Funds managed

| Fund name | Asset Class | License |

| Flagship | Not Available | PMS |

| Multi | Not Available | PMS |

| Focus | Not Available | PMS |

About

- Founded by Mr. Ajay Sheth in the late 1980s, they have been in the Indian capital markets for 3 decades. Their focus was initially on providing research in the small and midcap space to FIIs, Mutual Funds and other Institutional Investors. Their passion and belief fuelled the desire to start Investment management services under the SEBI (Portfolio Managers) Regulations, 1993. Today they manage money for over 700 family offices, corporates, HNI and NRI clients.

- With a clear focus on identifying tomorrow’s wealth creators yesterday, they have consciously channeled all their efforts on listed equities. They have combined research experience of over 100 years. Believe in curating a reasonably concentrated portfolio of ‘high conviction’ stocks and nurturing the investment over 3 to 5 years.

- Key fund manager- The Quest Investment Advisors PMS Fund Manager, Bharat Sheth is having an extensive 25 years of experience in the field of investment research and services.He holds a degree in economics which gives him the in-depth knowledge of the economy and the investment market as a whole. He handles more than seven hundred clients and his average investment tenure is around 3 years. The amount of asset under his management is approximate Rs. 1300 crore. He is also the co-founder of the firm.

Investment Philosophy (for firm)

Our investment decisions are based on a set of principles, which have been guiding us over all these years. These principles are stronger than any market upswing or downturn, are logical and rational, and are deeply rooted in our desire to provide stable, consistent and superior returns to our investors.

● Simplicity

Seek to identify simple businesses that are in a growth phase.

● The Business-Management Matrix

There cannot be a tradeoff between business and management. Both aspects are equally important to decide if a business is worth investing in. A good business has to be backed by an able, honest and passionate management team. More often than not, such businesses are less affected in adverse times, and more importantly, always treat their smallest shareholder as their partner.

● The Margin of Safety

Benjamin Graham, one of the best known value investors, has coined this particular term to describe companies whose shares are available at an “absolute” reasonable price and with a significant gap to their intrinsic value. We see this approach as more beneficial than a buy low-sell high approach.

● The Longer Run

We believe in generating returns over time as compared to timing-driven returns.

Investment Process

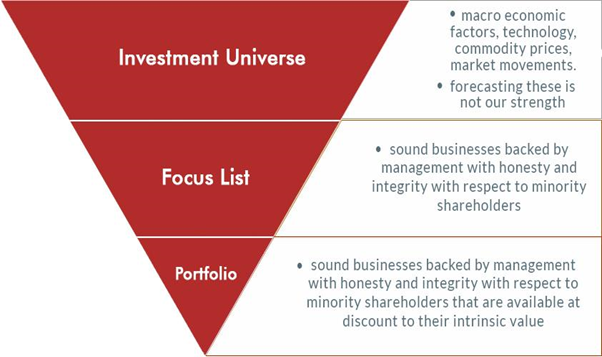

The Inverted Pyramid: The Inverted Pyramid represents our approach to investments. It starts with a broad examination of the investment universe, proceeding which we follow a narrowing down process until we find the right investment at the right price.

Media

Title: NewQuest Raises US$1 Billion For Its Fourth Flagship Fund, Source: Business Wire, Date: 17 November 2019

Analyst questions

- As mentioned, forecasting macroeconomic factors, technology commodity prices and market movements is not your strength, does that signify you follow a bottom up approach for investments or any other?

- Focus is on good management backed by honesty and integrity, how does the company’s ratios through balance sheet and income statement play a role while you analyse for an appropriate investment opportunity?

You must be logged in to post a comment.