Funds managed

| Fund name | Asset Class | License |

| Consistent compounder PMS (CCP) | Long only equity (Multi cap) | PMS |

| Little Champ | Long only equity (Small cap) | PMS |

| Consistent compounder offshore fund | Long only equity (international) | PMS |

| King of Capital | Long only equity (financials) | PMS |

About

- Marcellus Investment Managers was founded in 2018 with the sole purpose of influencing efficient capital allocation in the Indian economy.

Key staff

- Saurabh Mukherjea (CFA -Chief Investment Officer)- He is the former CEO of Ambit Capital and played a key role in Ambit’s rise as a broker and a wealth manager. When he left Ambit in June2018, assets under advisory were $800mn. In London, he was the co-founder of Clear Capital, a small cap equity research firm which he and his co-founders created in 2003 and sold in 2008. In 2017, upon SEBI’s invitation, he joined SEBI’s Asset Management Advisory Committee. In 2019, he was part of the five man Expert Committee created by SEBI to upgrade & update the PMS regulations. He has written three bestselling books: Gurus of Chaos (2014), The Unusual Billionaires (2016) and “Coffee Can Investing: The low risk route to stupendous wealth” (2018). He was educated at the London School of Economics where he earned a BSc in Economics (with First Class Honours) and MSc in Economics (with distinction in Macro & Microeconomics).

- Pramod Gubbi (CFA –Head of Sales)- He manages the sales & marketing efforts of the firm. He also sits on Investment Committee that discusses and approves investment strategies of the firm. He was previously the MD & Head of Institutional Equities at Ambit Capital. Prior to that he, served as the head of Ambit’s Singapore office. Before joining Ambit, he worked across sales and research functions at Clear Capital. Besides being a technology analyst, he has served in technology firms such as HCL Technologies and Philips Semiconductors. He did his B.Tech from Regional Engineering College, Surathkal and has a Postgraduate Diploma in Management from the Indian Institute of Management–Ahmedabad.

- Rakshit Ranjan (CFA -Portfolio Manager)- He spent 6 years (2005-2011) covering UK equities with Lloyds Bank (Director, Institutional Equity Research) and Execution Noble (Sector Lead analyst). During these six years, he was ranked amongst thetop-3 UK Insurance analysts (Thomson Reuters Extel survey) in the mid-cap space. Since 2011, Rakshit led Ambit Capital’s consumer research franchise which got voted as No.1 for Discretionary Consumer and within top-3 for Consumer Staples in 2015 and 2016. He launched Ambit’s Coffee Can PMS in Mar’17 and managed it till Dec’18. Under his management, Ambit’s Coffee Can PMS was one of India’s top performing equity products during 2018. He has a B.Tech from IIT(Delhi).

Investment Philosophy (for firm)

- Our investment philosophy has been shaped over several years by legendary investors like the late Rob Kirby and by outstanding capital allocators like Harsh Mariwala (Chairman, Marico) and KS Dhingra (Chairman, Berger Paints).

- Our approach to portfolio management doesn’t just focus on delivering healthy returns to our investors but also aims to do so by taking relatively low risks.

- CCP’s investment strategy is to invest in a concentrated portfolio of heavily moated companies that can drive healthy earnings compounding over long periods with very little volatility.

- The PMS comes with attractive performance-based fee options which align our interests with that of the investor. Furthermore, it has one of the lowest cost structures in the PMS industry with no entry loads, no lock-in and no exit loads.

- Marcellus investment philosophy is based on the concept of consistent compounders, which says that the return on capital should be greater than the cost of capital, this should be sustainable for number of years in a row.

- Gap between return on capital and cost of capital is free cash flow that the firm generates, the wider the gap the more competition the firm attracts, intense competition narrows this gap.

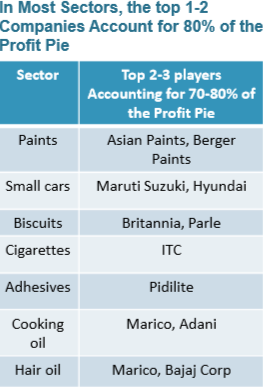

- In the global landscape, competition that dominates their sector do not generate high ROE, which is far higher than cost of capital, therefore consistent compounders aren’t present.

- In Indian landscape their exists firms like Asianpaints, ITC ltd, Nestle, Pidilite, Jockey, HDFC dominate in their sectors and have ROE far higher than the cost of capital.

- The core challenge is understanding the sustainable competitive advantage.

- Research process includes:

- Understanding that why is a company been able to generate consistent healthy fundamentals.

