Quantitative investing, also known as systematic investing, is a type of investment strategy that employs advanced mathematical modelling, computer systems, and data analysis to determine the best chance of executing a profitable trade.

Quantitative analysts, also known as ‘quants’, use a variety of data to create algorithms and computer models using mathematical and statistical methods.

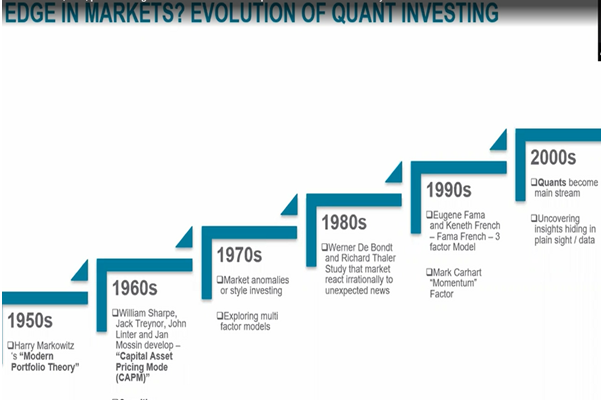

Quant investing has grown in popularity over the last two decades as computing technology has advanced. Today’s financial markets are dominated by automated trading strategies, and smart beta factor investing has taken off commercially. Meanwhile newer approaches using big data are gaining acceptance as more data becomes available digitally.

The following image shows the evolution of quant investing –

Quantitative techniques

In another CFA Institute webinar, Parijat Garg (an algorithmic trader, investor, and entrepreneur with 12 yrs of experience in the market) shared his insights into building quantitative systems. He believes that if a choice is given, one should not involve themselves in building in the quant system if the work is being done by getting basic data from sources and using a basic program. But if the basic program doesn’t work for one, they should go for making their system and making sure they are correct.

Following are some of the applications of the quantitative system which will be useful :

- Power Screening: Power screeners could be used in an organization to screen niche data which could be used in creating a system.

- Technical Research: Technical analysis could be performed in bulk. For eg 20 different patterns could be applied on 200 different securities which one will screen and automatically.

- Trading Strategies: The system relies on mathematic computations of data provide such as price and volume which could help in identifying trading opportunities.

- Fundamental Research: Fundamentals research of a large number of securities could be performed at the same time.

- Risk Assessment: Portfolio managers can use the quant system to create a risk assessment system that will help decide on their portfolio.

- Reporting: The asset manager could generate an automatic everyday report.

The basic schematic of the quantitative system involves three pieces:

- Database: This is like input, where all the gathered financial data is added to the system.

- Analysis: Specific to the application that one has created depending on his aim.

- Output: Reports in form of a text file or reports generated.

The following considerations one should think about before building a system:

- Data Architecture: It identifies the data that will be required for your system. It considers the purpose of the exercise while maintaining flexibility depending on the purpose of the system. Its complexity will change depending on the aim, for example, technical research would be less complex as compared to a risk assessment.

Technology Stack: One should consider which programming language which they will use for making the system and also decide on the data storage, whether it will be a hard storage or cloud system. When making a system for an organization, one should also look at regulations i.e. data security rules, and also keep a track of budget as it will help in deciding whether they want to create their server. The nature of Data & end-use may help in choosing the language you require for the system.

- Maintenance / Pipeline: The above figure shows a data acquisition pipeline. Source vary according to the requirement for eg. NSE, Bloomberg, etc. Data lakes are the storages where the raw data from sources is dumped. In extraction, the data is processed according to the process where it is then passed on to the database management system. These pipelines should automate periodic data and update regularly or occasionally/during an event. It should also regenerate data with corrections but also solve the issue of data integrity and source format drift.

- Identifiers: Identifier drift is one of the massive challenges a system may face during its work. For eg. If NSE changes the ticker name of any security, the system may not identify the security and stop collecting its data. Ideally one should create their ideal identifiers for data that could be managed by concordances.

- Accessibility: The database layer should be separate from the analysis. Also, an analysis should be modularized so it could be reused in different programs. Keep the presentation layer separate from the analysis.

- Documentation: Use the document method of the language you are using since the system evolves quickly and ends up with lots of moving parts and capabilities.

The session concluded with the importance of programming in today’s financial world. The programming today is basically like Excel in the 90s. It is important today to know excel or it will be hard to survive in the financial world, same will soon go on with the case in programming. Everyone needs to be experienced in programming but one should learn the basics of programming like basic functions and it could be critical in the coming period. It will help bring something new to the table instead of relying on others.

Roles within quantitative investing

Roles in the market include –

- Quantitative developer – A quant is a computer programmer who develops financial modelling solutions to quantitative finance and quantitative trading industry

- Risk model validation – The model processes data inputs into a quantitative-estimate type of output. Financial institutions and investors use models to identify the theoretical value.

- Quantitative research – Quantitative analysis provides analysts with tools to examine and analyze past, current, and anticipated future events

- Quantitative research front office – Front office quantitative analysts work for companies that sell and trade financial securities.

- Quantitative credit analyst – A credit analyst’s primary role is to assess the creditworthiness of an individual or company it gather different financial information from a customer, such as earnings and past repayment history, to assess their ability to honour financial obligations.

Skills required for quantitative investing

To apply for quantitative analyst jobs, you will need strong abilities in mathematics and statistics, solid skills in data mining and data analysis, extensive financial knowledge, programming skills.

—

This summary was prepared by Srishti Ladda based on the webinar by Abhishek Dhall CFA institute. The speaker Abhishek Dhall CFA is vice president and quantitative research analyst at the Northern Trust Asset Management (NTAM), India https://www.cfainstitute.org/en/research/multimedia/2020/career-insights-quantitative-investing

The summary on quantitative techniques was prepared by Dhiraj Dhole based on the webinar by Parijat Garg at CFA Society India.

You must be logged in to post a comment.