Funds managed

| Fund name | Asset Class | License |

| Absolute Freedom | Large and Mid cap equity | PMS |

| High Conviction | Multi cap equity | PMS |

| Emerging India | Small and Mid cap equity | PMS |

| India Economic Transformation | Multi cap equity | PMS |

Absolute Freedom

- Inception Date: 24 September 2004

- Number of Stocks : 20-25

- Fund Manager Name: Varun Goel

- Portfolio construct :

- 60% – 80% in Large cap stocks, provides stability to the portfolio

- 20% – 40% in larger Quality Midcaps, adds to the upside potential

- Investments are made with a Buy & Hold view.

- Average alpha observed is 4-5%

High Conviction

- Inception Date: 13 March 2014

- Number of Stocks : 20-25

- Fund Manager Name: Varun Goel

- Portfolio Construct :

- Endeavour to create diversified multi-cap concentrated portfolio of our top 20 – 25 most compelling investment ideas, which ensures meaningful positions are taken in majority of the holdings, while maintaining adequate diversification

- Judicious allocation to large, mid and small cap based on their return potential

- Portfolio aims to maximize compounding with a Buy & Hold view, leading to low churn

- 2/3rd in large cap and 1/3rd in mid cap space as of now, keeps changing.

Emerging India

- Inception Date: 7th March 2017

- Number of Stocks : 20-25

- Fund Manager Name: Varun Goel

- Portfolio Construct :

- Mid Cap portfolio of high growth emerging businesses that are existing / potential leaders in their field of operations

- Benchmark agnostic concentrated portfolio of our top 15 – 25 ideas

- Investments are made with a 3 year plus Buy & Hold view

- Low churn portfolio (less than 15%)

(Source : PMS – AIF world)

India Economic Transformation

- Product objective : Aim to deliver superior returns by participating in India growth story through a focused portfolio of high growth emerging businesses that stand to benefit from Economic Transformation in India, including the shift in business from unorganised to organised sector.

- Investment horizon – 3-5 years

- Portfolio suitability – Investors seeking potential upside of mid cap stocks along with the stability of large cap stocks, for long term wealth creation.

- Investment Style : Blend

About

Nippon Life India Asset Management Limited (NAM India) is the asset manager of Nippon India Mutual Fund (NIMF). Nippon Life Insurance Company (“NLI”) is Japan’s largest private life insurer, offering a diverse range of financial options, including individual and group life and annuity plans, through a variety of distribution platforms, with standard insurance products mostly sold through face-to-face sales channels. It is based in Japan and operates mainly in Japan, North America, Europe, and Asia.

SEBI Registration Number INP000007085 has been assigned to Nippon India PMS as a Portfolio Manager. Nippon India Portfolio Management (Nippon India PMS) is authorised under this license to handle its clients’ portfolios in accordance with the Securities and Exchange Board of India (Portfolio Managers) Regulations, 1993.

Key staff

- Varun Goel (Fund Manager): Varun Goel manages Equity PMS and Equity AIF products as a Fund Manager and works with Nippon India. He is a B.Tech in Mechanical Engineering, and MBA in Finance and Marketing from Indian Institute of Management, Lucknow. He has worked with Kotak Portfolio Management Team and was a part of the buy side analysts team actively tracking around 60 companies forming part of the BSE 500 Universe. During this role, he performed, in depth analysis of over 100 companies across sectors by interaction with top management and also analyzed company financials including balance sheet, profit & loss and cash flow statements. Achieved a success/ strike rate of 80% of recommendations worked; enabling the fund manager to outperform benchmark on three, six and twelve month basis.

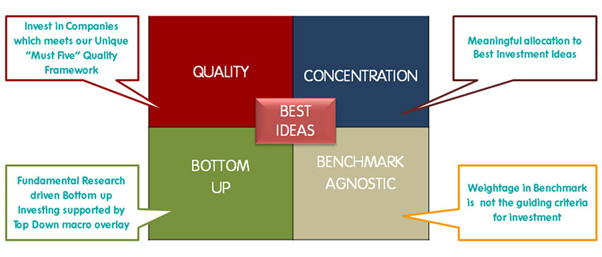

Investment Philosophy (for firm)

Our endeavour is to create wealth for our investors over a medium to long term period by creating Benchmark Agnostic Concentrated Portfolios of quality stocks, based on fundamental research driven Bottom Up stock picking.

