About

Established in 1999, HDFC AMC entered into a joint venture in 2001 between Housing Development Finance Corporation Limited and Aberdeen Plc (now known as Abrdn Investment Management, previously Standard Life Investments Limited).

The Assets Under Management (AUM) of Indian Mutual Fund Industry as on April 30, 2023 stood at ₹ 41,61,822 crores (~$ 507.43 billion @INR 82 per USD). Comparatively, the AUM of HDFC AMC stands at INR 4,40,000 crore (~$ 53.65 billion @ INR 82 per USD) as of March 31,2023.

HDFC AMC operates a network of 228 investor service centres (ISCs) spread across over 200 cities and 228 branches. Their services reach customers in 99% of PIN codes in India. It has a growing team of 1187 employees. HDFC limited owns 52.6% stake and Abrdn investment limited owns 10.2% stake (as of march 31, 2023). HDFC AMC provides diversified equity, ETF, fund of funds, thematic/sectoral equity, ELSS, theme based debt, duration based debt, index fund, close ended fund and others.it is listed as NSE: HDFCAMC and BSE: 541729.

Following the merger between HDFC Ltd. and HDFC Bank, SEBI has granted approval to HDFC Bank as the new owner of HDFC AMC. The merger process is expected to be finalized by July 2023. Following the merger, HDFC Bank will be 100% owned by public shareholders and existing shareholders of HDFC will own 41% of HDFC Bank. HDFC AMC is the second largest listed AMC in India with a market share of 11.6% as of May 2023. During FY18-19 it carried out an initial public offering, and became a publicly listed company in August 2018. HDFC Mutual Fund obtained registration with SEBI in 2000, and subsequently, in 2003, it acquired the mutual fund schemes of Zurich. Furthermore, in 2014, HDFC Mutual Fund successfully acquired the mutual fund schemes of Morgan Stanley.To meet the unique investment needs of HNI, family offices, corporates, trusts, provident funds and domestic and global institutions.

The AMC has 6.6 million unique investors with 11.4 million live accounts. It has 75,000+ empanelled distribution partners. HDFC AMC has a 17.8% market share in B-30 cities and 82.2% market share in T-30 cities as of 31st March, 2023.

Key Financials for the year 2022-2023

| Year | Total Income (INR crores) | Total Expense (INR crores) | EBIT (INR crores) | EBIT Margin | Net Profit (INR crores) | Total Income (USD millions) | Total Expense (USD millions) | Net Profit (USD millions) |

| 2021-22 | 2,433.20 | 577.91 | 1,855.29 | 76% | 1,855.29 | 324.43 | 77.05 | 247.37 |

| 2022-23 | 2,483.00 | 611.96 | 1,870.61 | 75% | 1,871.00 | 302.75 | 74.62 | 228.12 |

Key staff

Navneet Munot, MD and CEO of HDFC AMC effective from February 16, 2021. Prior to this, he worked with SBI Funds Management Pvt. Ltd. as an Executive Director and CIO and was a key member of the executive committee since December 2008. He started his career in 1994 with Aditya Birla Group. He moved to Morgan Stanley Investment Management in 2007 as an executive director and head of multi-strategy boutique and then joined SBI Funds Management Pvt Ltd. in December 2008. Presently, he is the Chairman of the board of Indian Association of Investment Professionals (CFA society, India). He has a Master’s degree in Accountancy and Statistics and is a qualified CA. He is also a charter holder of CFA Institute and CAIA Institute and done Financial Risk Management (FRM).

Chirag Setalvad took over as Head of Equities. He has over 24 years of experience, of which 20 years have been in fund management and equity research and four in investment banking. Setalvad has been associated with HDFC Asset Management Company Limited for over 15 years. Before this, he was the vice-president at New Vernon Advisory Services Pvt. Ltd for three years and also a fund manager at HDFC Asset Management Company Limited. He has been an assistant manager with ING Barings N.V., Mumbai, for three years. He has completed his B.Sc. in business administration from the University of North Carolina, Chapel.

