Funds managed

| Fund name | Asset Class | License |

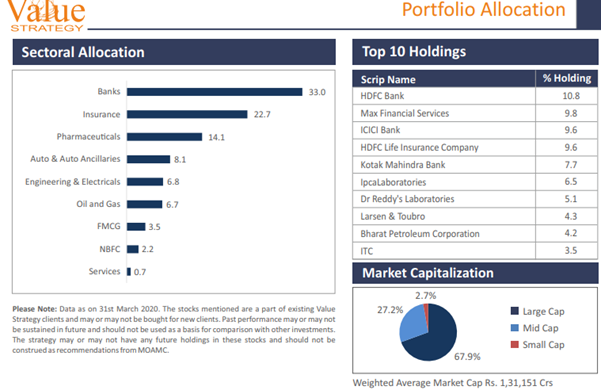

| Value Strategy | Multi cap | PMS |

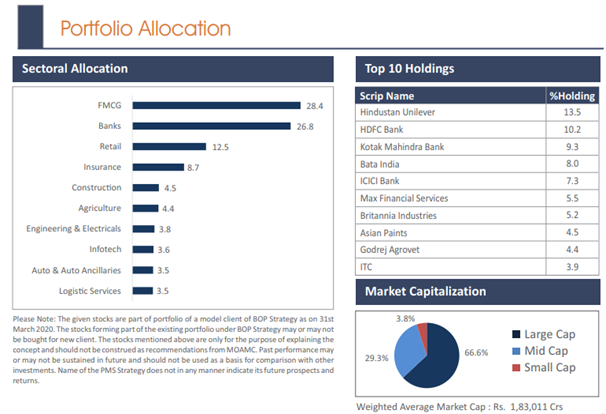

| Business opportunity portfolio | Multi cap | PMS |

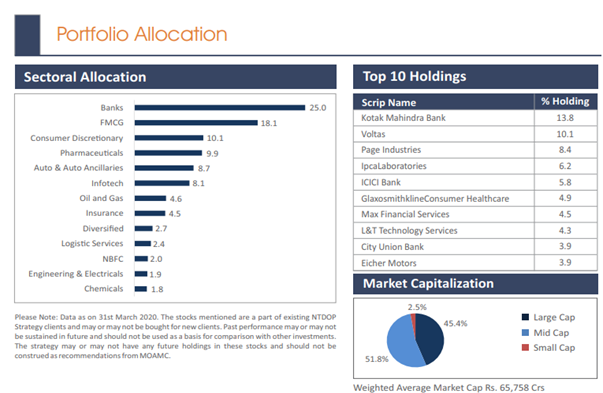

| Next trillion dollar opportunity | Multi cap | PMS |

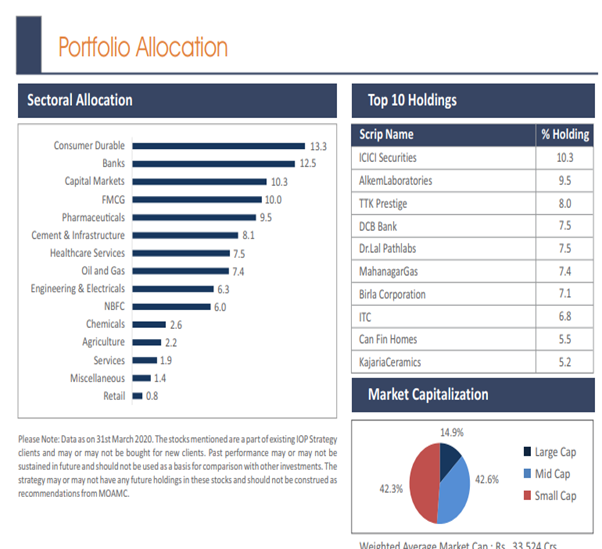

| India opportunity portfolio strategy | Multi cap – small and mid cap | PMS |

| India opportunity portfolio strategy V2 | Multi cap – small and mid cap | PMS |

About the AMC

Motilal Oswal Asset Management Company Ltd. (MOAMC) is a Mumbai-based AMC. It was incorporated in 2008.

The AMC is also registered with SEBI under SEBI (Portfolio Managers) Regulations, 1993 as Portfolio Manager vide Registration No. INP000000670.

Motilal Oswal Asset Management Company Ltd. is promoted by Motilal Oswal Financial Services Limited (MOFSL).

Motilal Oswal Mutual Fund is a premier AMC with active operations in over 600 locations across the country. With over 9 Lakh registered clients and over 2400 office premises

Key staff

- Shrey Loonker (Senior Vice President – Fund Manager, PMS)-Mr.Loonker, has done Chartered Accountancy from ICAI Mumbai in 2005 and has done CFA from CFA Institute, USA in 2009. He has overall 13 years of experience. He was associated with Reliance Nippon Life Asset Management Ltd, in his last role, as Fund Manager – Reliance Banking for 11 Years and with Ernst& Young Pvt Ltd, India in Global Taxation Advisory Services for 2 years.

