Large and multi-cap equities often constitute a considerable proportion of the investor portfolio. Portfolio managers employ concepts and specific methodologies to execute their large and multi-cap mandates, from ideation to portfolio building, management, and attribution. Current trends in growth investing using a method that incorporates both fundamental and technical variables.

Alok Agarwal, a senior fund manager equity at PGIM India shared some career insights for a CFA Institute webinar.

In India, land labor is abundantly available; still, capital and technology are significant enablers in a company’s growth, so follow GARP (Growth at Reasonable price) for growth investing. Growth is not for one month or one year; it needs to be durable.

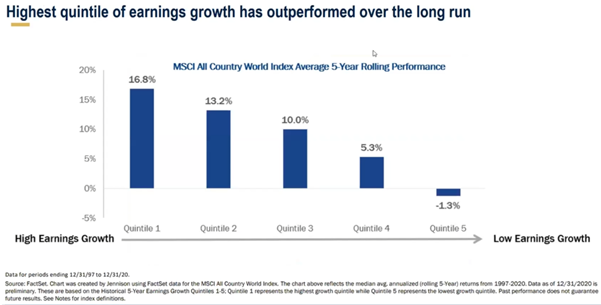

Earning growth of Indian stock in comparison to MSCI index

Here in the below chart MSCI world index data back from 1997 and took out the five-year average EPS growth of those companies here more than 2000 index from all countries, and divided them into five quintiles for each of those quintiles we tried to find out what was the average 5-year rolling performance, and no prizes for guessing and no surprises out there. The top quintile, the top 20% companies with the highest-earning growth rate, gave the maximum 5-year average performance, here not taken the country or sector-wise, all those 24 years of period taken.

So, most of the returns in the market come from the top 1 or 2 quintiles of the earning growth it means earning growth is extremely important.

Sometimes Earning growth is confusing; this means the EPS growth in the current year vs. last year or upcoming years, like when we consider the CAGR of 20% with any company without any index or sector- the point is worthless without comparison.

Comparison of Nifty 500 index performance to stocks performance

In the past 10 yrs, the Indian broad index (Nifty 500) was up by 2.7 times implying a 11.9% CAGR. During the same time period, 91 companies were up by 10x, 46 companies were up 20x, 18 companies were up 50x.

For example, one consumer durable company in online sales grew at 30%+ RoE, continuously increasing its operating margin. Another example is a specialty chemical company, which did lot of R&D and investment. Since the company is in a commodity sector with much pricing power and not much scope to gain market share, the company focused on higher value products, custom manufacturing which added better capital efficiency and margin expansion. The business is growing more than 40% of ROE over the 10 years.

Selection criteria of stocks for growth investment

The presenter showed an example of the portfolio construction process filtering from the vast universe of stocks to a portfolio, using a GARP (Growth at Reasonable Price) style (which itself follows stalwart investor Fisher who believed equity investing 90% is about management 9% is industry, one percent is everything else).

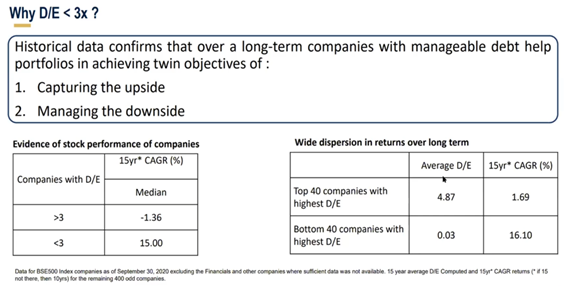

The first step is positive operating cash flow at least 7 out of the last ten years. The logic behind this is that business cycles tend to be 5-10 years. The second step is filtering on corporate governance as it is crucial that the company has both the capability to run the business and integrity to share Its wealth creation to the investors. And the third filter is the debt to equity ratio is less than three, which is explained in the chart below –

The presenter quotes Buffet saying that businesses are three types –

- First, consider a firm with a high ROE that is steadily increasing.

- Second, a solid business with an appealing and sufficient ROE to create economic value needs ongoing capital investments or Capex.

- The third grueling business does not generate a return or significant economic value and requires constant investment.

So, follow the OCQ principle (Opportunity, Capability, Quality), so companies can harness opportunities with quality and integrity

In conclusion, the practitioner suggested a way to filter a vast universe of more than 3000, considering some points like management, innovation, adding value to the economy, positive operating cash flow, ROE, ROCE, margin, sales growth, valuation, corporate governance, and D/E ratio is less than three.

Ashutosh Kumar prepared this summary based on the CFA Institute Practitioner’s Insights on Portfolio Management techniques for Large & Multicap equities – https://www.cfainstitute.org/research/multimedia/2021/practitioners-insights-portfolio-management-techniques-for-large-and-multicap-equities

You must be logged in to post a comment.