Funds managed

| Fund name | Asset Class | License |

| Carnelian Capital Compounder Strategy | Long only- multicap | PMS |

| Carnelian Capital Compounder Fund | Hedge Fund | SEBI AIF Cat 3 |

About the AMC

- Carnelian Asset Management, an investment management firm was founded by Vikas Khemani, Manoj Bahety, Sachin Jain, and Swati Khemani to pursue their passion towards investing in capital markets in 2019.

Key staff

- Vikas Khemani, CA, CFA, CS – Founder

Vikas has ~23 years of capital markets experience, most recently as the CEO of Edelweiss Securities Ltd, where he spent 17 years incubating & building several businesses to leadership positions including Institutional Equities and Equity Research. With a strong business acumen & deep understanding of the Capital Markets, he enjoys strong relationships with Corporate India and is associated with several Industry bodies & committees including the CII National Council on Corporate Governance, FICCI Capital Markets Committee, Executive Council of Bombay Management Association. He is also a member of Young Presidents Organization (YPO), a global forum for entrepreneurs and CEOs and was awarded Young Professional Achievers Award for the service sector by the ICAI in 2014. His passion for investing took shape during his college days and continues to drive him.

- Sachin Jain, CA – Founder

Sachin has spent 18 years in the financial services industry, of which the last 11 years were in the capital markets. He last served as the COO of the Capital Market Group at Edelweiss Securities Ltd, overseeing risk, technology, HR, strategy and operations for various businesses including Institutional equities and Investment banking. He also founded the prime brokerage business there, which under his leadership achieved significant scale and profitability. He was also a part of the senior leadership group at Edelweiss, besides serving as a director in several group entities.

Sachin is also passionate about long term equity investing and enjoys understanding different businesses. He is an avid poker player, who is also fascinated by behavioural psychology and studies the impact of EQ on overall life in general and markets in particular. He is also on the advisory board of “Leap for Word”, an NGO working towards resolving English literacy problem in rural Maharashtra.

- Manoj Bahety, CA, CFA -Founder

Manoj has over 20 years of a rich & diverse financial services experience having worked with marquee institutions including Edelweiss Securities, Morgan Stanley, RIL, HPCL. He last spent ~11 years at Edelweiss Securities as Dy. Head – Institutional equity research, Head – forensic, thematic & mid cap research. He is known for his differentiated, non-consensus research and pioneered forensic research, popularly known as “Analysis Beyond Consensus” (ABC research). ABC has helped investors across the globe make informed investment decisions based on true numbers versus reported numbers thus avoiding pitfalls (one of Carnelian’s virtues). Mid Cap research under his leadership has been credited with several multi-baggers including VIP Industries, Supreme Industries, Balkrishna Industries, PI Industries, AIA Engineering, ICRA, Fag Bearing, SKF, Gulf Oil. Manoj has represented several committees of the CFA Institute including Chairperson of India advocacy committee and is a member of the US based global CDPC committee.

- Swati Khemani -Founder

Swati has over 10 years of experience in the financial services industry including seven years at Edelweiss Financial Services across the Investment Banking and Institutional Equities businesses where she enjoyed equity research and institutional sales. She actively covered the Financial Sponsors and enjoys a good relationship with the investor & corporate community. While on a break to look after her family, Swati started her entrepreneurial journey with Newedge Consulting (HR consultancy focussed on financial services) and managing the family office. Over the last couple of years, Swati has found interest in angel investing and has been investing & mentoring in the start-up world. Her strength lies in understanding businesses, investing and relationship building.

Investment Philosophy (for firm)

- We believe investing success is an outcome of making good decisions consistently over a long period of time. Good decisions are those which are made “Objectively, Free of any bias”, considering “Probability of outcome” and factoring “Risk reward”.

- We believe investing in good growth businesses, managed by great management at fair valuation.

- We have built a proprietary quantitative and qualitative model to filter out ideas.

