In the future decade, India’s debt capital market is expected to expand rapidly. It is anticipated to be as large as, if not larger than, the country’s stock exchange. The debt market in India currently accounts for around 67% of GDP, with government bonds accounting for the majority of the pie. However, the corporate bond market has risen in recent years, with more participation from regular investors. This expansion is expected to continue in the future, thanks to a number of governmental efforts, including the new bankruptcy law.

Organisational structures

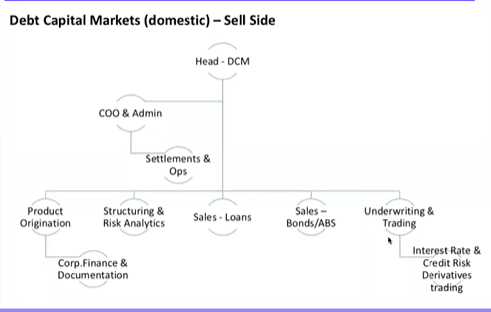

The presentation showed an organogram of typical positions in debt capital market teams.

Roles included those in Product Origination, Structuring & Risk Analytic, Sales–Loans, Sales-Bonds/ABS Underwriting & Trading, Interest Rate & Credit Risk Derivatives Trading.

“Carriers are built starting at one box going to the other box and moving around the entire eco-system”

Jayen Shah during a CFA Institute webinar

Sell side: Probably there are many more roles many more function in sell side. Things are larger and those are covered in wide variety of people.

Elements in a global CM platform – Sell Side

- Research – Macro, Fixed Income, Credit, Strategist, Syndicate Group,

- Sales is super-specialized, such as:Hedge Fund Sales, Interest Rate /Macro Sales, Credit Sales, Private Banking Sales.

- Origination Machinery may be focused on: Product type, Issuer type, Geographical.

- Funding desk: Repo, Structured Notes

Careers

- At sell-side & brokerage firms – The no. of roles much higher; also wider type

- Most of the roles directly or indirectly are client acing

- Revenue – volume-measures are key performance metric

- Technical skills and client management skills are required in good measure

- At buy-side investors-Concentrated team manages much large AUMs

- Long-term strategy, tactical-allocations, dynamic market positioning for alpha

- Portfolio management & technical skills Valuation, reporting

- Total & relative return – key metrics Ability to analyses and price risk

- Trading Units like Banks, PDs, Corporate – Traders, dealers & risk managers – rates & credit

- Corporate Treasuries

- Corporate have realized need to have dedicated team/person handling resource- mobilization & fixed income

- Conglomerates have common-treasury

- Long-term fund raising from domestic and/or international debt markets

- Goals – adequate liquidity, optimize costs, ALM.

- Full-fledged surplus / investment management active or passive styles

- NBFCs, HFCs, MFIs, – it is daily requirement:

- Similar to Corporate- core Resource raising.

- Regulatory compliance knowledge, Investor relationship

- Banks for capital resources:

- Capital Securities

- Long term funds – Infra bonds, Bonds & Offshore loans

- Regulatory compliance knowledge

This summary was prepared by Gautam Borundiya based on the webinar at the CFA Institute – Career Insights: Debt Capital Markets in India by Jayen Shah, 08 Oct 2020

You must be logged in to post a comment.