Funds managed

| Fund name | Asset Class | License |

| Pahal Health Fund | Social Venture Fund (growth stage SME) | SEBI AIF Cat 2 |

About the AMC

Ajooni seeks to deploy innovative financing and commercially viable market based solutions that can align private capital along philanthropic and public capital to catalyze Sustainable Development Goals.

Key staff

- LM Singh, CEO at Anjooni Impact Investments, prior work experience- head of USAID/India’s Innovation in Financing Platform- Pahal, IPE Global LTD. ,MD at Langham Capital, CEO & MD at Lotus Capital, President at TAIB Bank. Also worked at EYand CRISIL.

- Dr. Ajay K Singh, core team of Anjooni Impact Investment, prior work experience Mamta Health Institute for mothers and child. He did Ph.D. in Population Studies from International Institute for Population Sciences, Mumbai.

- Mohak Mathur, core team of Anjooni Impact Investment, prior experience at Coinmen Consultant, Yog Capital. He has experience in corporate finance, venture capital, investment banking and strategic advisory.

Investment Philosophy

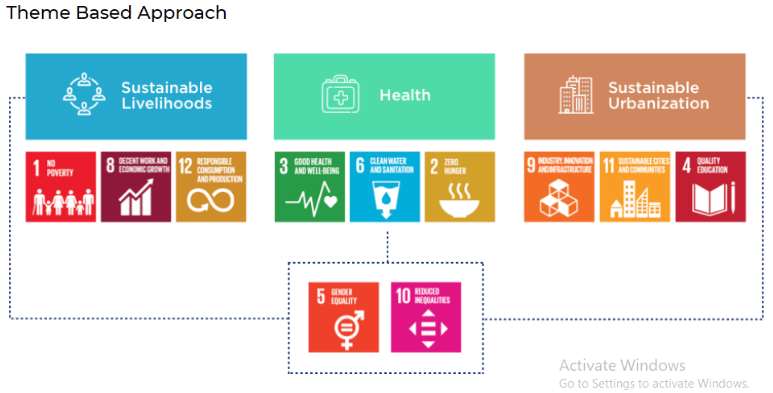

With the theme based approach they launched the Pahal Health Fund, focused on improving health outcomes by investing in and supporting growth stage social enterprises.

Social enterprises have the power to innovate and solve some of the toughest development problems, but need a holistic ecosystem approach which maximizes entrepreneurial potential and minimizes execution risk. We seek to catalyze and capacitate such enterprises by providing:

- Access to capital

- Access to technical assistance

- Access to market

Development impact lies at the core of Ajooni’s strategy. Our cross sectoral, deep understanding of implementing development programs, provides us a unique ability to design and develop results based frameworks that assess financial, social and environmental risk – returns on different types of investments for continued improvement and learning.

About the fund

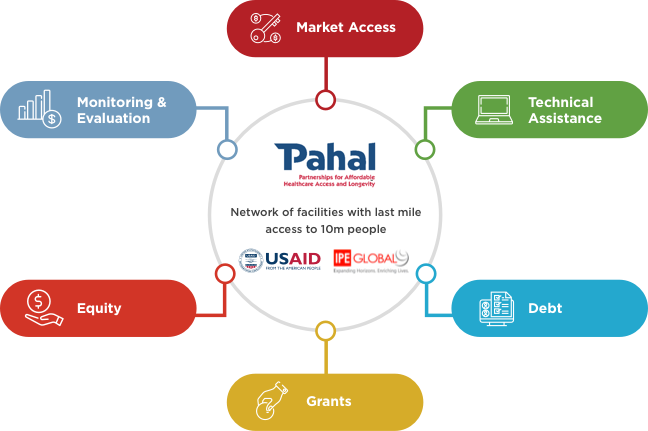

The Pahal Health Fund takes an ecosystem approach to scale growth stage social enterprises that ensure better health outcomes, well-being, quality of life and sustained incomes for the disadvantaged and achieve risk-adjusted returns.

The Pahal Health Fund has its genesis in PAHAL (Partnerships for Affordable Health Access and Longevity), a USAID and IPE Global joint that aims to provide catalytic support to growth stage scalable social enterprises improving health outcomes for the urban poor. The PAHAL platform enables the fund to support social enterprises using an ecosystem approach. This approach recognizes that synergies are lost if we work in silos. Hence to maximize growth and impact business models need to be de-risked by aligning different stakeholders and resources in the ecosystem.

Media

Title: PAHAL Participates in the National Conference on Urban Health Indian Institute of Health Management Research, Date: 24- 25 February 2018

https://www.ajooniimpact.com/uploads/pdf/ajooni1cca76_IIHMR-conference-report.pdf

- Need for expanding credit for affordable healthcare markets

- Impact funds as an innovative approach to improving healthcare

- Need for an ecosystem approach combining blended finance and technical support to help social enterprises achieve scale.

- Comprehensive insurance as a solution to improve access and reduce health expenses .

Title: AJOONI AT THE AVPN CONFERENCE 2018 ON “MAXIMIZING IMPACT” Singapore, Date: 4-7 June 2018

https://www.ajooniimpact.com/uploads/pdf/ajooni6e3dc4_AVPN-Conference.pdf

Mr. LM Singh, Co-Founder and CEO at Ajooni Impact Investment and Project Director, PAHAL at IPE Global, was the final speaker on the panel. He mentioned that despite being a middle income economy, there are more than 600 million underserved people in India, and therefore solutions that improve healthcare access and reduce out of pocket expenditure for these people should be supported. He said, “The amount of impact investments is low in comparison to mainstream capital. The real value is how bi-laterals, donors and impact investors, using $100-200 billion in impact investments, can unlock trillions of dollars for solving problems of the majority.” He also emphasized on PAHAL’s role in leveraging the power of partnerships and creating an ecosystem to support social enterprises, providing them with technical assistance, market access, catalytic grants, debt enabled through USAID Development Credit Authority (DCA) and equity through the Pahal Health Fund.

Title: Impact Investing, Date: September 2017

https://www.ajooniimpact.com/uploads/pdf/ajoonie61781_summary-report-impact-investing.pdf

- Social impact is as important for impact investor as the return on investments.

- An ecosystem is most effective for scaling up of the business.

- It is important to leverage and complement state capital for the impact business.

- Establish trustful relationship amongst the state, civil society and business.

- CSR funds have the potential to compliment impact capital, but not allowed in the current regulatory context.

Analyst questions

- What is the impact created so far with your initiative towards creating an ecosystem, converging all the stakeholders?

- How do you aim to reduce the out of pocket expenditure of underserved people?

- Why do serve to only urban poor, why not rural areas where there is a deficiency of better health care facility?

You must be logged in to post a comment.