- We believe margin of safety doesn’t necessarily lie only in price, but can be sought in detailed work.

- We believe one can never make money on borrowed conviction.

- We are happy to be contrarian when risk reward is compelling: mimicking herd = regression to mean

- We believe in being patient and long term. Investing is like watching grass grow.

- We prefer definite returns over immediate returns.

- We don’t mind sitting on cash if we can’t find better use.

About the model portfolio:

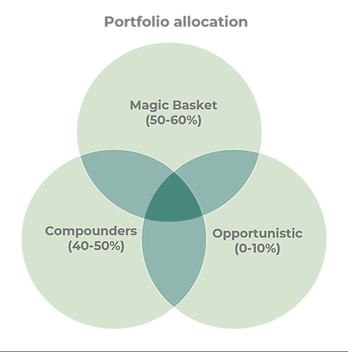

Carnelian Compounder Strategy is a long only, multi-cap, sector agnostic strategy, with an objective to generate sustainable alpha and compound capital over a long period of time through the MCO framework. The Strategy offers a unique & unconventional blend of Magic (accelerated growth), Compounder (stable growth) & Opportunistic companies.

What is the MCO framework?

Magic Basket:

The Magic Basket aims at capturing earnings growth and valuation rerating. Investing into companies through a catalytic/ change oriented approach. In the Carnelian investing world, Magic moments are changes/catalysts in the life of a company – when the company gets into a new growth trajectory, but not recognized by Mr. Market. The catalyst can be either one of or a combination of “change of management”, “change of industry/business structure”, “change of business strategy”, “new business product or segment” or “simply long investment phase getting over”. We will invest 50% – 60% of our portfolio in this Basket.

Compounder Basket:

The Compounder Basket aims at capturing earnings growth over a long period of time. Many companies, having created a significant moat around their businesses, managed by exceptionally talented managers, deliver a superior stable return over a long period of time. (MRFG – a combination of Moat, High Return On Equity, Free Cash Flows, Growth & Governance profile). Such companies are usually well discovered, well owned and usually on the higher end of the valuation range. They are richly valued and remain so as long as MRFG characteristics are intact. These companies entering this basket can remain here for a long period of time until they start losing their MRFG characteristics either due to internal reasons (complacency, hubris or greed) or external reasons (technology disruption, competition, industry growth).

Opportunistic Basket:

This basket is an opportunistic way of capturing opportunities market offers from time to time on a short-term basis (3-12 months) and may not meet all the conditions of the first two baskets to hold for long term but we have a high conviction around the risk reward it offers. This could also include special situations including IPO/merger/demerger/delisting, etc where we think ~18-20% return can be made in 3-12 months’ time. Markets tend to offer such opportunities very often. This is an optional basket and if there are no opportunities, we will not invest. We will deploy 0-10% of our portfolio in this Basket.

Forensic Expertise

In investing, avoiding an accident is equally important as getting the investment hypothesis right. Our unique forensic framework deep dives into the following before investing, what we call “CLEAR”.

C – Cash flow Analysis & Capital Allocation. We assign zero value to profits without cash flow conversion. We deep dive into source of cash flow instead of reported cash flow

L – Liability Analysis, True debt vs Reported debt, Contingent liability and likely impact on future earnings

E – Earning Analysis, True Economic Profit vs Reported Profit, Discretionary vs non-discretionary profit

A – Asset Quality Analysis, Some worrisome points – huge built up in loans and advances, large quantum of long duration inventories/receivables susceptible to value diminution, large payables supporting large receivables/inventory, profits getting re-deployed in non-core/expensive/uncertain inorganic growth, profits getting into intangible assets/goodwill – without visibility of commensurate profitability, subsidiaries/JVs which require consistent infusion of profit without any visibility of returns.