- Atul Mehra (Associate Fund Manager, PMS)- Mr. Mehra, has completed the Chartered Financial Analyst (CFA) Program, from CFA Institute, Charlottes ville, Virginia, USA and has specialization in Finance. He has over 10 years of work experience in the area of Research with last 5 years within Motilal Oswal Group, prior to which he worked with Edelweiss Capital for another 5 years.

- Susmit Patodia (Associate Director- Fund Manager)- Mr. Susmit Patodia has an overall experience of 14 years with over 11 years in the equity markets. Prior to joining Motilal Oswal Asset Management Company Ltd. Mr. Patodia was working with Motilal Oswal Financial Services Ltd – Institutional Equities Business as Head of Sales from 2015 to 2018, where he was responsible for managing the global client base for the Equities business of the Company.

- Manish Sonthalia (Associate Director, Fund Manager AIF & PMS)- Manish Sonthalia serves as the Chief Investment Officer and the Director of the India Zen Fund along with which he heads the Equity Portfolio Management Services at Motilal Oswal Asset Management. He has over 22 years of experience across equity fund management and research covering Indian markets, with over 11 years with Motilal Oswal.

- Rakesh Tarway (Fund Manager – AIF)-Mr. Tarway has 17 years of experience in equity markets as Analyst and Head of Research. He has worked with Motilal Oswal Securities Limited as Analyst and Head of Retail Products. Prior to joining, Motilal Oswal Asset Management Company Limited, he had worked as Head of Research for Reliance Securities Limited.

Investment Philosophy (for firm)

The recommended way to Create Wealth from equity –‘Buy Right : Sit Tight’

‘Buy Right’ means buying quality companies at a reasonable price and ‘Sit Tight’ means staying invested in them for a longer time to realise the full growth potential of the stocks.

It is a known fact that good quality companies are in business for decades but views about these companies change every year, every quarter, every month and sometimes every day! While many of you get the first part of identifying good quality stocks, most don’t stay invested for a long enough time. The temptation to book profits at 25% or 50% or even 100% returns in a 1 to 3 year period is so natural that you miss out on the chance of generating substantial wealth that typically happens over the long term; say a 10 year period.

‘Buy Right : Sit Tight’ philosophy emerged from the expertise of our sponsor Motilal Oswal Securities Ltd. that experience in equity market research and advisory since 1987. This philosophy drives all our equity products and offerings; be it Mutual Fund or Portfolio Management Services.

Buy Right:

Q-G-L-P approach to buying right stocks

Q: Quality of business and management

G: Growth in earnings and sustained ROE

L: Longevity of the competitive advantage / economic moat of the business

P: Buying a good business for a fair price rather than buying a fair business for a good price.

Sit Tight:

Focus and Discipline

Buy and Hold: We are strictly buy and hold investors and believe that picking the right business needs skill and holding onto these businesses to enable our investors to benefit from the entire growth cycle, needs even more skill.

Focus: Our portfolios are high conviction portfolios with 20 to 25 stocks being our ideal number. We believe in adequate diversification but over-diversification results in diluting returns for our investors and adding market risk.

Value strategy

Objective:

The Strategy aims to benefit from the long term compounding effect on investments done in good businesses, run by great business managers for superior wealth creation.

Philosophy:

- Focus on Return on Net Worth : Companies which are likely to earn 20-25 % on its net worth going forward.

- Margin of safety : To purchase a piece of great business at a fraction of its true value.

- Long-term investment View : Strongly believe that “Money is made by investing for the long term”

- Bottom Up Approach : To identify potential long-term wealth creators by focusing on individual companies and their management bandwidth.

- Focused Strategy Construct : The strategy should not consist of more than 20-25 stocks

Performance:

Since Inception Value Strategy has delivered a CAGR of 22.5% vs. Nifty 50 returns of 16%, an outperformance of 6.5% (CAGR)

Portfolio Construction:

Allocations – Market capitalization

- Large Caps : 65 % – 100%

- Mid Caps: 0% – 35%

Number of Stocks : Around 20 stocks

Business opportunity portfolio

BOP is a multi-cap strategy with a balanced mix of ~67% Large Cap allocation, ~29% Mid Cap allocation and ~4% Small Cap allocation

Objective:

The PMS Strategy will invest in a high conviction concentrated portfolio of minimum 20 stocks. The portfolio will be constructed based on in-depth research leading to bottom-up stock picking with a view of Wealth Creation from 3 – 4 years perspective

Key Investment themes:

- Consumer Discretionary – Beneficiary of Doubling of per Capita GDP

- Private Banks and Insurance – Play on Value Migration from Public sector to Private sector and evolution of Insurance

