Funds managed

| Fund name | Asset Class | License |

| Fund 1 | Early stage (Pre A & Series A) | SEBI AIF Cat 1 |

About the AMC

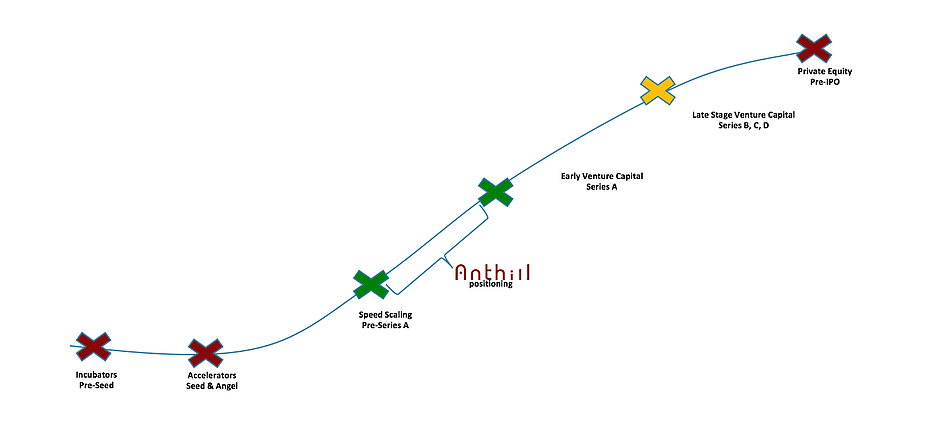

- Anthill Ventures is a Speed Scaling Ecosystem which helps early growth startups in Pre-Series ‘A’, go to series ‘A’ & ‘B’ in 1-2 years through rapid Speed Scaling

- Anthill typically invests in the Pre-Series A stage, where cheque sizes can range from a few hundred thousand dollars to $1 million.

Key staff

There are 7 partners:

Prasad Vanga, Rajiv Menon, Lakshmi Nambiar, Sailesh Sigatapu, Bharani Setlur, Mahesh Balani and Devang Mehta

Investment Philosophy (for firm)

- Highly curated deal flow from influential investment syndicates that establishes a strong deal flow and higher degree of conversion rates.

- Annually we target 36 global investments that have high SQ™* and will raise series A within 12 months.

- Most investments will be co-invested and co-syndicated from our influential investment network that provides hands on speed scale mentoring “Smart Money”.

- Relentless focus on driving the portfolio to series A through our speed scaling platform.

*SQ (Scalability Quotient is a proprietary algorithm of Anthill to identify highly scalable startups through a rating of 108 parameters).

- Market access potential in India in the next 3 years.

- Co-invested by funds and aligned to Corporate & Family Office Charters.

- Product Focus: Global solutions that plan to expand into the Indian Market

- Typical Valuation: $3MM to $9MM

- Pre-Series A raise: $1MM to $3MM

- Ticket Size: $75k to $500k

Media

Title: Anthill Ventures gets SEBI approval for its VC Fund, Source: Anthill Blog, Date: 4 July 2018

Anthill Ventures, an investment and scaling platform for early-stage startups, announced it has received approval from the Securities and Exchange Board of India (SEBI) for its Category 1 Venture Capital Fund.

Title: Anthill Ventures Selects 15 Startups For Its Asian Market Programme A-Scale, Source: Inc 42, Date: 19 May 2019

https://inc42.com/buzz/anthill-ventures-selects-startups-a-scale-programme/

Anthill Ventures select 15 startups to fund from Asia in Singapore, Israil, India and US. Working across sectors such as health tech,media tech and urban tech. A- Scale will help raise funding upto $1mln and additional $20mln from co – investors and also announced its partnership with Andhra Pradesh government for this project. Some selected start ups are Vuulr, TrakitNow, KroniKare etc.

Title: Anthill Ventures to invest up to $1 mn in consumer startups via Urban-i, Source: Tech Circle, Date: 9 December 2019

Anthill Ventures has launched Urban-i, a programme targeted at consumer startups in areas such as personal care, fashion and accessories, food and beverages, health and nutrition, consumer technology and ecommerce. Through the programme, the firm will invest up to $1 million in 5-9 selected startups. The startups will receive an initial sum as an upfront investment and the balance will be deployed in tranches. Some companies may receive additional syndicated capital up to $3 million.

Title: Less is More while pitching to investors, Source: YourStory, Date: 18 September 2019

In a conversation with YourStory, Devang Mehta of Anthill Ventures discusses the firm’s investment philosophy, and how his entrepreneurship experience and being a product marketer shaped his thesis.

Analyst questions

- Your investment strategy seems tricky and complicated, can you talk us through it in brief and simplified form?

- Since it’s known you have got your VC fund approval recently under AIF CAT I category, can we assume there is only one round of investment has been done to the portfolio companies? Or there have been more rounds which took place for some companies?

You must be logged in to post a comment.