This summary focuses on the basics of private equity and introduces you to the different careers available for private equity (PE).

CFA Namit Arora managing partner at IndGrowth Capital took a detailed look at the subject. He has provided students insight into the industry and helped them understand different aspects of the private equity ecosystem in India.

Private equity industry in India

In his webinar, he starts off by Stating that PE industry has about history of three decade in India but specifically over the last two decades PE industry emerge as an important part of capital market in India there is been multiple drivers for growth such as capital needs of economy, increasing activity across types (including minority growth capital, bayouts, Venture Capital, special situation etc.), secondary PE opportunity etc.

Arora then explained that players in India now include most leading global PE funds, several homegrown Indian funds with established track record, sovereign wealth funds from several country around the world (SWFs), foreign pension funds, mezzanine funds etc. The PE market is a very competitive market but it also gives a sense of how important the economy is and i.e. there are large no of entrant and now becoming large players in India. Going forward as the PE industry will continue to gain traction in India, PE funds will grow in size and complexity. This will create more career opportunities. There are PE related career opportunities across various part of broader PE ecosystem.

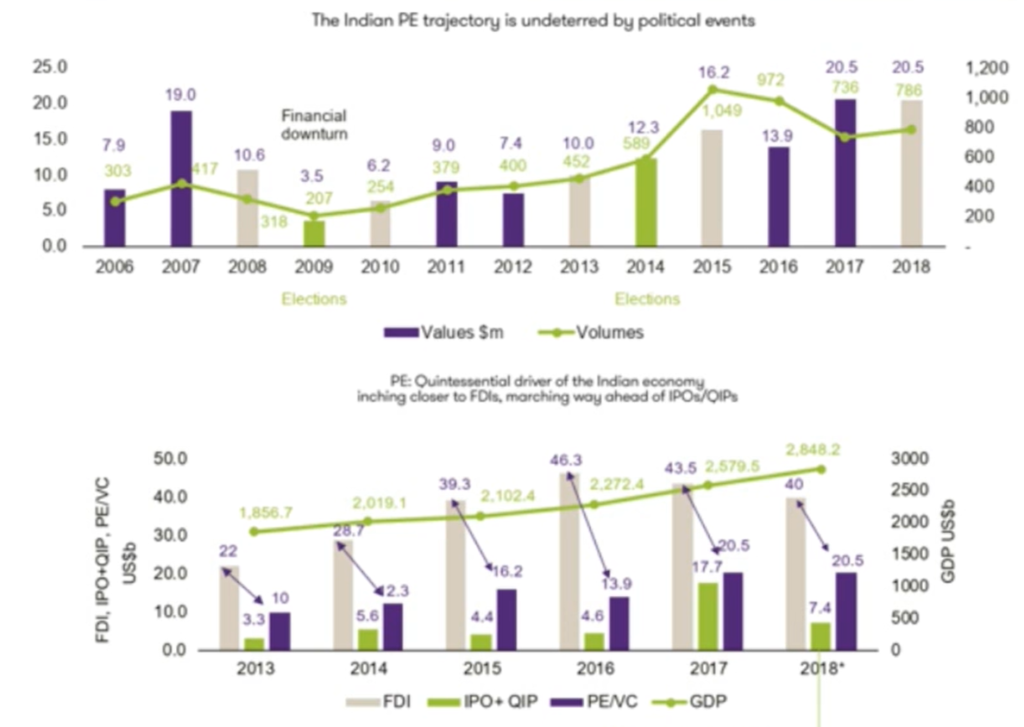

Arora explained about the Indian economy that 1st set of reformed that are happened 1991 & 1992 and now we are 28 years down the line there is some statistical data that suggest that the economy heads toward the inflection point as shown in figure so, it does feel like inspite of all challenges India is at that inflection point today there have been various drivers for it such as demographic, urbanization and reforms such as Financial Inclusion, Improving Transport Infrastructure, Ease of Doing Business, GST etc. so forecast suggest that in about a decade India could be the third largest global economy and PE is one way of participating in this growth story which also explains why several fund and Indian funds are using PE as a way to play the opportunity in Indian Economy.

PE firms in India

The following chart shows some of the global and Indian PE Firms

He explains that volumes in PE industry that India peaked at 2007 at about $19 billion and in the last two years 2017-2018 the PE volumes is significantly more than $20 billion. From 2009 to 2018 the volumes are gone more than 5X; PE is now becoming the important asset class and bridging the gap.

Skills and traits required for career in private equity

Arora lists the following personality traits –

- Eye for detail and flair for rigorous analysis

- Patience and perseverance, long term orientation (deal closure timelines, broken deals, deal lifecycles of 5 years on average, exit and monetization of investment is the real goal, not writing a cheque which is easy!)

- Team player

- Humility (Markets are supreme, we are as good as our last deal)

- Curiosity (Reading interests, continuous learning, ability to form a view on emerging / long term trends)

- Passion (Titles / compensation, quality of work)

- Enjoy engaging with people and travel (e.g., scuttlebutt, real first-hand research vs. desk top reading of sell side equity research, plant and site / dealer visits)

- Networking – ability to cultivate and nurture relationships (new deal origination, portfolio management and value creation)

- Ability to handle failures and learn from them

- Ability to handle pressure and tight timelines without compromising quality

Education and hiring

What education qualification are required?

- MBA / CA typically desirable for investment roles;

- CFA a valuable additional qualification

- Pre-MBAs welcome for Investment analysts

- Operating roles – non-MBA / CA welcome, relevant industry experience

How would the CFA curriculum help?

- Portfolio management, portfolio construction

- Equity valuation methodologies, practical considerations

- M&A transactions for portfolio companies

- Historical financial statement analysis

- Financial projections, return on capital metrics, cash flow analysis, capital budgeting and IRRs

What are people evaluated on ?

- IQ+EQ

- Track record in prior roles, project management

- Professional and personal references

What are the common technical and behavioral questions?

- Financial statements, forecasting

- Assessment of personality traits

What do case studies try to capture?

- Logical thinking, analysis, structured thought, reactions to people situations

—

This summary was prepared by Ashutosh Kumar Prasad based on the webinar by Namit Arora at the CFA Institute.

Career opportunity: Private Equity Eco-system in India (cfainstitute.org)

You must be logged in to post a comment.