- Agriculture related growth – A play on rising Rural Income

- Affordable housing – Governments Focus on Housing for All by 2022 and beneficiaries of sops for affordable housing space

- GST Beneficiaries – Business Migration from Unorganized to Organized

Next Trillion Dollar Opportunity Strategy

A multi-cap portfolio with 11 years track record. Originally started as a midcap strategy in Dec 2007; gradually transformed to multi-cap as a testimony to the success of holding high quality midcap companies for 5-7 years and held on basis their sustained growth potential and competitive advantage

Objective:

The Strategy aims to deliver superior returns by investing in stocks from sectors that can benefit from the Next Trillion Dollar GDP growth. It aims to predominantly invest in Small and Mid Cap with a focus on identifying potential winners that would participate in successive phases of GDP growth.

Investment Philosophy:

- High Growth Stories : Sectors and companies for higher than average growth.

- Reasonable Valuation : Invest in high growth companies at reasonable price / value.

- Emerging Themes : Focus on Identifying Emerging Stocks / Sectors.

- Buy and Hold Strategy : The Portfolio shall focus on above philosophies and hold positions till value crystallization.

Performance:

Since Inception NTDOP has delivered 16.09% vs. Nifty 500 Index returns of 5.64% delivering an alpha of 10.45%.

India Opportunity Portfolio Strategy

Objective:

The Strategy aims to generate long term capital appreciation by creating a focused portfolio of high growth stocks having the potential to grow more than the nominal GDP for next 5-7 years across market capitalization and which are available at reasonable market prices.

Philosophy:

- Buy Growth Stocks across Market capitalization which have the potential to grow at 1.5 times the nominal GDP for next 5-7 years.

- BUY & HOLD strategy, leading to low to medium churn thereby enhancing post-tax returns

Performance:

Since Inception India Opportunity Portfolio Strategy has delivered a CAGR of 11.06% vs. Nifty Small-cap 100 returns of 5.41%, an outperformance of 5.65% (CAGR).

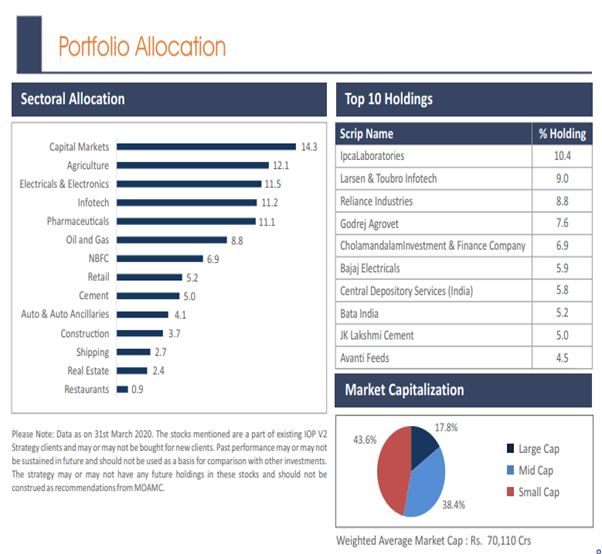

India Opportunity Portfolio Strategy V2

Objective:

The Strategy aims to deliver superior returns by investing in stocks from sectors that can benefit from India’s emerging businesses. it aims to predominantly invest in Small and Midcap stocks with a focus on identifying potential winners. Focus on sectors and companies which promise a higher than average growth

Philosophy:

- Focus on Sectors and Companies which promise a higher than average growth with concentration on emerging themes

- BUY & HOLD strategy, leading to low to medium churn thereby enhancing post-tax returns

Media

Interview with Raamdeo Agarwal – extract from book ‘Brightest Investment Minds’ by Anuj Shah

Loading…

Loading…

Title: HNIs are buying into, not selling, PMS schemes : Motilal Oswal, Source: CNBC18, Date 24 March 2020

The market collapse may have caused some investors to consider pulling out of stocks but such a trend is not visible for high-net-worth individuals (HNIs), says Manish Sonthalia, Head Equities – PMS, Motilal Oswal Asset Management Company.

He also stated the they were able to generate inflows on all these days. Even redemptions are few and far in between. So basically we are not seeing too much of a redemption pressure in the PMS,” he said.

He also said that they will be looking to buying companies with low level of leverage and sound management and business.

Analyst questions

- Your philosophy of BUY RIGHT , SIT TIGHT suggests to hold the stocks for long term in the portfolio so how and when you plan to change the stocks from the portfolio?

- Motilal oswal have a wonderful past record so how are you able to manage performance in these turbulent times? Is there a change in strategy?

- Why did you choose nifty 500 as your benchmark ? is it relevant for every strategy?

- How do you distinguish between India opportunity portfolio strategy and India opportunity portfolio strategy V2?

You must be logged in to post a comment.