What is private equity? 1

Private equity refers to the investment made in unlisted securities by a fund, formed by pooling money from accredited investors. Private equity fund can also invest in publicly listed company in order to get it delisted. Private equity consists of various kinds of deals namely – leverage buyouts (LBO), venture capital, growth capital, distressed investments and mezzanine capital. In LBO, private equity tends to buy majority stake in the mature firm, while in VC and growth capital they rarely go for majority stake.

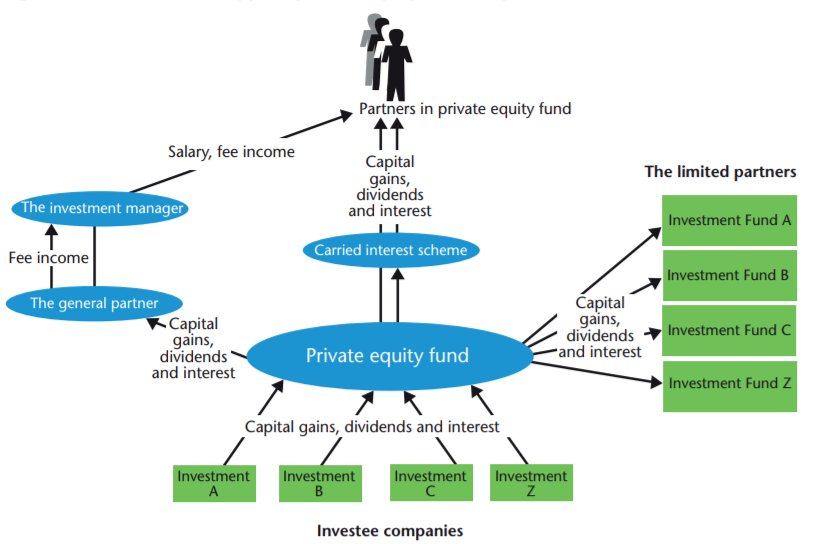

Structure of a private equity fund

Private equity considers itself as an active investor as it takes part in the operations of the firm (investee companies) to produce better outcomes. A private equity can be a passive investor when it completely relies on the management to produce returns; this is known as commoditized approach.

Only accredited investors such as HNIs and institutional investors like pension fund get the opportunity to invest in private equity fund (PE), however some large private equity funds such as Blackstone Group (BX) trades on NYSE.

Overview of private equity in India2

As per Bain’s report, private equity invested around $45 billion in India in 2019. Investment value in 2019 is 110% higher than the average of previous 5 years with major contribution by consumer tech, real estate and infrastructure, telecom, IT and ITES, BFSI and energy. Dry powder level amounted to $8.3 billion ensuring capital sufficiency for high quality deals. India has around 55 private equity firms. Indian having less private equity firms than other emerging countries like China, while India has more listed securities than China, seems as if private companies got listed even before private equity firms entered in India.

What is it like to work in a PE firm? 1

PE majorly performs the following functions-

- Deal origination involves maintaining and developing relationship with transactional professionals or intermediaries such as investment banks, which is imperative to secure high quality of deal flows. Some firms maintain internal teams to generate leads.

- Transaction execution involves assessing the investee firm in terms of quality of management, overseeing historical performance, forecasting and performing valuation analyses, which helps in making the decision of whether to invest or not and if the investment committee decides to go ahead with the investment, they submit an offer to the seller.

- Due diligence is carried out when both parties agree to move forward, it involves validating the financial records and management’s claims.

- Operational orientation involves taking part in the management and advising better strategies to deploy resources in order to achieve efficiency and effectiveness.

- Exit through an IPO or secondary sale (acquisition by another firm). Success of a PE firm depends on return generated by it on exit, which entirely depends on value created through active participation in the portfolio company.

“Private equity is not a job; it’s a way of life”

Renuka Ramnath, Founder, Multiples Alternate Asset Management 2

Essentials for a successful PE firm 4

- Clarity on economics- understanding of the balance sheet, cash flow, P&L and debt covenant is required. Insights into what creates value and cost at the portfolio company, scrutinize fixed and variable costs in order to get a view about the operating leverage of the company.

