime set up fee for setting up a structure.

Depending upon the complexity the fee may change. For example, if you have regulators involved, you have listed shares or you have other promoter entities. It is basically scope driven. Trusts are for people who have done well in life and do not want their next generation to unnecessarily spend their time, money and effort on getting the assets they deserve and also want to preserve these assets because they may not be in India all the time. At the same time you may want to minimise any tax adventures like inheritance tax etc so you would want to create a structure like that, where cost would not be a major concern.

“Costs are an aspect of mindset, as they are insignificant when compared to the value of asset,.” adds Ghosh from Barclays.

Taxation of trusts

Trusts in India are fiscally transparent entities and the income of a trust is effectively taxed in the hands of its beneficiaries. However, a trustee maybe obligated to pay tax in the capacity of a representative assessee. The scope of this obligation extends to all income received by a trustee for the benefit of or on behalf of the beneficiaries. A trustee would be subject to the to tax to the same extent that would be recoverable and levied upon the beneficiary. Hence, the aggregate liability of a trustee should not be greater than the aggregate liability of the beneficiaries. At the same time, a trustee is entitled to recover the tax amount from the beneficiary.

Where a trust is specific i.e. the beneficiaries are identifiable with their shares being determinate,

a trustee can be assessed as a representative assessee and tax is levied and recovered from him in a like manner and to the same extent as it would be leviable upon and recoverable from the person represented by him. The tax authorities can alternatively raise an assessment on the beneficiaries directly, but in no case can tax be collected twice.

While the income tax officer is free to levy tax either on the beneficiary or on a trustee in his capacity as representative assessee, as per section 161 of the ITA, the taxation in the hands of a trustee must be in the same manner and to the same extent that it would have been levied on the beneficiary. Thus, in a case where a trustee is assessed as a representative assessee, he would generally be able to avail of all the benefits/ deductions, etc. available to the beneficiary on the distribution of income from a trust.

In case of a discretionary trust set up offshore with both Indian residents and non-Indian resident beneficiaries, a trustee should not be subject to Indian taxes or reporting obligations. However, if all the beneficiaries of such discretionary trust are Indian residents, then a trustee may be regarded as the representative assessee of the beneficiaries and can be subject to Indian taxes (on behalf of beneficiaries) at the maximum marginal i.e. 30% (excluding surcharge and education cess, as applicable). Further, in case will be regarded as the representative assessee of the beneficiaries and subject to tax at the maximum marginal rate i.e. 30%.

Section 61, which is an anti-avoidance provision, provides for taxation of a revocable trust in the hands of a settler/transferor. As per section 61 of the ITA, all income arising to any person, by virtue of a revocable transfer of assets, shall be chargeable to income tax as the income of the transferor and shall be included in his total income. No tax liability should accrue to the beneficiary in case of final distribution in cash or in kind on winding up a trust, so long as the distribution is a capital distribution.

You must be logged in to post a comment.