- Voice of the private banker

- Connected strategy for wealth management

- The market for private wealth

- Private wealth’s value proposition

While the number of high net worth individuals and the size of their wealth give an indication of the ‘potential market size’ (or total addressable market) for the overall savings or money management industry, we now look at how the wealth industry chooses to respond to client needs. In other words, we explore the ‘value proposition’ of the wealth management industry.

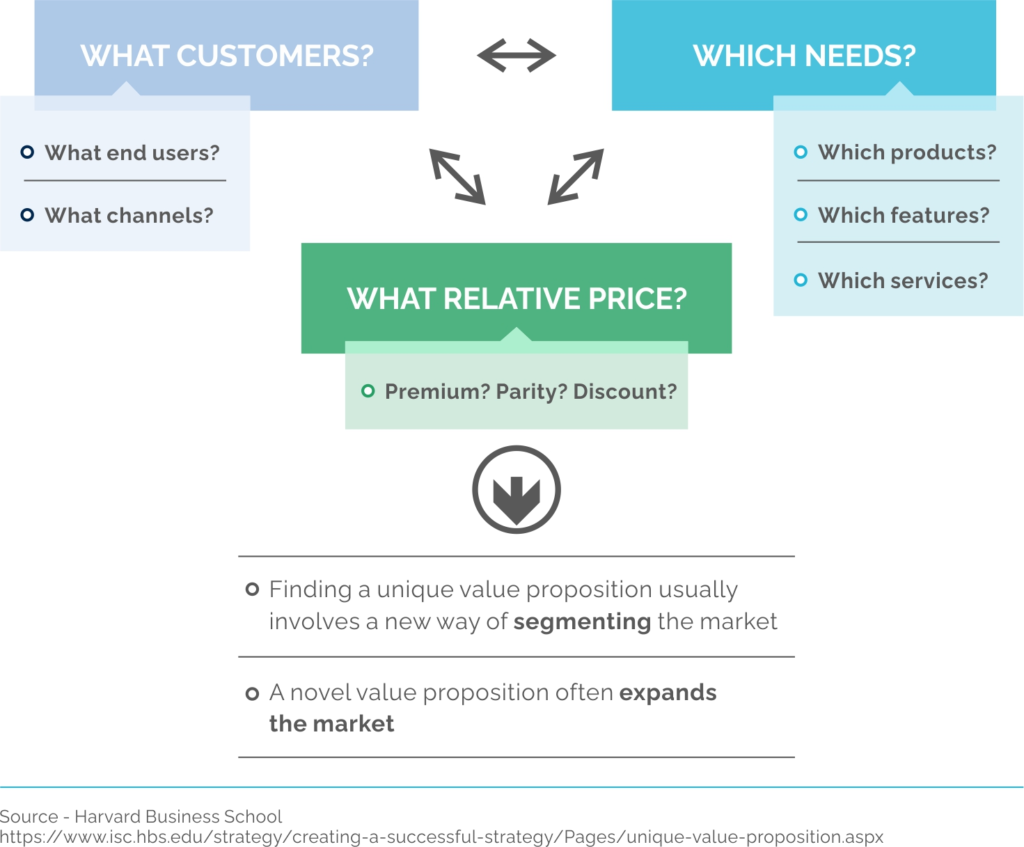

An article by Harvard Business School explains the value proposition concept in the following way.

A value proposition defines the kind of value a company will create for its customers. Finding a unique value proposition usually involves a new way of segmenting the market. While the value chain focuses internally on operations, the value proposition is the element of strategy that looks outward at customers, at the demand side of the business. Strategy is fundamentally integrative, bringing the demand and supply sides together.

- Which customers are you going to serve?

Within an industry, there are usually distinct groups of customers, or customer segments. A value proposition can be aimed specifically at serving one or more of these segments. For some value propositions, choosing the customer comes first. That choice then leads directly to the other two legs of the triangle: needs and relative price.

- Which needs are you going to meet?

In many cases, choosing the need the company will serve is the primary decision that leads to the other two legs of the triangle. Here, strategy is built on a unique ability to meet a particular need or a subset of needs. Often that ability arises from the specific features of a product or service. Customers might be defined by the common need or set of needs they share at a given time instead of demographics.

- What relative price will provide acceptable value for customers and acceptable profitability for the company?

