Funds managed

| Fund name | Asset Class | License |

| Avaana Capital Growth Fund I | PE/ VC | SEBI AIF Cat 2 |

About the AMC

- Avaana Capital is a venture capital & private equity firm. It invests in early and growth stage companies. It was founded by Anjali Bansal in 2018.

- It specializes in such as, strategy, business development, capability building, financing, governance, gender smart policies and provides mentorship.

- It believes in responsibly investing in ESG focused companies.

- It has opened up avenues for women entrepreneurs by providing capital to these businesses; it promotes gender diversity in senior teams and boards and invests in companies that offer products and services for women.

- It has partnered with organizations to engage entrepreneurs and help them with research and knowledge, advocacy, policies and industry engagements through these partnerships.

Key staff

- Anjali Bansal (Founder): She founded Avaana to back entrepreneurs that provide innovative solutions to solve problems and be a catalyst in causing an impact as well as generating returns. She graduated as an engineer from Gujarat University and acquired a master’s degree in international finance and business from Columbia University. She was appointed as the non-executive chairperson by the Government of India to steer the merger of Dena Bank with Bank of Baroda. She was previously global partner and MD with TPG Growth PE responsible for India, south east Asia, Africa and the Middle East. She was the global partner and CEO with Spencer Stuart and co-headed their Asia Boards practice. She was a strategy consultant with McKinsey and Co in New York and India. She chaired the India board of Women’s World Banking, a leading global livelihood-promoting institution and continues to be an advisor to SEWA. She serves as an independent non-executive director on the boards of Siemens Ltd, Tata Power, Voltas, Bata, Kotak AMC, and Delhivery. She also co-founded and chaired the FICCI Center for Corporate Governance program for women on corporate Boards. She serves on the managing committee of the Bombay Chamber of Commerce and Industry. She is a charter member of TiE, serves on the managing committee of the Indian Venture Capital Association, mentor to Facebook SheLeadsTech, NITI Aayog’s Atal Innovation Mission.

Advisory board:

- S Ramadorai (former vice chairman, MD and CEO of TCS)

- Shyamala Gopinath (former deputy governor of RBI)

- Harsh Mariwala (founder and chairman of Marico)

- Tsega Gebreyes (managing partner and CEO of Satya Capital).

Investment Philosophy (for firm)

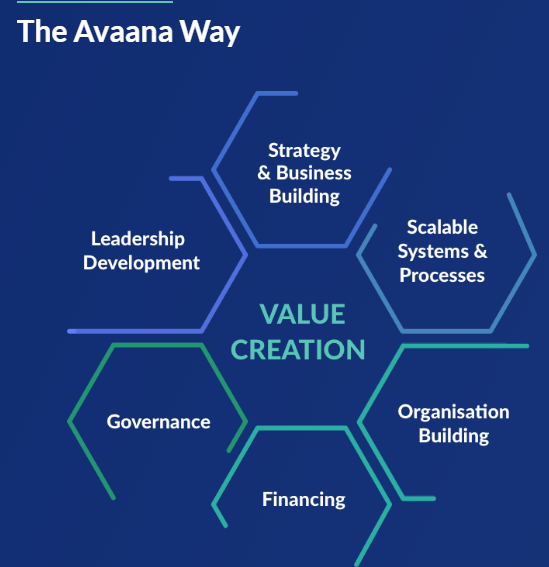

Avaana creates value for the companies it invests in through these following factors:

Apart from the value creation shown above, it adds value in ways like:

- Opening up avenues for entrepreneurs to growth opportunities.

- Solidifying management reporting and processes.

- Help the companies with recruiting, retaining and developing the best talent.

- Enabling access to debt and equity.

- Building boards and leadership.

Sectors it invests in:

- Financial services – Insurance, credit and savings.

- Consumers and producers based sectors – “For consumers (improved standard of living through access to quality and affordable products) and for producers (driving greater efficiencies resulting in increased yields)”.

- Supply chain, commerce, jobs & livelihood.

Investee companies include:

Media

Title: Avaana infuses fresh funds in Frog Cycles, Source: ET, Date: 05 February 2020

Avaana invests new capital in Frog Cycles. Anjali talks about this investment; India wants good quality and comfortable products. As Alpha Vector’s brand Frog Cycles is creating affordable, comfortable and stylish products, she expects the brand to emerge as a major player.

Topic: Media on Avaana’s website, Source: avaanacapital.com.

https://avaanacapital.com/category/news/

Title: Anjali Bansal on startups reimagining models to survive the crisis, Source: Inc42, Date: 14 April 2020

Anjali talks about having two teams especially in these times of crisis wherein one thinks about the present and focuses on the future. She says teams need to be creative enough to survive the on-going crisis and seize the opportunities that may arise due to the pandemic.

On the personal front, she says that the work has doubled during the pandemic because the commute time has reduced which has led to attending one meeting to the other continuously.

She also expressed her views jokingly about how Covid-19 has had a significant impact on climate change than all the climate conferences combined.

She then compared the difference between the global financial crisis & dot.com crash to the current situation. She says the former events caused a gradual disruption, however, with Covid-19 everything has come to a halt. From the supply-chain to businesses, there’s no movement at all.

She says “A number of segments will see a rapid acceleration of digitisation. Prominent among them are education, healthcare and consumer services. Thus, we may see accelerated growth in those segments”.

Talking about Avaanaa’s investment in Delhivery, Urban Company, Coverfox and LoanTap, “Currently, there is a massive demand for FMCG, food, grocery and other essential supplies. Delhivery has had a huge demand, and many people are reaching out to us proactively”. “If we take the example of Coverfox. It had two and a half days of interruption, and in no time they set up a remote call centre operation. Now, they are back to a hundred percent productivity”.

“Plus, the Reserve Bank of India (RBI) ruling on the moratorium, LoanTap has had a good relationship on the liability side, where the founders have worked hard to get moratoriums from their lenders.”

“Urban Company is at the forefront of ACT (Action Covid-19 Team) vs Covid and putting in place a program to support innovation and provide social security-loans and insurance- to all its partners”.

Talking about funds, “Most funds right now are being conscious about new investments. I say cautious also cautiously because that doesn’t mean they are not closing new investments. It is just that during the period of crisis, we don’t know how long this uncertainty will last”.

Talking about survival v/s growth, “Any company that has a short runway, must take advantage of all funding options, which would include raising a bridge, internal round. If somebody is willing to invest at this point even if it is a lower valuation, they must work with their stakeholders and accept that lower valuation and take the equity”. “On the other hand, if they are a high burn startup which needs to extend their runway, there are debt options that are becoming available. SIDBI recently announced a debt round for startups. So, this is the time when companies and founders have to become creative about everything, be it their product, their market as well as their cap structure”.

Analyst questions

- (Anjali), To what extent does the gender gap exist in the PE/VC industry?

- When you say “create an impact and generate stable returns” by investing in companies that belong to the non-cyclical industries or does it also imply to the cyclical ones? If yes, how are stable returns generated?

You must be logged in to post a comment.