Funds managed

| Fund name | Asset Class | License |

| Insider Shadow Fund (open for subscription) | Long only equity (midcap) | PMS |

| BC-AD Fund (open for subscription) | Long only equity (midcap) | PMS |

| Blended – Rangoli Fund (open for subscription) | Long only equity (midcap) | PMS |

| Green Fund (closed for subscription) | Long only equity | PMS |

| APJ 20 Fund (closed for subscription) | Long only equity | PMS |

| Spin Off Fund (closed for subscription) | Long only equity | PMS |

| HoldCo Fund (closed for subscription) | Long only equity | PMS |

| Deep Value Discount Fund (closed for subscription) | Long only equity | PMS |

| India Sector Trend Fund (closed for subscription) | Long only equity | PMS |

| Event Arbitrage Fund (closed for subscription) | Long only equity | PMS |

About the AMC

- Unifi capital pvt. ltd. was established in 2001.

- Sarath K. Reddy, CIO & Founder prior work experience- started his career with Standard Chartered Bank.

- Narendranath K., Executive Director & Cofounder, prior work experience- with a leading non-bank finance company.

- G. Maran, Executive Director & Cofounder, prior work experience- Alpic Bank of Bahrain & Kuwait Finance Ltd.

- Christopher Vinod Executive Director & Cofounder, prior work experience- Navia Markets Ltd.

Investment Philosophy (for firm)

“We believe that scale is not a driver but an outcome of excellence in our work. Our thematic investment styles are designed around niche investment opportunities that exist in the Indian capital markets. Usually such specialties offer limited scope for scale-up in terms of the capital we can deploy effectively. The focus is always upon discovering and taking advantage of an insight that can provide the edge, and then adding layers of research and due diligence to construct a portfolio. The common foundation of knowledge, work culture and networks underpin all our investment strategies, providing us the benefit of scale.

Unifi is essentially a value investor in growth businesses. We place Value first but always also demand growth potential in a business we own. We believe that stock performance, particularly in mid and small firms, needs a catalyst; and often the best catalyst is an attractive price combined with growth.

Unifi believes that both micro (firm level) and macro risks are critical in determining outcomes. We carefully evaluate the fundamentals of each business that we own, and in addition ask ourselves if the prevailing and expected conditions in the economy will act for or against our interest. At times, while making longer term investments, we consciously trade off adverse macro conditions for terrific entry valuations.

Defining what Value, Risk and Consistency in returns mean to us.

Value investing is easy to understand but hard to practice. Our job is to buy something for less than it is at least worth and generally hold on (for years) till we can sell at a price above its fair value.

Risk is typically measured by the volatility of returns generated by an asset. While this makes great sense, we include another dimension to it, and believe that the greatest risk emanates from the probability of an asset’s permanent diminution of value i.e. loss of invested capital. While earning superior returns relative to benchmark is important, it is far more important to earn superior return on each unit of risk that we are exposed.

Consistency of returns relative to our initial objective (in certain strategies we allow ourselves considerable latitude to deviate in order to outperform eventually) as well as the benchmark is an important measure of performance. We aim to consistently generate top quartile performance.

Our People. The bedrock of our firm’s ethos is best represented by our commitment to accountability and continuity, both internal and external. We attract people who are passionate and give them time and opportunity to succeed. We maintain a tight code of conduct and have zero tolerance for poor integrity or quality.

Adhere to the clients’ mandate. Typically, our clients are smart and successful individuals. The most important investment decision is the one made by our client (with our RM’s careful advice) at the outset in choosing the asset class and the risk level. As his investment manager Unifi is committed to stick diligently to the client’s mandate and deliver the best possible outcome while remaining vigilant on the underlying risks.”

Key points

- The thematic investment styles are designed around niche investment opportunities that exist in the Indian capital markets.

- Unifi is essentially a value investor in growth businesses.

- We believe that stock performance, particularly in mid and small firms, needs a catalyst; and often the best catalyst is an attractive price combined with growth.

- Unifi believes that both micro (firm level) and macro risks are critical in determining outcomes. We carefully evaluate the fundamentals of each business that we own, and in addition ask ourselves if the prevailing and expected conditions in the economy will act for or against our interest.