Investment philosophy

Equity oriented schemes

Investment philosophy of the firm for equity-oriented investments is based on the belief that over time stock prices reflect their intrinsic values. Investments in equities are driven by fundamental research with a medium to long-term view. Their research efforts are predominantly focused on bottom up research keeping in mind the economic outlook and macro-economic conditions. The focus of research effort is on understanding the businesses, key drivers and understanding the risks taking into account both quantitative (growth prospects, key variables, analysis of P&L statements, Balance Sheet and cash flows etc.) and qualitative (management quality, corporate governance, track record, competitive advantage, feedback from dealers, customers & experts etc.) factors.

Debt Schemes

Investments in fixed income securities are guided by the investment philosophy of safety, liquidity and returns (SLR), generally in that order. Given the limited liquidity of fixed income markets in India, the firm believes focus on liquidity, especially in open ended schemes is of paramount importance. The credit risk assessment framework lays emphasis on four Cs of credit – character of management, capacity to pay, collateral pledged to secure debt and covenants of debt, wherever applicable. Further, the firm has an internal framework to determine absolute and relative investment exposure limits for individual credits. Apart from quality and credit research, the firm aims to add value in fixed income investments by managing duration of portfolios driven by its view on interest rates and yield curve etc.

Media

Fireside Chat with Navneet Munot, MD & CEO, HDFC AMC ,The Digital Leadership Symposium | 10th March 2023

The Securities and Exchange Board of India (SEBI) has granted approval for a change in control of HDFC Asset Management Company (HDFC AMC) due to the amalgamation of HDFC Ltd and HDFC Bank Ltd. This move paves the way for HDFC Bank to become the new owner of HDFC AMC, subject to compliance with applicable regulations. HDFC AMC announced in April that the merger between HDFC Ltd and HDFC Bank Ltd would be completed by July of this year. Upon completion, the combined entity is expected to have a total asset value of approximately Rs 18 trillion, solidifying its position as a major player in the Indian financial market.As part of the amalgamation, existing shareholders of HDFC Ltd will hold a 41% stake in HDFC Bank. Conversely, HDFC Bank will be entirely owned by public shareholders. Under the merger agreement, HDFC shareholders will receive 42 shares of HDFC Bank for every 25 shares they currently hold, ensuring a fair distribution of ownership.:

SEBI’s new total expense ratio proposal may hit HDFC AMC most, businessline website, June 01, 2023

Link to media- https://www.thehindubusinessline.com/markets/sebis-new-total-expense-ratio-proposal-may-hit-hdfc-amc-most/article66916727.ece

SEBI’s new proposal to impose a uniform total expense ratio (TER) for all asset management companies (AMCs) is expected to have a greater impact on HDFC AMC’s revenue. Brokerages suggest that larger AMCs like HDFC AMC and those with a higher hybrid mix may be more affected. However, they also note that AMCs have the option to pass on the cost impact to unitholders. In the long term, AMCs are expected to benefit from SEBI’s move towards greater transparency.

According to JM Financial, the immediate impact will be higher for larger AMCs like HDFC AMC, with an estimated 10-12% cut in earnings per share (EPS) if 50% of the impact is passed on to distributors and brokers.

HDFC Mutual Fund launches India’s first defence fund, economic times website,May 17, 2023

Link to media- https://economictimes.indiatimes.com/mf/mf-news/hdfc-mutual-fund-launches-indias-first-defence-fund/articleshow/100292634.cms

HDFC Asset Management Company Ltd on Tuesday announced the launch of the country’s first mutual fund focussed on defence sector, a move that will provide investors an opportunity to participate in growth potential of this space. The new fund offering (NFO) of HDFC Defence Fund, an open-ended equity scheme, would open on May 19 and close on June 2, HDFC AMC said in a statement. The fund will invest at least 80 percent of its net assets in defence and allied sector companies.

SEBI approves HDFC Bank as new owner of HDFC AMC, businessline website,May 24, 2023

Link to media- https://www.thehindubusinessline.com/money-and-banking/sebi-approves-hdfc-bank-as-new-owner-of-hdfc-amc/article66888886.ece

HDFC Asset Management Company has received the final approval for a change in control to HDFC Bank from Housing Development Finance Corporation. The change in majority control was part of the amalgamation of Housing Development Finance Corporation into HDFC Bank. The merger of HDFC with HDFC Bank is in the final stages and is expected to be completed in a few months.

