About the firm

Mercer is an American human resources consulting firm. It is the world’s largest outsourced asset manager with over $300 billion USD outsourced assets under management and $15 trillion USD under advisement in total. Headquartered in New York City, the firm operates in more than 130 countries, and is the largest provider of outsourced chief investment officers.

Mercer is a subsidiary of global professional services firm Marsh & McLennan.

Wealth –

In 2017, Mercer combined its investment and retirement consulting practices into a new Wealth consulting division. Clients served by this practice include pension plans (both defined benefit and defined contribution plans) and a range of institutional investors. In December 2017, Mercer’s investment assets under delegated management reached above $200 billion.

Investment philosophy

Mercer has a well-documented investment philosophy published as Investment Beliefs.

The website has a good selection of whitepapers available freely that outlines their thoughts on a range of investment topics.

Mercer has a base institutional rating, but then also issues star ratings under Mercer FundWatch in Asia (Singapore/HK).

Rating process

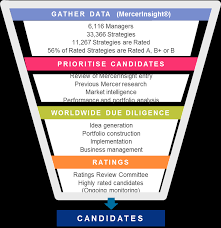

The research process focuses on identifying alpha through the following methodology:

Research driven: Our forward-looking, research-intensive process builds on a deep understanding of each investment fund covered.

Repeatable: We use a robust and consistent framework to assess each fund’s capabilities.

Evidence based: We focus on characteristics that have been shown to enhance the probability of sustainable alpha generation, which can vary over time and by asset class.

Flexible: We use flexibility and past experience to focus on the relevant characteristics for a given fund.

A GUIDE TO MERCER’S MANAGER RESEARCH PROCESS

This short guide is designed to assist investment managers and related parties when navigating through Mercer’s manager research process.

GETTING STARTED – GIMD

WHAT IS GIMD?

Mercer’s Global Investment Manager Database (GIMD) is a proprietary,web-based database containing information on more than 6,100 investment managers (www.mercergimd.com). This global repository provides information and insights on investment managers and strategies across all asset classes: equity, bonds, real estate, and alternatives. The entries are maintained by the investment managers themselves, with Mercer’s research consultants adding research notes, news items, research priorities, and ratings. The information in this database supports Mercer’s global research on investment managers and the manager searches that they perform for the clients.

GIMD is the starting point for the research. It is used globally by all researchers and consultants, acts as the primary source of investment manager information, and houses the research.

The more information you include in GIMD detailing your investment team, investment process, and products, the better.

ASSIGNING A RESEARCHER

When a new investment manager account is created in GIMD, a Mercer researcher will be assigned. Factors such as geographic location, asset class, and focus will be considered when selecting the appropriate researcher. The name and contact details of this researcher are visible on GIMD and this person will be your primary contact at Mercer at a business level.

Over time, individual products may be assigned to different researchers — for example, a private debt product will be assigned to a specialist private debt researcher. Again, this researcher’s name and contact details will be visible on GIMD and he or she will be your primary contact at a product level

SETTING PRIORITIES

New products on GIMD will have a default rating of N (not rated). Initially, they conduct a desktop review of new products, based on the information on GIMD and any supplemental materials received. Reassess existing products from time to time and will prioritize a product for further research if (1) their client base has demand for the asset class/strategy or if future demand is anticipated, and (2) their desktop review indicates that the product warrants further research. This assessment does not rely on past performance but rather a view of the people and process behind a product, including the experience and level of team resources.

RATING PRODUCTS

For those products that are prioritized for further research, meetings will be arranged with the individuals managing the product. Typically, at least one meeting will be on site; it is essential that they have access to the key decision makers. The process aims to formulate forward-looking views on the future prospects of products.

The factors they look at are broadly grouped into (1) idea generation, (2) portfolio construction, (3) implementation, and (4) business management. Their overall view of a product is summarized by its rating, which is on the scale A, B+, B, and C.

Products rated A are those that they would expect consultants to recommend to clients. R ratings also exist, which implies a strategy is researched but not fully rated.

The formal rating process requires the researcher to write a research note that reviews the product and recommends a rating. The rating is then submitted to a ratings review committee that will approve it, agree a different rating, or request further research.

Mercer ratings helps to recommend products to the clients based on their assessment of future value, and are therefore proprietary and not disclosed externally. However, the assigned researcher for a product will give honest feedback to investment managers on the research findings.

INFORMATION GIMD CONTAINS –

The database allows investment managers to enter firm wide information, together with in-depth, product-specific detail.

Minimum details are –

- Firm wide details including – AUM, No. of staff, offices, ownership details.

- Product details including – Processes, benchmarks, available vehicles, performance track records.

When undertaking new manager searches, the consulting staff and MercerInsight subscribers often screen the database for particular information. Criteria can include performance, fees, office locations, team turnover, risk levels, etc. As such, the more information you enter into GIMD, the more likely you are to be included in these screens, even if your strategy is not rated by Mercer. Unrated strategies that consistently appear in such screening tend to be prioritized for future research.

Its benefits –

- Live information: GIMD is web-based, ensuring that (real-time) information is immediately available to all members of Mercer’s Investments team. Managers can therefore communicate with consulting staff globally in a single action.