For some value propositions, relative price is a primary leg of the triangle. Some value propositions target customers who are overserved (and hence overpriced) by other offerings in the industry. A company can win these customers by eliminating unnecessary costs and meeting “just enough” of their needs. Where customers are overserved, the lower relative price is often the dominant leg of the triangle. Conversely, some value propositions target customers who are underserved (and hence underpriced) by other offerings in the industry. These customers want an enhanced product or service and are willing to pay a premium for it. The unmet need is typically the dominant leg of the triangle, while the higher relative price supports the extra costs the company has to incur to meet it.

The wealth industry’s value proposition

What customers? Line between high net worth and affluent are blurred

As outlined earlier, the wealth management industry usually segments its customers into three broad globally accepted categories – retail, affluent, and high net worth – based on their net financial worth (net worth not counting principal residence). However, given the difficulty of confirming the net worth of the customers at account opening, when there is low trust, most banks resort to setting the threshold for the amount entrusted to them rather than net worth.

For example, some firms define their ‘private wealth’ offer with INR 1 crore (~ 125k) invested with them, while others ask for INR 5-7 crores (~ USD 1 million). This practice makes it hard to split the revenue and profit pools between the affluent and high net worth segments. Indeed, some banks open their affluent accounts with INR 30 lakhs, which is closer to USD 40k, while others with INR 10 lakhs, blurring the line between affluent and retail segments.

Which needs? Sorting needs

Let’s start with a list of perceived needs that most private wealth managers say their clients ask for –

- Investment returns – competitive in line with risk profile

- Execution of investment decisions

- Custody of investments

- Consolidated reporting

- Benchmarking of investment returns to market and industry peers

- Financial/goal planning

- Understanding of global geo-political economy and markets

- Access to interesting/high return opportunities

- Network for strategic business opportunities

- Investment banking services

- Tax advice

- Wealth planning services such as estate planning and succession planning

- Strategies for intergenerational transfer, protection from family disputes etc using trust structures

- Insurance – global, tax efficient, keyman, general insurance for assets

- Credit – loan against securities, loan against property, unsecured loans

- Foreign exchange and cross-border transactions

- Concierge services

- Philanthropy advice and execution

- Finance education – for self and/or family members

- Access to Ivy League and other high profile educational institutions

- Other …………

A wealth firm needs to balance the expressed needs against the expertise and cost of providing the service. Firm wouldn’t waste resources on services that the client might not appreciate and pay for. Let’s now look at some ways a wealth firm may look at deciding which of these needs the firm may want to address.

Ranking based on tangible and intangible benefits

- Utilitarian benefits – of maximum returns per unit of risk, or execution and custody

- Expressive benefits – of access to hard-to-access private investments, for example, that might confer bragging rights

- Emotional benefits – of behavioural coaching

Ranking based on importance

- Hygiene or must-haves – investment execution and custody

- Performance benefits – higher returns, quicker and easier-to-understand reporting

- Delighters – unexpected service or UI/UX design

Segmenting based on regulatory constraints

- Investment distribution – including research, execution, reporting

- Investment advice – separated out because of regulation

- Broking – of investments and insurance products

- Credit – separated out because of regulation

- Wealth planning services – seen as ‘ancillary’ or ‘complementary’ services, offered in-house or through partnerships

What relative price will provide acceptable value for customers and acceptable profitability for the company? Splitting the value chain between wealth management or asset management

By definition, the main service provided by the wealth management industry is ‘managing wealth.’ However, this encompasses both the investment management through funds offered by asset management companies (AMCs) and as well as advisory services by wealth management companies (WMCs). Manufacturing and distribution is part of the same value chain of providing returns on capital. The close, and somewhat blurred, relationship between asset and wealth management is perhaps why these are often grouped together in diversified financial services groups.

In theory, the wealth manager advises on asset allocation and the asset managers do the stock-picking, clearly demarcating the sources of value-add. In practice, the wealth manager provides stock-picking services and the asset manager implements asset allocation through diversified funds. So the two industries are part of the same continuum of value-add.

This has implications for measuring the size of the industry, both in terms of assets as well as revenue and profit pools. An investor can choose to invest through a fund on the advice of a wealth manager, in which case the invested amount is included in the ‘assets under management’ (AUM) figures of the asset management industry, as well as ‘assets under advice’ (AUA) figures of the wealth management industry. If the investor chooses to invest in direct stocks, again on the advice of a wealth manager, it is counted only as AUA of the wealth segment (though they may pay brokerage commissions on the transaction values rather than an ad valorem fee based on the AUA).