Investment approach

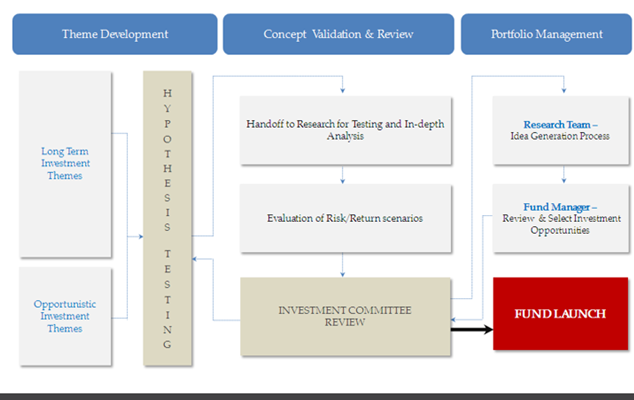

Unifi’s investment strategies are designed to offer superior risk adjusted returns and can be mapped to the risk-return expectations of clients. Funds are developed based on a combination of long and short-term investment themes, and undergo a comprehensive validation and review by Unifi’s investment committee. These investment strategies are then handed over to Unifi’s dedicated in-house research team who identify and select specific opportunities for investment within the fund’s strategy.

Portfolio structure

The portfolio is likely to have around 15-20 stocks in the PMS platform. The investor’s assets will always remain in the investor’s name with a SEBI registered custodian. While tracking and monitoring of investments will be active, there’s likely to be low turnover in the fund.

1. BC- AD Fund

Objective

The investment focus is on growth oriented companies in specific sectors which are leading the migration of market share from unorganised players to organised players. As India’s economy grows rapidly in scale and sophistication, several sectors are positioned to change dramatically over the next decade. Certain powerful trends are driving the shift in the balance of competitive advantage in favour of organized businesses.

Investment Approach

India’s economy has a high proportion of unorganised businesses which are estimated to account for about 35% of the GDP. As the economy grows in size from the current $ 2.6 Tn to $ 5 Tn over the next decade, it will traverse certain social, technology, scale, legal, taxation and regulatory changes. These changes are likely to challenge the current business models of unorganized players in certain sectors. As a result, well established organized players in such sectors will gain market share along with improving margins, potentially generating very high earnings growth. The BC-AD fund has been structured to benefit from this imminent migration of market share from the unorganised segment to organised players. The fund would be investing in well-established organised players who would be gaining market share from the unorganised players thus posting higher revenue growth rate than that of their industry. The high top line growth along with the benefits of operating leverage would help them record a superior earnings trajectory over the next decade.

Universe

The Universe of Companies would be broadly selected from the following sectors:

1. Building materials

2. Consumer durables

3. Logistics

4. Personal grooming & Hygiene

5. Dairy

6. Retail & Jewellery

7. Healthcare

8. Hospitality & Entertainment

9. Alternative finance

10. Real Estate

These sectors are only indicative of our current thinking and it is entirely possible that as our research progresses we might look at companies beyond these sectors.

Investment Risks

The fund would focus on companies in sectors where it expects a gradual shift in consumer demand from the unorganized players to the organized. The investment process would involve analysing multiple sectors and drawing up the list of factors which would be triggers for the migration of demand to the organized space. The key risk would be the time required for the transition to start playing out within the selected sectors. There might be stocks/sectors wherein the anticipated migration might take longer than the initially estimated time periods. Thus, it is suggested that investors take a longer time horizon view when investing in this particular theme.

Benchmark: S&P BSE Midcap

2. Insider shadow fund

Objective

The fund seeks to generate superior risk adjusted returns, in relation to the broad market, by investing in fundamentally sound companies which have repurchased its own shares or where its promoters’ have acquired additional shares at market prices. Typically, such an action by a company or a controlling shareholder demonstrates their conviction that the company’s growth prospects or inherent value has not been captured in its stock price at that point. Unifi’s proposition is to gain from the eventual balancing of the value-price mismatch in the market by identifying and investing in such companies after a detailed review of their fundamentals and corporate governance standards.

Investment Approach

The basic strategy is to invest in companies where the promoter or the company has acquired additional shares

- At market prices either through creeping acquisition or buyback route

- That seem to be motivated either by an undervalued stock price or an impending improvement in business prospects that are still to be reflected in the market price and

- Where complete disclosures of stock purchases have been made to stock exchanges.