- What has been the nature of competition, disruptions, evolutionary changes that these firms faced in the past and what is that their moats, because of which the return on capital as a result were not competed away.

- High governance

- To understand the DNA of a company they watch the companies like a hawk for years.

- Their philosophy is based on Robert Kirby’s paper ‘ The coffee can portfolio’ , wherein he says to find a company and stay for 10 years , and don’t time the entry or exit and sit tight for a decade.

- They employ high quality of people to ensure proper delivery of the process and maintain highest level of transparency with the clients, they explain them about the investment philosophy, for them the trust is of at most importance.

Investment Strategy

1. Identify companies with clean accounts

2. Identify companies with track record of superior capital allocation

3. Amongst companies which pass steps 1 & 2, identify those with high barriers to entry.

Step 1: Identify companies with clean accounts

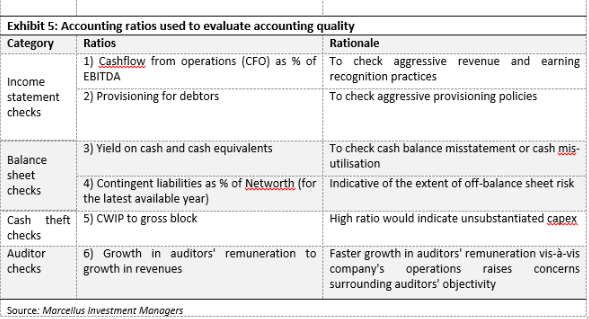

Ten forensic accounting checks used to identify naughty companies

Income statement checks:

- Cash flow from operations (CFO) as% of EBITDA

- Volatility in non-operating income

- Provisioning for doubtful debts as a proportion of debtors overdue for >6 months

Balance sheet checks:

- Yield on cash and cash equivalents

- Contingent liabilities as % of net worth (for the latest available year)

- Change in reserves explained by the profit/loss for the year and dividends

Auditor checks:

- Growth in auditor’s remuneration to growth in revenues

Cash theft checks:

- Miscellaneous expenses as a proportion of total revenues

- CWIP to gross block

- Free cash flow (cash flow from operations + cash flow from investing) to median revenues

This checklist forms an essential part of the qualitative assessment of stocks:

Methodology:

- We look at over six years of consolidated financials for the universe of firms.

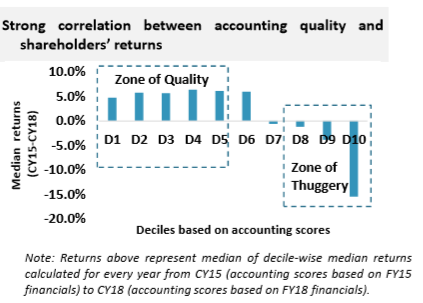

- We first rank stocks on each of the 10 ratios individually. These ranks are then cumulated across parameters to give a final pecking order on accounting quality for stocks.

- This framework draws upon Howard Schilit’s legendary text on forensic accounting, “Financial Shenanigans”.

Step2- Identify companies with track record of superior capital allocation

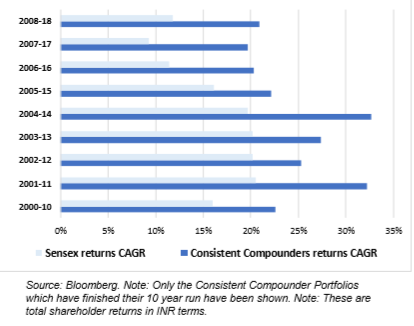

- We create a list of stocks using a twin-filter criteria of double digit YoY revenue growth and return on capital being in excess of cost of capital, each year for 10 years in a row.

- Next, we build a portfolio of such stocks each year and hold each of these annual iterations of portfolios for the subsequent 10 years (without any churn).

The bar chart on the right shows the back testing performance of such a filter based portfolio.

There are two conclusions from this exercise:

• This filter based portfolio delivers returns of 20-30% p.a. (of INR returns) and 8-12% outperformance relative to the Sensex.

• The volatility of returns of such portfolios, for holding periods longer than 3 years, is similar to that of a Government of India Bond.

{Returns here (both for our portfolio and for the Sensex) are on a Total Shareholder Return basis i.e. all dividends are included in the returns.}

Step3: Amongst companies which pass steps 1 & 2, identify those with high barriers to entry

Perform in-depth bottom-up research of companies, which pass our filters to assess sustainable competitive moats and build a portfolio of 10-15 stocks which consistently compound earnings.

What do we look for in our research?

- Look for managements with an obsessive focus on the core franchise instead of being distracted by short-term gambles outside the core segment.