- Easier access to Mercer’s research: GIMD makes your firm visible to Mercer’s global manager research team, which conducts more than 2,700 meetings with investment managers each year in order to identify investment strategies suitable for the clients. The database is a primary resource for identifying strategies suitable for research. During 2018, used this research to help the clients with 756 manager searches worldwide, accounting for US$50.3 billion worth of assets placed.

- Easier access to information for clients via MercerInsight: GIMD allows investment managers to respond directly to requests for information from the research platform subscribers who can screen and analyze investment products via MercerInsight. Their 2311 MercerInsight subscribers account for approximately US$7.0 trillion globally of Mercer’s and its affiliates’ assets under advisement. The geographical distribution of these subscribers is approximately equally split between the Americas, EMEA, and Asia Pacific, and the clients are principally large pension funds sovereign wealth funds, insurance companies, multi-managers, private banks, and family offices.

- Free of charge: Creating and maintaining an entry on GIMD is free.

- Faster selection process: Maintaining the information stored in GIMD often negates the need for our consultants to make requests for proposals or information (RFPs/RFIs). This reduces the strain investment managers often face when presented with multiple requests for similar information and makes the search process with Mercer significantly smoother and faster.

Mercer FundWatch (Retail ratings in Asia)

(https://www.mercerfundwatch.com/assets/intro.html)

Mercer FundWatch is an investment ratings service providing research and ratings on funds available to individual investors and financial advisors.

- Delivers high-quality, forward-looking research on funds and a simple rating system

- Focuses on the “exposure” a fund provides and net-of-fee future performance prospects

- Offers access to a Mercer news bulletin that highlights changes affecting rated funds

Ratings are forward-looking and are based on four qualitative factors that the firm believes will drive future performance: idea generation, portfolio construction, implementation and business management.

(source: https://fundselectorasia.com/mercer-launches-fund-research-for-the-public/)

Mercer ESG Ratings

Mercer believes responsible investors should integrate environmental, social & corporate governance (ESG) risks and opportunities into their investment processes. To do that, it’s essential that they can identify the investment manager strategies leading the way – and that’s where Mercer’s ESG Ratings come in.

It’s global manager research team evaluates more than 4,400 investment manager strategies on their integration of ESG factors, and active ownership (voting and engagement). This provides clients with a consistent and robust way to evaluate how managers approach ESG and active ownership; then assess how this contributes to their own investment outperformance.

How It Works

When Mercer researchers review a strategy, they will determine an appropriate ESG rating. This rating sits alongside the traditional alpha ratings (A, B+, etc.) and is considered alongside all other relevant factors. Maintaining such ‘parallel’ ratings:

- Instils a disciplined process to embed ESG questions into Mercer’s core research process and make the responses visible within that process.

Provides a unique ESG marker for the growing client demand for an independent assessment of current or prospective ESG integration and stewardship practices by managers.

- Enables client portfolio comparisons with the Mercer manager universe at a point in time.

- Tracks ESG integration progress across the Mercer manager universe by asset class over time.

Each rating is a qualitative assessment of the depth of ESG integration throughout a strategy’s process, following Mercer’s Four Factor Framework.

- Idea Generation (e.g. risks and opportunities identified)

- Portfolio Construction (e.g. identifying whether ESG views are translated into portfolio positions)

- Implementation (e.g. evidence of active ownership, turnover, time horizon and so on).

- Commitment across the manager’s firm to ESG issues.

- There are four ESG ratings categories ranging from ESG1 (the highest rating) down to ESG4 (the lowest rating). For a strategy to be assigned an ESG1, the investment team must have demonstrated market-leading capabilities in integrating ESG factors and active ownership in some or all of the four factors. An ESG4 undertakes little or no integration of ESG factors or active ownership into core processes.

- Approximately 17% of ESG-rated strategies receive the highest ratings of ESG1 and ESG2, and the chart below shows the range of ESG integration across the major asset classes:

Mercer’s approach to evaluating ESG integration into core investment processes discourages ‘box ticking’ or prescribing a ‘one size fits all’ model. Rather, they look for an indication that managers have made an effort to integrate ESG factors into their alpha generation process as well as beta enhancement by exercising their ownership rights.

Whilst practices vary, highly-rated strategies often have the following common features:

- A demonstration that ESG factors feature in investment teams’ decision making process and corporate culture.

- An effort made to build ESG factors into valuation metrics, using the investment team’s own judgment about materiality and time frames.

- A long-term investment horizon and low portfolio turnover.

- Ownership policies and practices that include sufficient oversight, integration with investment decision-making and transparency.

- For alternative assets, evidence of pursuing best practices in transparency and evaluation, monitoring and improvement of ESG performance as relevant for portfolio companies and sectors.

- A demonstrated willingness to collaborate with other institutional investors to improve company, sector or market performance.

- A commitment to ESG integration across the organisation.

(source: https://www.mercer.com/our-thinking/mercer-esg-ratings.html)

Analyst questions

- Why does Mercer have separate institutional (A, B etc) and retail ratings? What additional factors does the latter include?

- Are Mercer ratings available in India?

- Does Mercer publish the value-add from its ratings? Is this available to financial advisers and retail investors?

Prepared by

Ridhima Jaisinghani (June 2020)

You must be logged in to post a comment.