Funds managed

| Fund name | Asset Class | License |

| Aditya Birla Private Equity – Fund I | mid-market, high-growth | AIF Cat 2 |

| Aditya Birla Private Equity – Sunrise Fund | mid-market, high-growth | AIF Cat 2 |

About the AMC

- Subsidiary of Aditya Birla Capital Company.

- Provides companies with strategic direction for their growth and operations.

Key staff

Vandana Rajashyaksha (Investment Director)

- Have a successful track record across various sectors and lifecycles.

- Experience in private equity, consulting and manufacturing domains.

- Skilled in Corporate Finance, Financial Services, Due Diligence, Financial Modeling, and Portfolio Management.

- At ABPE, she is responsible for management of investment, optimizing performance of portfolio companies along with fundraising.

- Apart from that she provides inputs in developing overall organization strategy.

- Being among the Board members of various portfolio companies, she has provided guidance through their economic cycles by providing financial and strategic inputs indicating the importance of corporate governance along with adding value to the stakeholders.

- She holds a B.Tech Degree in Metallurgical Engineering from IIT Mumbai along with a MBA (Finance) degree from PUMBA.

- Further, she also completed an advanced course in Private Equity from Harvard Business School.

Sunil Jain (CFO)

- Experience in corporate finance, Capital market actions, M&A execution including deal origination, project evaluation, financial modeling, valuation, due diligence.

- As a CFO, he is responsible for the finance, accounts and compliance function.

- He also manages customer relations in the organization.

- His highlighted works include an investment in the rating firm, CARE besides the 3-way complex merger of US$ 1.2 billion to form Aditya Birla Nuvo and post-acquisition integration of Sidex Steel S.A. of Romania with Mittal Stahl (now ArcelorMittal).

- Has a B.Com (Hons.) degree from the University of Calcutta, India.

- He is also a CA from Institute of Chartered Accountants of India (ICAI).

Piyush Shah (Company Secretary (CS) & Chief Compliance Officer (CCO)

- Possess extensive experience in Legal Compliance, Taxation, Administration, Accounting and Investor relation for the listed as well as unlisted companies.

- He holds an Associate Company Secretary (ACS) degree from the Institute of Company Secretaries of India, Delhi and a B.Com degree from University of Mumbai, India.

- In the past, he has led the teams that were in-charge of domains like Financial Planning, MIS, Budgeting, Finalization of Accounts, IPO launches and implementing ERP systems.

- He was also designated as the Management Representative (MR) and member of the core team for the implementation and compliances of ISO.

Investment Philosophy (for firm)

- Takes stakes in the form of equity, quasi-equity or equity linked instruments.

- Follows active partnership based model.

- They focus on the growth type investments in mid-market companies that are based in India.

- Aims to cater to broader AIF market through various products such as buyout funds and mezzanine funds at the upcoming times.

- They invests into the firms that are growing fast along with the following characteristics:

- The companies already are/ seem to be the potential in their space in the near future,

- Have a management that is dynamic and experienced who has proven their track record of success,

- Possess reasonable pricing power via differentiated/ price inelasticity of their offering,

- Known for their corporate governance and financial discipline,

- Scalable business at current along with a clear future business plan for the next 3 years.

- Companies which are recognized for their strong and profitable business model.

Investments focused on-

- Consumption Led Growth. Sectors driven by a combination of rising per capita income and credit expansion

- Infrastructure enablers. Trying to benefit from huge investment in public as well as private investments.

- Niche Emerging Sectors. Sectors such as education, healthcare, logistics, etc which have a potential to emerge as scalable businesses with genuine pricing power and contra-cyclical characteristics.

- Skilled Ancillary Business. Investments within the manufacturing ecosystem, supporting ancillaries and business services, etc.

They add value in the market via:

- Knowledge

- Network Support

- Long Term Strategic Alignment

- Implementation Experience

- Active Partnership

- Exit Management

- Understanding different growth cycles for each company.

Investment Philosophy(Fund)

Aditya Birla Private Equity – Fund I

- Was set up in 2010 and had collected US $ 138963017.50 (Rs 1,055 crore, 1 US $= Rs. 75.92).

- Sector-agnostic domestic Fund

- Aimed to provide growth capital to mature sectors as well as businesses.

- Corpus-INR 8.81 billion

- Holds minority stakes with investments which are primarily in unlisted, mid-market, high-growth, India-centric businesses which have the potential to play the role of an active investor.

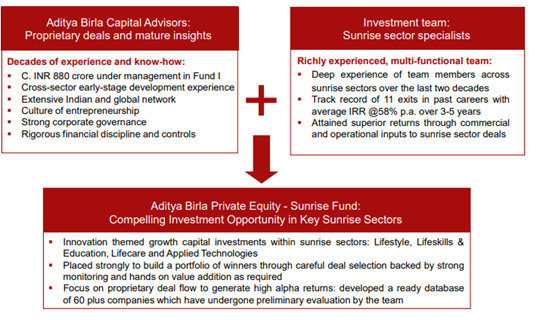

Aditya Birla Private Equity – Sunrise Fund

- Aimed to provide growth capital to mature sectors as well as businesses.

- Innovation driven investment (Innovation as super theme)

- It focuses on proprietary deal flow in order to generate high alpha returns

- Holds minority stakes with investments which are primarily in unlisted, mid-market, high-growth, India-centric businesses which have the potential to play the role of an active investor.

- Based on proven venture investing and exit credentials of senior team in similar sectors.

- Aim of this fund is to:

- Improving quality of life care

- Improving quality of lifestyle

- Improving skills

- Improving the environment and obtaining sustainable sources of energy

- Revenues of the portfolio companies should be around US $ 3320494.09 (INR 25, 1 US $= Rs.75.29) crore, nearing break-even/ profitable, in the year of investment

- These companies should be adaptive along with professional management.

- Ticket size of the individual Portfolio Investment: INR 25-50 crore

- Fund Details:

- Target Returns: Pre-Tax IRR @30% p.a. (Not Guaranteed)

- Investments over 2.5 years & Exits between 3.5 – 6 years (+ 1 year extension, investment manager’s discretion)

- Hurdle Rate: 10% p.a., compounded

- Upfront Load: 2.25% (fixed)

- Management Fee: 2% p.a. + Applicable Taxes

- Carried Interest: 20% (With Catch-Up)

- Early cycle mover in sunrise sectors to target the public market beating IRR, commensurate with higher risk.

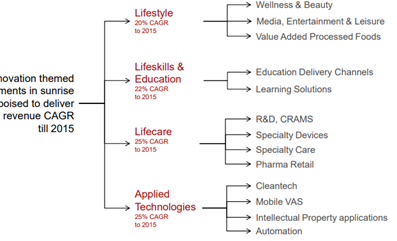

- Sunrise sector funds includes:

- Lifestyle

- Lifecare

- Lifeskills & Education

- Applied Technologies

Media

Title: Aditya Birla Private Equity said to be looking to raise $500 mn fund, Date: 04 June 2015

Title: Aditya Birla PE targets first close of third fund by September, Date: 29 March 2018

https://www.vccircle.com/aditya-birla-pe-plans-first-close-of-third-fund-by-september/

Analyst questions

- Your Sunrise fund seems to be sector focused. What is it that investments are attracted to this way?

You must be logged in to post a comment.