- Look for companies which relentlessly deepen their competitive moats over time

Look for promoters who are sensible about capital allocation, i.e. refrain from large bets (especially those outside core franchise) and return excess cash to shareholders.

Little Champ- https://marcellus.in/newsletter/little-champs/introducing-little-champs-our-small-cap-pms/

Covers details about the little champ fund selection process.

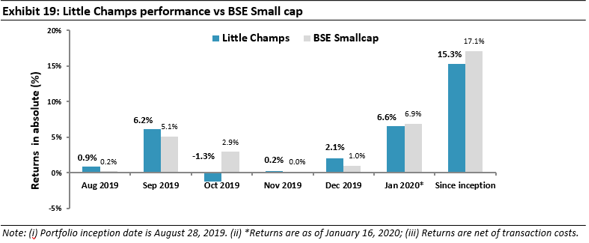

The Little Champs portfolio as on January 16, 2020, had a total of 14 stocks with equity allocation of close to 88%. While its stock selection is purely bottom-focussed, no single sector constitutes >20% of invested corpus. The Little Champs portfolio went live on August 28, 2019.

The smallcap strategy intends to keep the portfolio churn low (not more than 25-30%) to reap the benefits of compounding as well as minimise the impact of trading costs.

Continuous monitoring and evaluation will also be key, even though Marcellus does not put much weightage on short-term factors like weak quarterly earnings. What it will watch out for is important structural change in the company like key management change, noteworthy capital allocation decisions or crucial corporate governance.

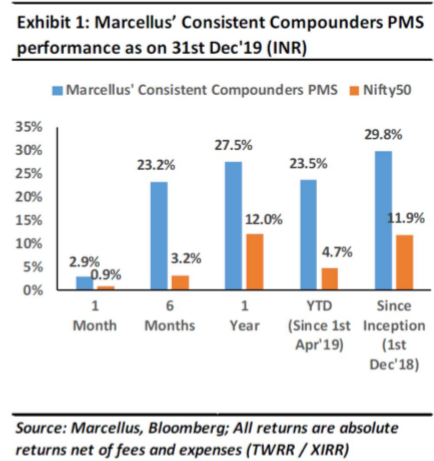

Performance of-

CCP– There are 13 stocks in the CCP.

Little Champ Portfolio- https://marcellus.in/newsletter/little-champs/introducing-little-champs-marcellus-small-cap-pms/

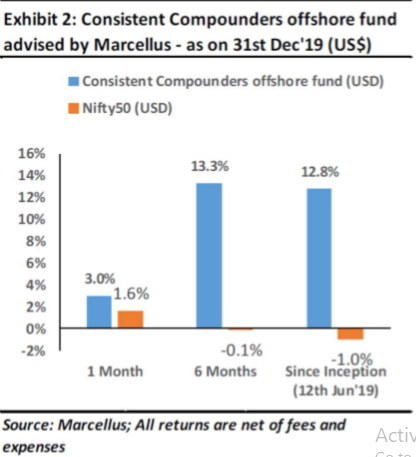

Consistent compounder offshore fund

Kings of Capital PMS was launched in July 202 with Tej Shah as fund manager

“Kings of Capital” strategy is to own a portfolio of 10 to 14 high quality Financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation and high barriers to entry.

The non-borrowing portion of the portfolio provides stability to the portfolio during periods of stress. The investment team of Marcellus King of Capital believes that insurance firms have a lower beta than lending firms, while asset management and investment firms do not take any balance sheet risks.

Media

MMI interview with Saurabh Mukherjea, 2022

Know your 4C Fund Manager, Source – Motilal Oswal Wealth Management (YouTube), June 2020

Discusses investment philosophy

Title: Marcellus Investment Managers Webinar, Source: Marcellus investment managers (youtube), Date: 2019

https://www.youtube.com/watch?v=n-um7yqAsbo

Discussed investment philosophy, they make a concentrated portfolio. They don’t time the market. Δ P =Δ P/E x Δ E. P/E multiple does not compound but earnings keep compounding over a period of time. Consistent Compounders have historically delivered 20-25% annualized earnings compounding in a very consistent manner. Even during periods of weak economic growth these firms tend to deliver 15-17% annualized earnings growth. Moreover, given their consistency of healthy of healthy fundamentals during periods of P/E multiple compression these stocks undergo a low degree of P/E multiple compression than the border market.

Analyst questions

- You have been in the industry for more than a decade,has your investment philosophy evolved over the years? If yes, then how?

- Why is that only India has consistent compounders that lead the market?

- Did you ever go wrong in picking a stock, what did you learn?

Prepared by – Vanshika Bagrecha, June 2020

Updated Sep 2021

You must be logged in to post a comment.