Funds managed

| Fund name | Asset Class | License |

| Sameeksha India Long Only Equity Fund | Equity | PMS |

| Sameeksha India Long Biased Equity Fund | Equity | PMS |

About

- Sameeksha Capital is a SEBI registered PMS, founded by Bhavin Shah in April 2016.

- Eswar Menon, Fund Advisor

- The AUM of the Sameeksha Capital is about 267 crores. Sameeksha Capital Private Limited’s Corporate Identification Number is (CIN) U67120GJ2015PTC082273 and its registration number is 82273.

Key staff

- Bhavin Shah is among the most successful professionals in equities. Rated the #1 technology sector analyst in Institutional Investors polls for a decade. He has 20 years of experience building top research franchises: Seven years as Managing Director and the Global head of Technology at JP Morgan, Six years as Director and Head of Asia Pacific Technology at Credit Suisse and five years as founder of Equirus Securities. Anchored the rise of Credit Suisse from an unknown name in Asian equities to a number one ranked firm in Asian equities; head of Asia Pacific Tech Research. Credited for building top ranked Global as well as Asian tech research practice at JP Morgan as MD and Global head of tech research; Made defining contribution to enable JPMorgan to move from an also-ran player to a top global name in equity research . Built a very profitable and award winning Indian equity business at Equirus from scratch on a tiny budget; achieved number two ranking in Asia for idea performance.

- Impeccable track record of identifying true long term winners ahead of others including Samsung Electronics, TSMC, Infosys and TCS.

- Best in class business education from the world renowned business school: Double major in Economics and Finance, Beta Gamma Sigma cum laude from the University of Chicago Booth. Excelled in studies under world renowned faculty such as Dr. Raghuram Rajan, former governor of the Reserve Bank of India.

Investment Philosophy (for firm)

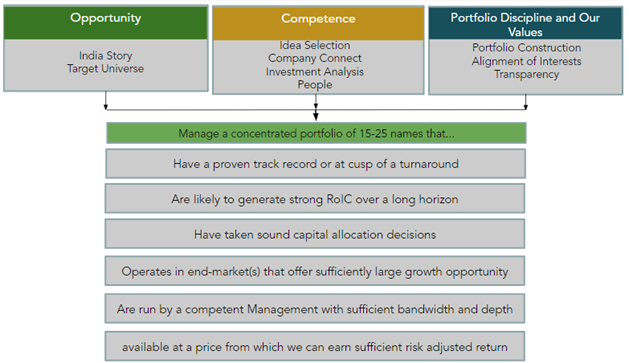

- They focus on process driven investing and have developed proprietary analytical models and methods which they follow rigorously to identify companies with superior risk-reward characteristics. A comprehensive set of rules guides them in the investment process and arguably reduce individual biases and mistakes.

- Though market cap agnostic, we tend to find many great investment ideas in the small and midcap space; companies that are outside the radar of many large investors but offer opportunity for high returns because of growth both in earnings as well as valuation.

- They believe in investing heavily in resources to support our detail oriented approach. The Fund Manager and Advisor to the Fund together bring complementary but rich and relevant experience spanning over two decades each, and have had a track record of excellence in equity research and portfolio management respectively. Because of their prior education and experience in technology sector, they are very comfortable understanding complex industry dynamics that may shape the future of companies available for investment.

Fund Objective and Strategy

- Provide superior long term returns while protecting against permanent loss of capital: Invest in long-term growth opportunities in Indian companies across market capitalization (with greater emphasis on mid and small cap companies that are not fully discovered) that have superior business model, sufficiently large market opportunity to deliver growth, strong and shareholder focused management and are available at price that would result in sufficiently attractive risk adjusted returns over a horizon of at least two years.

- Manage market exposure both by modulating cash position in the portfolio depending on the opportunity set and attractiveness of investment ideas.

- Follow Rigorous fundamental research-driven and rule based investment process that is disciplined and yet leaves enough room for creativity and ingenuity; Investment process entails interactions with the companies through common as well as uncommon means, detailed financial model on the company as well as the industry to properly size up the growth opportunity, completion of a detailed check-list and review of investment argument by the entire research team.

- Focus on long-term return and hence may experience short term volatility, but will use its research capability to minimize the permanent loss of capital and will adhere to established risk guidelines.

Media

Title: Interview On Nifty’s Big Drop Since February 2018, Source: BloombergQuint, Date: 28 February 2020

https://www.youtube.com/watch?v=smN1KxU0icw&t=15s

Due to drop in NIFTY Bhavin talks about how it is a good time to start investing if an investor has some spare cash which he wants to deploy. On the other hand he also talks financial stocks like Bajaj Finance and Karvy. How they are not the correct choice in the light of current environment. He further talked about auto sector (Nifty Auto), investor should stay cautious of auto industry right now. It’s better to wait. He also said that HDFC Bank Stock is underperforming because of changes in the top management but this is a transition phase for the bank. It’s a probability risk, which will be beneficial for them in the long run. He finally talked about fall in Nifty IT, reason could be liquidity some investors might have made an exit from the IT stocks. When it comes to IT stocks, one shouldn’t panic as US economy is not the worrisome factor.

Title: Top Performing Fund Managers of 2019, Source: BloombergQuint, Date: 10 January 2020

https://www.youtube.com/watch?v=_sjBCFQ22K8&feature=youtu.be

What worked for Bhavin? His company focused on firms which captured market share in 2019. Emphasis on value hunting in ‘battered’ small and mid-cap space. He also picked some IPOs which the market had ignored. He properly valued large cap company. According to him the market doesn’t know how to value them properly. The firm followed the proper liquidity criteria due to this he was able to cover maximum companies in the portfolio.

Title: Markets Facing Resistance At Higher Levels, Source: BloombergQuint, Date: 27 November 2019

https://www.youtube.com/watch?v=PyJwv7Ku7OI

He shares his philosophy of investing i.e. his strategy is multi cap and bottom up. He talks about that an investor should have index funds in their portfolio. As they have outperformed the large cap funds. Investor should focus on those segments which have rich valuations. He also talks about the staggered approach about investing.

Analyst questions

- what are the market dynamics or forces which sell side firms are not able to understand while picking stocks?

- which type of investing approach works? Prudent or Momentum. Especially when market environment is uncertain.

Peer review by Dishant Savla

You must be logged in to post a comment.