Funds managed

| Fund name | Asset class | License |

| TVS Shriram growth fund 3 | PE | SEBI AIF Cat 2 |

| TVS Shriram growth fund 2 | PE | SEBI AIF Cat 2 |

About the AMC

- TVS Capital Funds was founded by Gopal Srinivasan, a third-generation entrepreneur of the TVS Family, in 2007, with a vision to provide financial and capability capital to India’s entrepreneurs and to engage with them to build sustainable and successful businesses.

- TVS Capital funds is one of the pioneers of mid-market PE investments in India.

- TVS Capital manages ₹ 2,000 Crores in AUM across 3 Funds, with the First Fund Launched in 2007 and is currently investing out of its 3rd Fund

- The major focus of the funds are – a) Financial Services b) Food & agriculture c) Lifestyle & Leisure

Key staff

- Gopal Srinivasan ( MD & Chairmain)– Gopal Srinivasan is the Founder, Chairman and Managing Director of TCF and a third-generation member of the TVS Family. Over an entrepreneurial career spanning 30 years, he has incubated 8 companies operating in diverse sectors including technology, financial services & auto components.

- Sundaram D (MD & Vice Chairman)- D Sundaram is the Vice Chairman and Managing Director at TCF. He was the former Vice Chairman & CFO of HUL with 34 years’ of professional experience in corporate finance, business performance, governance, talent management and strategy.

- Mukandan K (Executive Director)– Mukundan is an Executive Director at TCF. He is responsible for sourcing, evaluating and structuring investment opportunities and managing portfolios. Mukundan brings over 25 years’ experience in private equity&venture capital investments, SME lending and infrastructure financing.He joined TCF from National Investment and Infrastructure Fund, where he was a Consultant to its Investment Strategy and Policy Group. Previously, he was the CEO of UTI Capital.

Investment Philosophy (for firm)

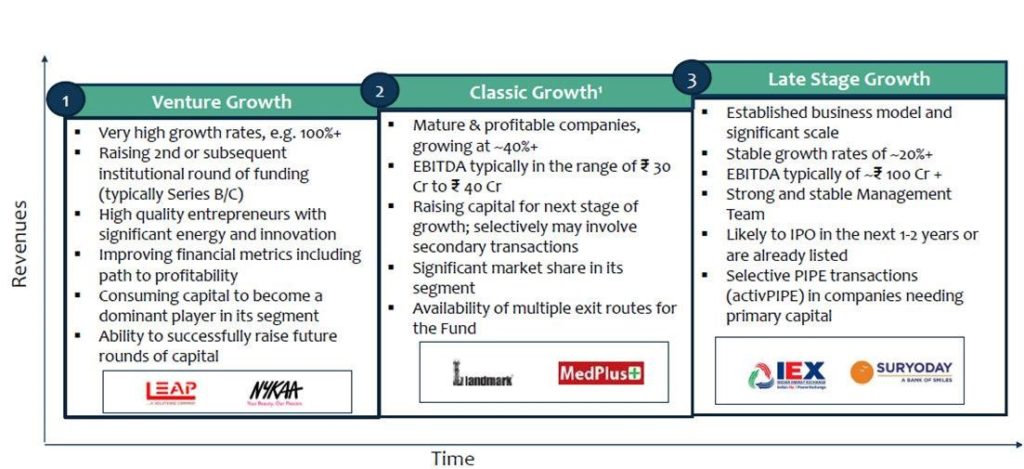

We believe in investing in best ideas across stages of investments which besides having a positive impact on risk-adjusted returns, also significantly enhances the ‘exit-ability’ quotient of the investments

This pragmatic approach to stage of investment provides us wider investment opportunities and multiple exit avenues.

Sector Focus

Based on an assessment of current macro-economic conditions and our strengths, we have identified the following as focus sectors for the fund:

- Financial Services;

- B2B Services; and

- Niche Consumer

Within each focus sector, we have identified and established specific categories based on GICS

Media

Title: Moneyball: TVS Capital’s Gopal Srinivasan On How The Pandemic Changes Things For The Economy, Source: inc42, Date: 8 April 2020

https://inc42.com/features/gopal-srinivasan-on-how-the-pandemic-changes-things-for-the-economy/

Summary of what was said:

- A few sectors will bounce back faster, but some will take longer and will need massive changes, said Srinivasan

- Srinivasan estimates that India will suffer a GDP loss of up to INR 4 Lakh Cr per week due to the pandemic

Title: TVS Capital Marks 2nd Close Of Third Fund With INR 1,100 Cr In Commitments, Source: inc42, Date: 9 July 2019

https://inc42.com/buzz/tvs-capital-marks-2nd-close-of-third-fund-at-inr-1100-cr/

Summary of what was said:

- The fund has targeted a corpus of INR 1,000 Cr

- TVS Capital has announced the first close of third fund in Oct 2018

- PE firm’s third fund portfolio includes LEAP India and Suryoday

Analyst questions

- As the TVS capital growth fund 3 has already hit its second close and with this current situation of covid-19, which sectors you plan to invest after this cycle ?

- Will there be a change in the sectors ?

- Having funds which always gets subscribed over and above their target , does this allow funds managers to take more risk while screening for stocks ?

- How have previous funds performed?

You must be logged in to post a comment.