Funds managed

| Model Portfolio | Strategy | License |

| Growth Strategy Portfolio | Multi-cap | PMS |

| Life Strategy Portfolio | Multi-cap | PMS |

| Indian Entrepreneur Strategy Portfolio | Multi-cap | PMS |

| Strategic Portfolio | Multi-cap | PMS |

| India Select Portfolio | Multi-cap | PMS |

| Domestic Resurgence Portfolio | Multi-cap | PMS |

About the AMC

- Ask Investment Managers Limited (ASKIM) is an asset and wealth management company. It was founded by Asit Koticha in 1983 and has a registered office in Mumbai.

- They primarily cater to the HNIs and UHNIs in India. Also, to institutions, SWFs, pension funds, endowments, multi-managers and family offices.

- They focus on investing in equities listed in India for their clients based in India and as for their clientele offshore, through segregated accounts and commingled funds.

- They follow purely discretionary investment management.

Key staff

- Asit Koticha (Chairman & Founder): “He has over three decades of experience in the Indian capital markets. Under his mentorship, ASK Group has developed independent and focused expertise in the areas of equity research, asset management (both equities and real estate), financial planning and wealth advisory.”

- Sameer Koticha (Vice chairman & Founder): “He has been mentoring all the business verticals of ASK Group for over three decades. He is a member of the board and investment committees of all the businesses, and he mentors ASK Group in areas of corporate governance and best practice. He is also closely associated with several social causes focusing on betterment of underprivileged through various means.”

- Bharat Shah (Executive Director): “He holds a bachelor’s degree in commerce from the University of Bombay and a post-graduate diploma in management from the Indian Institute of Management, Calcutta. He is also a member of the Institute of Chartered Accountants of India and a member of the Institute of Cost and Works Accountants of India. He has been on the board since 2008. He has over 24 years of experience in the field of investment management and has previously worked at Birla Capital International AMC Limited and Asian Paints (India) Limited.”

- Prateek Agrawal (CIO & Business Head): “He holds a bachelor’s degree in engineering from Regional Engineering College, Rourkela, Sambalpur University and a postgraduate diploma in management from the Xavier Institute of Management, Bhubaneshwar. He has several years of experience relating to finance and equity management and was previously working as the vice president and head of research at SBI Capital Markets Limited. He has also worked with Bharti AXA Investment Managers Private Limited and ABN AMRO Bank Asset Management (India) Limited.”

- Sumit Jain (Senior Portfolio Manager): “He has been managing Indian Entrepreneur Portfolio strategy since inception. The fund has grown to upwards of INR 5000 crs over last 7 years. He is also engaged in research of business within ASKIM universe, identifying new investment opportunities and tracking their performance at regular intervals. He closely covers infrastructure and IT businesses at ASK. Prior to joining ASK, he has worked with First Global tracking US macro economy and FMCG sectors. His articles have appeared in leading US business journals. He is a post graduate in Management from Mumbai University.”

Investment Philosophy (for firm)

“At ASK Investment Managers (ASK IM), we design concepts to provide differentiated, customised solutions, with all of them adhering to our common and consistent investment philosophy. We aim at creating long-term sustained wealth for you, short-term volatility notwithstanding.

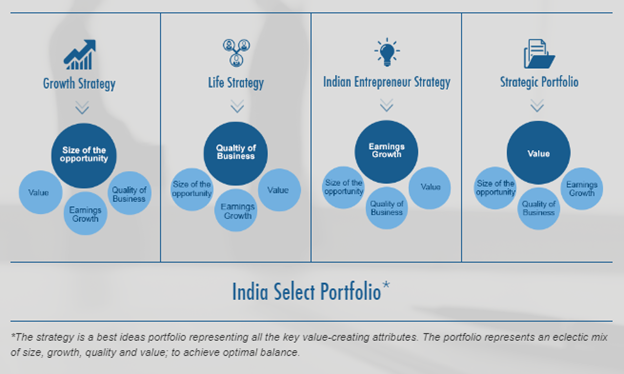

Our suite of offerings is basically derived from our investment approach based on imbuing our five key investment attributes: size of opportunity, quality of business, management quality, earnings growth, and value.

Quality of management is a qualitative attribute, while the other four are quantitative, and its threshold for clearance is kept at the ‘highest’ level. As far as quantitative factors are concerned, the threshold is kept at ‘high to highest level’ of clearance.