R – Related party transaction & Governance issues

Pitfalls they avoid

Below illustrated are companies / managements we will not invest with:

- Companies with aggressive accounting practices

- Companies with high financial leverage

- Companies with low tax incidence

- Companies with the management having no skin in the game or misaligned objective

- Managements with consistent poor governance track record

- Managements in a hurry to create value

Investment process

https://www.carneliancapital.co.in/investmentprocess

Portfolio construction

- Universe ~20 – 25 stocks

- Avoid concentration

- Sector limit ~ 30 – 40%

- Stock limit ~10%

- Ensure adequate portfolio level liquidity- 30% of portfolio can be liquidated within 5 days

- Low churn

- Well defined internal risk management & insider trading policy

Model portfolio return:

Media

Title: Decoding the Pandemic Panic | Nilesh Shah & Vikas Khemani to ET NOW, Source: ET now, Date: 17 March 2020

Vikas thinks in a deep crisis like this there is no one solution. Central banks will figure out solutions on a continuous basis and just monetary policies are not enough, fiscal spending needs to take place. Combination of both can pull out the economy.

Should one invest in mid and small caps now?

Vikas says it really depends on the risk appetite but yes a lot of opportunity in the small and midcap industry.

Title: Economy Ripe For A Rebound? | Vikas Khemani To ET NOW, source: ET now, Date: 13 February 2020

https://www.youtube.com/watch?v=FBTPhEFIDKs

There is a post budget discussion. Vikas also talks about how coronavirus impact is currently being neglected by the market participants because China is connected to all the global economies and this needs to be taken into consideration.

He further adds, if you see a combination of outstanding management, structural legs to growth and low floating stock then you need not worry about the valuation of the company in the shorter time.

On being asked about his view on the economy and ease of doing business he says, the economy will do well in the next 3 years and he has no doubt in the policies of the government but execution and implementation is a big problem. And credit growth revival is a very urgent need of the economy that needs to be addressed by the govt.

Title: Carnelian Capital Advisors On Market Strategies | NSE Closing Bell, Source: CNBC- TV18, Date: 26 November 2019

https://www.youtube.com/watch?v=JKOsaokIm7I&feature=youtu.be

Vikas says they follow their strategy very closely, bottom-up stock picking. We are true to our investment philosophy and process. If the process is correct one will definitely see results. He then talks about the MCO framework mentioned above in detail.

Title: Vikas Khemani, Founder of Carnelian Capital Advisors speaks on liquidity expectations in the market, Source: ET now, Date: 08 April 2019

Vikas Khemani discussing the current market scenario.

Analyst questions

- You have a proprietary quantitative and qualitative model, can you tell us more about the model or the filters used?

- Your investment philosophy states that margin of safety doesn’t necessarily lie only in price, but can be sought in detailed work. What do you mean by that?

- You said you prefer definite returns over immediate returns, investing is not a science and hence nothing is definite. How do you identify definite returns?

- Magic Basket aims at investing into companies through a catalytic/ change oriented approach.The catalyst can be either one of or a combination of “change of management”, “change of industry/business structure”, “change of business strategy”, “new business product or segment” or “simply long investment phase getting over”. These kind of changes happen in almost all companies over their life cycles. How do you identify whether these changes are an opportunity or a trap?

- Compounder basket has a criterion – governance. How do you measure good corporate governance?

- You(Vikas Khemani) have 20-25 years of experience in investing, how has your investment perspective evolved over time?

Prepared by – Rashika Bhatia

Additional questions by peer reviewer –

- In the Capital Compounder Strategy you mentioned sustainable alpha in your performance, how do you consider to maintain it or is there any threshold ?

- What does automated quality check in investment process mean , can you elaborate?

- In Shift strategy do you think apart from the manufacturing and technology sector any other sectors could experience such growth?

- What are your risk management strategies?

- What is your stock selection process and how do you filter out stocks?

- Considering that Shift strategy was recently launched , what is your AUM and how to intend to grow it in future?

- What other aspects apart from those mentioned in your process do you consider while selecting a stock for the portfolio?

Peer reviewed by – Janvi Panchal, May 2021

You must be logged in to post a comment.