- Finding right people- existing management in the portfolio company can be flux, in order to generate returns, right people need to be empowered.

- Ownership of data- availability of data should be ensured to find new opportunities to create value.

- Free from bias- private equity firms need to be free from any bias but often it is found that they suffer from cognitive biases, such as illusion of control and overconfidence.

Top global private equity players in India

- The Blackstone Group – Founded in 1985, is a multinational private equity alternative investment management and financial services firm based out of New York. The firm manages $175 billion in PE. Website- https://www.blackstone.com/

- The Carlyle Group – Founded in 1987, is multinational private equity alternative investment management and financial services firm based out of Washington, DC. The firm manages $224 billion of assets. Website- https://www.carlyle.com/

- TPG Capital- Founded in 1992, is a private equity firm focussed on leveraged buyouts and growth capital based out of California. The firm manages $72 billion of assets. Website- https://www.tpg.com/

- Warburg Pincus- Founded in 1966, is a private equity firm focussed on growth investing. The firm manages more than $54 billion of assets. Website- https://www.warburgpincus.com/

- CVC Capital Partners- Founded in 1981, is a private equity and investment advisory firm based in Luxembourg. The firm manages $75 billion of asset. Website- https://www.cvc.com/

Top domestic players in private equity

- ICICI Venture Fund Management- Founded in 2002 is the oldest and largest private equity fund in India, managing $4.25 billion of asset. Website – http://www.iciciventure.com/

- Kotak Private Equity- Founded in 1997 invests in companies which have the drive to become future leaders. Sectors focused are pharmaceuticals, life sciences, healthcare, consumer, technology & financial services. Since then, the alternate assets business of the Group has raised in aggregate US$ 2.7 billion. Website- https://alternateassets.kotak.com/kotak-private-equity-fund.php

- Chryscapital- Founded in 1999 is one of the leading investment firm in India. It manages AUM of $4 billion. Website – http://www.chryscapital.com/

What does a private equity analyst do all day? 5

- As an analyst you need to prepare financial model based on operational assumption that forecasts the potential of the business.

- You will have to contact the management of the company which is looked upon as a potential investment. Significant amount of time goes in researching investment opportunities.

- You can be appointed to work with the portfolio company as they develop a strategic plan.

- You can be asked to come up with new investment opportunities, although the probability of it materializing is remote, you will have to churn before settling on one, but that is apparent when you pitch new ideas.

- Working as analyst requires shadowing the CIO which may require traveling across the world to witness the strategic discussions which occur at top level.

What are the skills required to ace that job?

- You need to be good with numbers and mental math. You may be asked to perform some calculation based on the model that you prepared in a meeting.

- You need to be a good team player. PE firms work in close- knit team, so ability to work in a team is required.

- You need to possess the skill of commercial judgement. If you are given company reports and associated number you should be able to make a sound judgement. You can be given a large chunk of financial data and be expected to form a view about whether it is viable option to invest.

- You need to be proactive; you can’t wait to being assigned a task. You should be able to take charge of the tasks without being spoon-fed the same.

Payscale

Let’s talk about money now! How much do you expect to make?

Well money should not be the first consideration; you should look into other parameters (above discussed) before choosing private equity as a career option.

Following consists of the various designation and associated expected salary at different level

| Designation | Expected Salary (INR)* |

| Analyst (Pre MBA) | 500000 |

| Associate | 700000 |

| Experienced professional | 1000000 |

| Vice President | 3000000 |

| Director | 5000000 |

*These are expected compensation levels and will differ with the organisation

What does the future of private equity looks like in India?

There is an emerging market for private equity firms in India. The culture within an organisation can be pretty dynamic, therefore there would be a constant need to adapt and change. The enforcement of AIF regulation by SEBI in 2012, has led to surge in the number of private equity players in the market. With new regulatory norms and tax reforms this trend will continue.

Links

Bibliography

1 https://www.investopedia.com/articles/financial-careers/09/private-equity.asp

2 https://www.bain.com/insights/india-venture-capital-report-2020/

3 https://youtu.be/UVYiD8g4NFQ

5https://news.efinancialcareers.com/uk-en/251720/private-equity-analyst

You must be logged in to post a comment.