Before a stock is included in the portfolio, it will have to adhere to all the five investment attributes. However, each of our offerings are differentiated by the dominance of one of the four quantifiable parameters, as illustrated below:”

Media

Bharat Shah in conversation with Ashish Shankar, Motilal Oswal Wealth Management, YouTube, June 2019

Title: Nimish Mehta talks about ASK IEP PMS, Prabhudas Lilladhar Pvt Ltd, Source: YouTube, Date: March 2019

- Nimish Mehta is the Director and Head of Business Development and Products of Ask Investment Managers Ltd. He starts with mentioning the four P’s that he is going to talk about viz. people, product, process and performance.

- He talks about Bharat Shah who is said to be one of the key people who started the mutual fund industry in India who partnered with Asit and Sameer Koticha to establish Ask. Ask being one of the oldest PMS in India with its first portfolio being started in 2001.

- He then talks about the product and process part of IEP. They believe in trusting in businesses with promoters that have the maximum stake in it. This accordingly to them provides a solid foundation and involvement by the promoter.

- He talks about an aspect of process by stating that they believe in going for companies with stable and predictable earnings and do not usually go with companies that have volatile earnings.

- Speaking of performance, he states if the first three steps of choosing the right “people” with a well put “product” and a reliable “process” fall in place then the performance follows.

Title: Prateek Agrawal, CIO monthly update May 2020, Ask Group, Source: YouTube, Date: 29 May 2020

- He states that Nifty50 EPS will be flat in FY20 with a further decline in FY21 and pick up from FY22.

- Talking about Covid-19’s impact on the GDP, the initial one week of lockdown has caused -1.2% decline in GDP.

- He advised to be invested in cash on book businesses as opposed to levered businesses, branded products as opposed to commodities, favor staples as opposed to discretionaries.

- Speaking of the market performance going forward he states, expect Q1 FY21 to be a washout, YoY growth expected to revive from Q3 FY21.

Title: Sumit Jain, Senior Portfolio Manager on IEP, ASK Group, Source: YouTube, Date: 30 March 2020

- IEP focuses on businesses owned by Indian entrepreneurs. In order to come to the conclusion of focusing on “entrepreneurship owned” businesses they first divided 500 companies based on their ownership patterns. The four ownership structures are, entrepreneur owned, MNC owned, PSU owned and professionally driven firms. Also studied these businesses on various parameters like revenue, capital efficiency and value creation.

- According to this study, they came to a conclusion that entrepreneur owned businesses did far better than the rest in terms of revenue, profit and value creation but lacked on capital efficiency. They put the selected Indian entrepreneur owned businesses through many filters to reach to 60 businesses. Then a 20 stock portfolio was made that generates capital efficiency. It has had a 19% CAGR since inception in 2010.

Title: Kuldeep Gangwar, Portfolio Manager on Domestic Resurgence portfolio, ASK Group, Source: YouTube, Date: 30 March 2020

- The portfolio focuses on domestic opportunities as India is one of the fastest growing opportunities in medium to long term. Key themes of investing – consumption and financial services.

- Private consumption accounts to 60% of the GDP and he states the major drivers of the same are, per capita income, urbanization, shift from the unorganised to organised sector and so on.

- Financial services sector is likely to benefit from formalization of the economy and growth of banking and finance.

- They have picked 20-25 companies with superior long-term compounding potential. They made sure more than 90% of revenues of the companies come from the domestic market.

- Since capital preservation is one of their main objectives, risk control is of paramount importance.

Title: Chetan Thacker, Portfolio Manager talks about India Select Portfolio, ASK Group, Source: YouTube, Date: 30 March 2020

- He talks about the firm’s philosophy of capital preservation and appreciation.

- He then explains the portfolio. They filtered 500 companies based on parameters like, PBT of 75cr plus, 20% plus sustained ROCE and 15-20% long-term period growth.

- They were left with 20-25 companies which they further filtered on the basis of current and projected profitability, capital structure and asset utilization.

- It adheres to the investment philosophy of the firm of choosing recurring income over one-time income, asset heavy businesses over asset light.

- They balance the domestic and import business from time to time in portfolios.

Analyst questions

- When you say “we balance the domestic and import component (companies) from time to time”, what is the deciding factor and how do you do it?

Prepared by – Shivani Kadam, June 2020

You must be logged in to post a comment.