In a CFA webinar, the CIO at Equities Edelweiss Asset Management, Harshad Patwardhan, explains his learnings over the past decade while selecting mid-caps stocks and misconceptions attached to it.

Myths regarding mid-cap investing

1. Midcap signifies inferior quality – don’t equate (compare) small or mid cap with top quality of large cap stock. He says in fact, identify business in smaller product market segments with good quality business in smaller segments. Adding to this he gave an example I.e.

Sectors like- Capital goods, Chemicals, Retail, etc. they may give you good returns over the years, but they may not be as big as the other industries like Auto, IT or Banking, in spite of leading in that business because the size of the industries are small.

2. Midcaps must trade at a discount to large caps – (11mins45sec)

There is no point in comparing valuation at index level because the composition is different.

You can compare within the sector as close as company as possible.

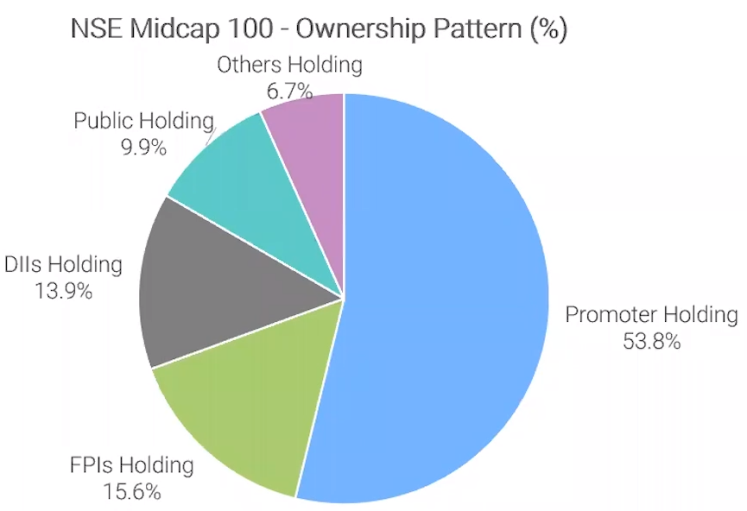

3. FII/ FPI don’t invest in midcaps – (15mins)

Evidence from historical returns

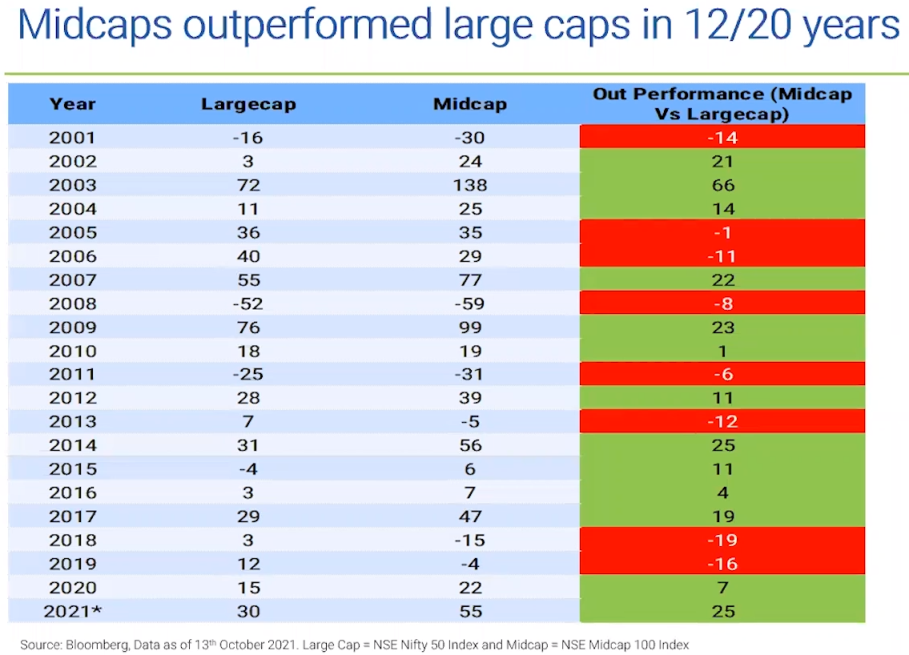

The mid-cap index started from 2001. In the calendar year 2018 and 2019 mid-cap index underperformed the larger cap index by -19% and -16% which were the worst years on record. (15mins45sec)

On a 3-year daily rolling return basis, 64% of times mid-cap index has outperformed large cap index.

On a 5-year daily rolling return basis, 75% of times mid-cap index has outperformed large cap index. (18mins30sec)

Over a longer period, midcaps have outperformed large caps. (17mins)

A comparison between Nifty 50 and NSE Nifty Midcap 100

Source: Bloomberg

Coverage of mid-caps stocks is lower then large caps stocks

Mid-cap stocks are less researched than larger caps. An average large cap stocks covered by major analyst or brokerage firm are 31, while for mid cap it’s only 18, followed by 3 for the small cap. In Indian market it is over researched when it comes to large cap compared to mid-caps.

This is how the institution brokerage world works; they will cover stocks that give them commission from the clients. In down market brokerage firms don’t want to waste their resources in tracking mid or small caps because clients aren’t interested and they get a hefty commission for covering large caps.

Why successful midcap stocks generate superior returns & how to mitigate impact of mistakes

Bottom –up picking is more important because if you have proper resource and time to identify the stocks early on, you can really benefit from the earnings growth as well as rerating happens when that stock becomes more visible. (Ignoring the dividend source of income)

Successful Midcap ideas gain from both EPS growth and re-rating.

Managing liquidity

It is very important to balance performance and liquidity if you are holding it for the long term. Pockets of illiquidity may lead to compromising interest of investors who do not redeem on time.Losing sight of liquidity of underlying stocks while building position can cause trouble in stressed times.

He concludes that the mistakes are inevitable, but things to take into account like, sizing of bets proportional to level of conviction, diversification, being mindful of negative bets (particular sector wise), being ruthless when hypothesis proves incorrect, not to get over attached to any particular stock or completely depend on the management and corporate governance. So that it doesn’t mitigate impact on the overall portfolio.

Adding to this he said that while investing in mid-caps what people should be cautious of drawdown and volatility which is the part of the game, but if you hold a quality business that you are confidence of, then the drawdown is temporary and fundamental will play their role in medium to long term and this is what we have seen in past.

Career opportunities

His first advice is not to take a short cut at all, if you want to make a career in investing.

There are mainly two aspects i.e., research and portfolio management. People who are young and want to make career in investment he suggests to do as much research as possible. Try to understand business and sector and not just go through latest annual reports, but try to study and understand last 5, 10 or 15 years of annual reports so that the picture immerges in your mind and you try to connect the dots.

This summary was prepared by Darshil Punamiya based on the webinar by Harshad Patwardhan CFA, at the CFA Institute.

You must be logged in to post a comment.