- The underlying assumption behind this strategy is that the managers and controlling shareholders have a clear advantage over other market participants and are well positioned to take sensible investment decisions especially in case of small and under-tracked companies. By limiting the investible universe to such companies, we believe that we would be able to improve the probability of achieving superior risk adjusted returns.

We find that promoters typically use one or more of the following methods to increase their stake by:

- Preferential issue of shares and/or warrants.

- Merger of promoter owned private/public companies.

- Creeping acquisition in open market.

- Voluntary open offers.

- Subscribing to the unsubscribed public portion in rights issues.

- Initiating the company to do a buyback either through market purchases or tender offer route.

- While preferential issues invariably enable promoters to hike stake at a price substantially lower than the market price, mergers are also structured to get the same benefit. However, we would focus only on those companies where promoters increased stake by purchasing the shares at then-prevailing market prices or at a premium in any form, be it rights, creeping acquisition, tender offers or buybacks.

Universe

Our universe is built from the news flow of disclosures made by promoters/executives/companies under Clause 7 & 8 of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations and Clause 13 of SEBI (Prohibition of Insider Trading) Regulations. We will never consider companies where such disclosures are not made, thereby clearly avoiding market rumours and speculation. Such disclosures are constantly screened and fed into our internal model based on which the universe is expanded / pruned. From the universe of such companies, we would select ideas to invest based on a bottom up approach that we have been practicing over the last six years.

Investment Risks

While research supports the view that insider shadowing works best in the aggregate, in few cases it could result in negative value creation. Lehman Brothers did a USD 10 Billion buyback just a few months before bankruptcy. Even in Indian context, we have had similar instances as some promoters tend to get carried away in predicting that good times will continue to persist. Few promoters also just use this medium to send a signal without any genuine interest to buy. To address such risks, we will meticulously deploy a second layer of filtering based on the merit of fundamentals and scrutiny of the promoter’s behaviour.

To quote, Warren Buffet: “Before investing in a company that is repurchasing its own shares, you should investigate the company fundamentals and its management quality. Overall, if a company purchases its own shares on a regular basis and its fundamentals appear sound, you should consider buying shares in the company”.

Benchmark: S&P BSE Midcap

3. The Blended Rangoli fund

Objective

The Blended – Rangoli fund cherry picks the best opportunities from across seven thematic funds that Unifi manages. The mandate is to participate in opportunities that arise from a mix of emergent themes, corporate actions and attractiveness of core fundamentals. The fund aims to thrive through market cycles and helps cutting down the investors switching cost and effort in migrating between different funds over time.

Investment Approach

Value creation requires a mental model which goes beyond the obvious. It requires a meticulous mind-set which is able to sift through reams of information and assimilate only that which is relevant in identifying value accretive opportunities. Metaphorically this could be compared to searching the proverbial needle in a haystack. This fund investment strategy will be to pick best opportunities from the following themes.

Spin Off: In a single corporate structure with multiple businesses, the sum of the value of the separate parts is often less than that of the whole. A de-merger of disparate businesses, unlocks the financial and management bandwidth required for the respective businesses to grow. Spin off fund invests in situations that offer great scope for the businesses to realize their full growth potential and attract commensurate market valuation.

DVD: Few segments of the market tend to be mispriced in spite of visible growth prospects, resulting in such stocks trading at a deep discount to their intrinsic value. Reasons could vary from inadequate understanding of a business by most analysts, low relative market cap and liquidity or the lack of correlation to benchmark indices. DVD invests in such businesses and exploits market inefficiencies.

Holdco: Many holding companies are run as group holding companies rather than strategic investment companies. This results in a perennial discount in their valuations but such discounts are not a constant. The Holdco Fund identifies strong underlying businesses and looks for massive valuation discounts that are likely to recover as promoters feel the heat of change in the regulatory landscape; meantime benefiting from value convergence in a rising market.

APJ20: As always, markets fancy few sectors that have done well in the past ignoring the rest. Of the sectors which are less understood, few like speciality chemicals, agri, precision manufacturing have become globally competitive and are privy to an expanding market opportunity. APJ20 invests in firms that have evolved and are in a ripe position to benefit from such growth prospects.