Then there’s the managed account (called portfolio management services or PMS in India) industry, which is a hybrid of asset and wealth management, in that providers offer a service that acts like a product. Wealth firms seem to view their own PMS as a service but evaluate those offered by AMCs as a product. Fintech makes it even harder to demarcate by offering technology solutions that implement advice on scale, disintermediating the need for fund structures.

How to price services

Wealth management firms charge for their services using a combination of formulae, including –

- Asset-based commissions (paid by asset management firms)

- Transaction-based brokerage on placement and/or trading of direct securities and funds

- Interest rate spreads on lending

- Embedded margins in structured products

- Asset-based fees (charged to clients)

In some markets, clients are also demanding fixed fees or hourly rates though we didn’t see much evidence of this in India, except in the case of family office services.

The wealth management industry has been a ‘distribution’ industry for the asset management industry for a long time. Hence, it used to get paid on upfront and ongoing commissions, also called retrocessions in some markets, for placing client assets into funds or pooled products. While the upfront commissions are getting harder to generate, the industry still relies on ongoing commissions from the asset management firms, or administration platforms in some markets.

Firms that have evolved from securities firms also rely on brokerage on trading of securities, especially equities and derivatives.

On the other hand, banks are used to making interest rate spreads on lending. Private banks lend against securities (called Lombard lending), whether widely traded or the client ESOPs, real estate and business assets. Wealth firms that are not affiliated with banks set up non-banking financial companies (NBFCs) to offer lending services.

Lastly, wealth firms can also generate significant revenue through margins embedded in pricing of structured products. Hence, depending on the origin of the firm, the revenues will be a combination of revenue streams.

Going forward, the revenue model for most firms in the wealth management industry the world over is moving towards asset-based fees – replacing asset-based commissions. This transition is challenging as it’s usually accompanied by fiduciary responsibilities.

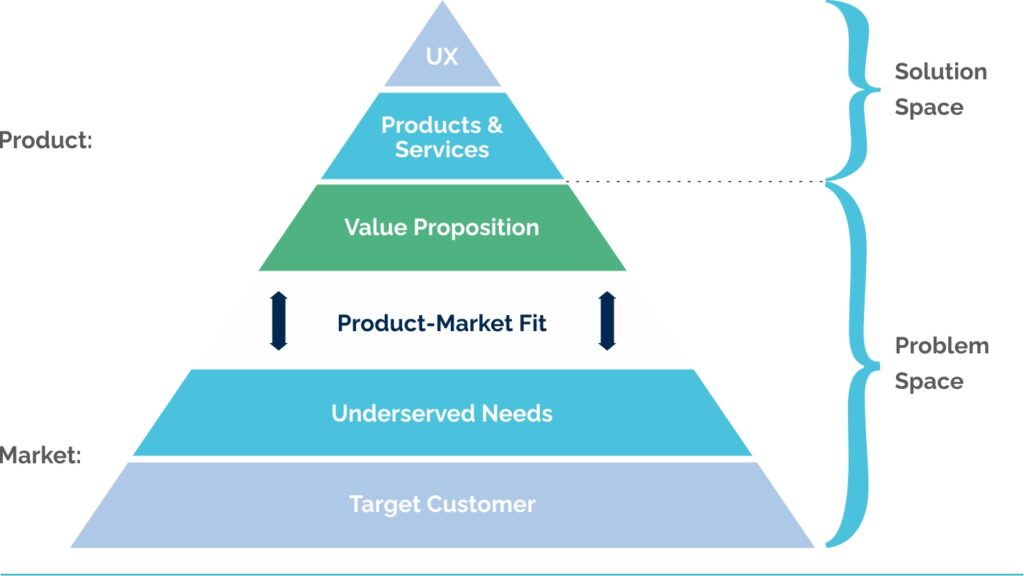

Has the wealth industry achieved good product-market fit?

As outlined in the article titled ‘the market size (link)’, and confirmed by everyone interviewed for this report, private wealth management appears to be a good market opportunity, as defined by size and growth prospects.

However, as we will see in the next article titled ‘the industry size (link)’, it appears the current market size is still relatively small. This could be a calculation issue. Or a gap in the product-market fit.

For example, is it possible that the industry is not providing the right mix of products and services? Or that the benefits haven’t been communicated correctly? Or that they are not being priced appropriately to allow for a decent margin? Or that the industry is only just achieving scale so the industry is just about to see improved economics?

Refer to the industry interviews for different views on these questions.

You must be logged in to post a comment.