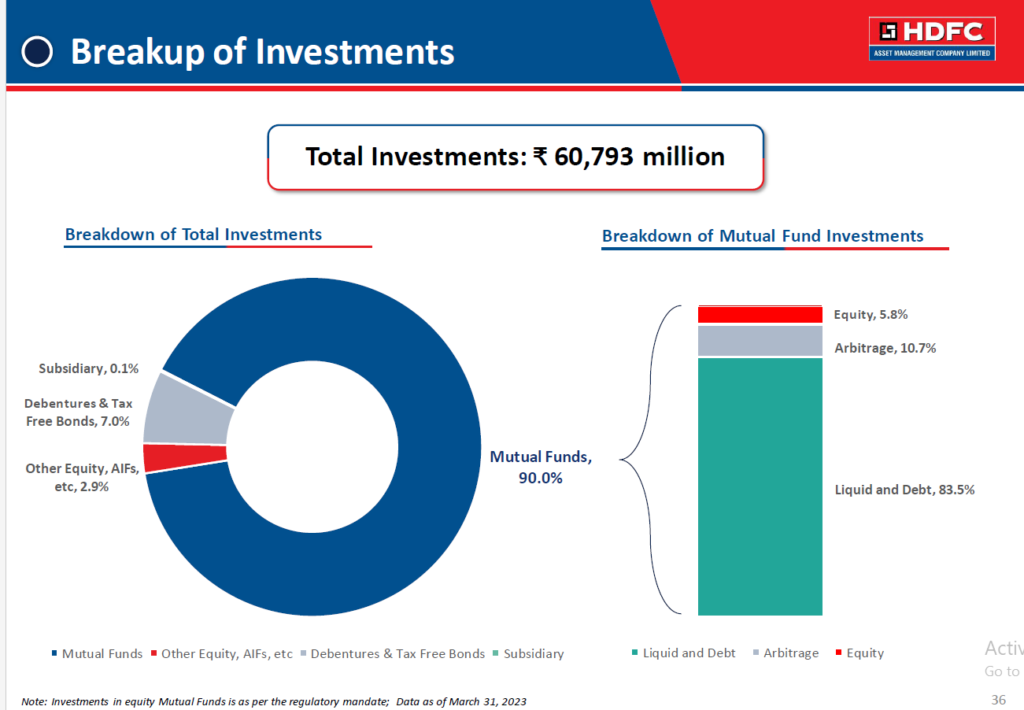

Breakdown of Mutual fund investments and total investments, HDFC AMC investor presentation, March 31, 2023

Source – Screenshot from HDFC AMC investor presentation (available from website)

Interview with Prashant Jain, ex-CIO, Brightest Investment Minds book, 23rd March 2022

Loading…

Loading…

Prashant Jain’s style of investment has been the same for the past twenty years, he has always focused on buying good businesses at reasonable prices. He believes that markets are imperfect in the short run but nearly perfect in the long run so he looks for the opportunities that market offers and takes a long term perspective. In his view, the divide between growth and value is not very clear, the key is to figure out the long-term growth rate. Hence, his style can be termed as “growth at a reasonable price”.

He is not fixated on the fact that superior or faster growth can only come from smaller companies and it is also not even all about rapid growth. It is about the price for the growth that the business has, even buying a slow-growing business if offered at lower value is reasonable. In his opinion, there are two mistakes that an investor make – 1) Overpaying for a unsustainable business 2) Losing out on a business opportunity.

How HDFC MF’s Prashant Jain filters signal from noise, Bloomberg Quint,25 November 2019

Link to media- https://youtu.be/cZfAGJCnBaw

The investment style of Prashant Jain-Blend is an apt description, with a bias towards value, out of the characteristics like – momentum, value, growth, blend & freestyle. My preference is to invest in a growing business at a reasonable price and hold them for medium to long periods. On avoiding confirmation bias: they specifically look for sell-side analysts who have an opposite view to the firm’s analysts. They document the belief that they have about the business and discuss it within the team and then look at the sell-side if they can improve their understanding. Their aim in speaking with sell-side analysts in general is to get a deeper understanding of a specific industry or business or situation and not to judge or measure their evaluation. They will listen to many, but eventually, put it all together to come up with their decisions. On filtering noise: to get the best ideas from noise of 50-60 recommendations submitted by the sell-side firms, they ask the research house to present their top 3 ideas for the quarter and then a part of commissions are distributed among the sell-side firms objectively based on the five best ideas submitted to them during a year (buy as well as sell). The evaluation criteria are also shared transparently.