Green Fund: The investment focus of the green fund is on companies which provide products and services that help in reducing the carbon footprint in the environment and/or result in more efficient use of natural resources. Within the context of this strategy, the sectors that have been identified for creating the portfolio are – emission control, energy efficiency, water management and waste management.

Insider Shadow Fund (ISF): The Insider Shadow Fund invests in companies in which founders’ have acquired meaningful quantity of additional shares at market prices. Such an action demonstrates their conviction on company’s growth prospects or inherent value not captured in stock price at that point. The proposition is to understand and validate the founder’s perspective of value and gain from the eventual balancing of the value-price mismatch in the market.

BCAD: The investment focus is on established companies in specific sectors which are leading the migration of market share from unorganised players to organised players. As India’s economy grows rapidly in scale and sophistication, several sectors are positioned to change dramatically over the next decade. Certain powerful trends are driving the shift in the balance of competitive advantage in favour of organized businesses.

Universe

The fund’s investment universe would include the diverse investment opportunities within the following mentioned funds at any specific point of time: SPIN OFF, DVD, HOLDCO, APJ20, Green fund, Insider Shadow Fund and BCAD.

The fund’s investments will be majorly concentrated in small and midcap space wherein it is difficult for “institutional” type of capital to invest and where Unifi’s relatively smaller size helps us to focus in niche areas of the market.

Investment Risks

Though careful and meticulous effort would be put in selecting only the best of opportunities’ within UNIFI’s fund universe, the risks here can originate from the time required for value unlocking in case of stocks picked from the Spin Off or Holdco universe. Other risks will include ones associated with illiquidity, change in strategy, change in business fundamentals and value destructive acquisitions in the case of stocks selected from the APJ, Green or DVD universe.

Benchmark: S&P BSE Midcap

Media

Title: Signal Vs. Noise : Q&A session with Mr. Maran, UNIFI Capital Pvt. Ltd., Source: Media Unifi Capital, Date: March 2020

Global market perspective, compared US market with Indian market, answered questions related this unprecedented situation.

Title: The best performing PMS schemes of April 2019, Source: Rupeeiq, Date: 11 May 2019

“Unifi Capital’s Spin Off strategy is a star performer in April with a 4.54% gain. This thematic strategy is probably the only one among Unifi strategies that has delivered a positive return this month. However, Spin Off strategy needs to deliver better returns if it has to shrug off its 1-year loss of over 17%.”

Analyst questions

- What are the criteria for picking up the funds for Unifi blend fund, or how do allocate amongst the various funds? Is it Dynamic or static?

- You do active management then how do you maintain low turnover in the fund? How do you generate alpha?

- While an investor is investing in your fund, what alpha should he/she be expecting?

- What parameters do you take into consideration while coming up with the theme? (How do you come up with themes)?

Peer review and additional questions

- Since all the funds need different types of analysis, what is the process of picking funds for the Blended Rangoli Fund?

- For how long, according to you, will the BC-AD (Business Consolidations after Disruptions) Fund model continue to be profitable and why?

- Can you explain the various reasons why promoters increase or decrease their stake in a company? Are the reasons always genuine or they can do so for manipulation?

- In one of his interviews, Mr. G. Maran said, “In most western countries like the US, Owner Management and Executive Management are two very different concepts whereas in India, both are more or less the same”. Can you elaborate on why this difference exists and how it impacts the markets?

- What is the fee structure of your portfolios?

- What is the AUM of your portfolios?

- What is your investment philosophy?

I think that there will come a point when most of the industries will get as organized as they possibly can as we are already witnessing a major shift from unorganized industries to organized ones. That leads me to the 2nd question that I want to ask as an analyst.

On their website, they’ve mentioned all the details about all the funds clearly but I couldn’t find any information on AUM and the fee structure. These are some really important details that, according to me, should be mentioned properly on the website.

I think that there is no real way to make out whether the Blended Rangoli Fund is actually performing well because not many funds can be found that have a similar approach towards investing. I think that just the Alpha is not enough to decide whether the fund is actually outperforming. The performance of the substitutes of the fund that have a similar approach is the best parameter to judge the performance of the fund.

Prepared by – Preet Malde

You must be logged in to post a comment.