On process vs person: he believes that good processes can improve certainty of average outcomes. However, exceptional outcomes are still dependent on people in this industry. They have a small team of 12-14 analysts in equities, they give utmost significance to the experience and therefore analysts are not rotated across sectors. The firm invests in enriching the skills, experiences and keeping analysts motivated. On being asked about how he takes the popular belief about him to be contrarian, he said that they’re not contrarian investors per se, they look at underlying value and how it will evolve and sometimes, that can be a contrarian view. But they’ve often held positions that are also consensus positions – such as IT for a long time but when they believe that the valuations are unsustainable they might turn out to be contrarian. On the size of a mutual fund: he thinks that the performance is not dependent on the size but instead it depends upon the choice of decisions that are undertaken. I do not however recommend this approach for others. In my judgement a sound investment plan comprises of three simple steps:

1. Asset allocation towards equities should be a function of individual risk appetite and should be carefully assessed from a long term perspective. While equities are a rewarding asset class in the long term, over short to medium periods they are risky and uncertain. Hence, only that portion of wealth that one can set aside for next 3 to 5 years at least and on which one can tolerate volatility, both emotionally and financially, should ideally be invested in equities. The rest should be invested in safer asset classes.

2. Diversify across a few managers that have a good track record.

3. Patience. The longer one holds equity funds, the more wealth should get created in general.

Prashant Jain of HDFC Mutual Fund shares his “Investment Mantra” Media platform name- ET now Date- 2018

Link to media- https://youtu.be/6ebPBvquvrk

There are two views, one of John C Bogle supporting indexing, and Warren Buffet supporting active management. In the US , mutual funds account for 50% of the market, therefore it is not possible to outperform the market. But in India mutual funds account for only 5% of the market, and markets are always creating excesses, creating opportunity therefore with long term discipline and elementary valuations, you can outperform the market. Equities are exposed with systematic risk which can be reduced by longer holding periods. Mutual funds diversify unsystematic risk.

Prashant Jain on his stock picking strategy, NDTV, 06 April 2016

Link to media- https://youtu.be/Vz79lgveutE

In the interview Prashant Jain talks about his investment philosophy, he has a balanced view on picking a company, he looks for growth under a reasonable price in a stock. He believes that the businesses with sustainable growth also have inherent competitive advantage in the long run.

He talks about the idea generation process of the firm for picking stocks. They have a large team which do sectoral research and look for the companies which are not covered before. They select stocks from a universe of 350-400 stocks which approximately represent 90 percent of the market capitalization. The decision of selection is left upon the individual portfolio managers. For evaluating stock, they look for minimum reasonable quality and consider two things –

Business quality- In this they evaluate sustainability and look for inherent competitive advantage and Business management- competence and integrity of management is looked upon and assessed on the basis of financial track record and the general opinion about them in the industry.

He thinks there is a high correlation between business quality and management and both go hand in hand. On being asked the parameters that they use to assess the above two factors in the business, he said for evaluating sustainability, return on capital employed more than 15 percent over a long term is quite enough as it also would reflect the competitive advantage of the business. He thinks that there is no such minimum threshold on it as more often it is a subjective view of the person. He thinks that management assessment is also subjective but the Board of Directors and dividend track record of the company can be considered. In his view, value investing could be painful in the short to medium term (3 – 5 years). He focuses on long term and thinks extrapolation of short term growth to long period is not a right thing to do and the good value is found in the segments which are ignored when majority of the market participants are focused on a particular segment.

In the firm the decision to sell is left upon the individual managers and generally they sell out a stock when either of the two things happen, business becomes expensive and does not offer value or when some of the other businesses are giving meaningful return over the long term.

Prepared by – Punit Bansal, May 2021 & Sattik Mukherjee, Dec 2022.

Updated by – Akash Damani, June 2023.

You must be logged in to post a comment.