Their Bottom – Up approach

The Assessment is based on Earnings Growth, Operating Leverage, Demand Environment, Margin Expansion, and Financial Leverage. Assessment also includes Senior Management Interaction, Key Customer, Suppliers feedback, Competition feedback, Key Stakeholders Interaction.

Post identification of stocks based on rigorous fundamental research, they identify reasonably priced stocks, based on Valuation gap analysis

- Historical Vs Current valuations

- Peer Group Valuation

- Potential Rerating Triggers

Investment is made in stocks with the Highest Conviction. Such companies tend to weather sector declines. Our endeavour is to benefit from the early identification of an investment idea; where there is higher potential for outsize returns.

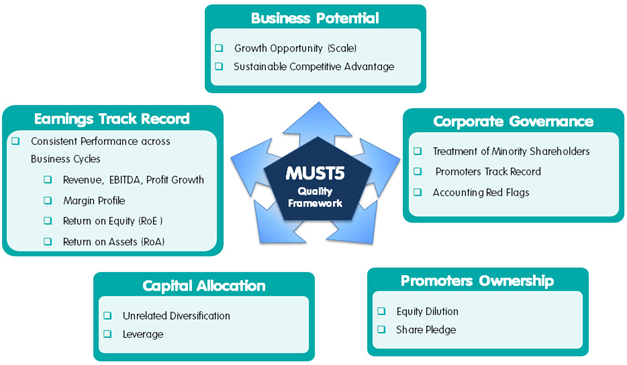

Must 5 quality frameworks

Why Benchmark Agnostic ?

The aim is to invest in stocks and sectors, which have potential to give relatively outsize returns over next 3-5 years, irrespective of their weights in the benchmark. There is no compulsion to buy the high weightage stocks / sector if the Portfolio Manager does not have high conviction on them or if the Portfolio Manager doesn’t see the value in those stocks compared to other peer group companies. Therefore, this results in a portfolio of best ideas, which is “unfettered” from the benchmark

Why Concentration ?

Concentration builds meaningful allocation in their Best Investment Ideas. Typically, it is seen that there is no significant reduction in Portfolio Risk (SD) beyond 20-25 stocks. They believe over diversification leads to Average Returns and hence, Our Concentrated Portfolios aim to avoid excessive diversification.

Media

PMS Bazaar, 30th April 2020

In the media interview, , with PMS Bazaar, Varun Goel emphasized on how the markets have reacted to the covid-19 news. He called the year 2020 as an ideal year to enter the markets. The money that they allocated in the markets in the next 6-9 months could generate good returns in 3-5 years as the stocks were available at discounted prices. He said that the e-commerce industry will be most benefited due to the lockdown as people who are at home may order more products. As people work from home, they may need mobile data due to which telecom companies might gain profits. The chemical industry of India that is currently $ 35 trillion, in the next 7 years might become a $ 100 trillion industry.

Title: Demystifying the common myth about PMS being a bull market product I PMS AIF World with Varun Goel, PMS – AIF world, Source: Youtube, Date: 21 September 2019

https://www.youtube.com/watch?v=6HzagWaPQWo

PMS being the best way to create long term wealth through equities, have flexibility, transparency and has the ability to create alpha. After SEBI tightened the rules for mutual funds regarding what ratio of stocks pertaining to cap size are permitted, in those terms PMSfunds tend to be more flexible and have been generally outperforming, but with higher flexibility there comes a higher risk as well, they reduce this risk by sticking to the mandate and careful stock picking, by taking companies who are debt free or have little debt. They focus on corporate governance, no proper indicators are available but then they check for dividend payout ratio, then consistency of the ratio, then deter days, working capital borrowings (these being accounting red flags), company should have more than 15% ROE, growth potential, competitive advantage.

Perception is – mid caps are aggressive and high beta stocks, while there are mid cap companies which are leaders in their verticals, sectors become large , companies will become large therefore, opportunity for high growth, then Varun talks about how they look about each sector, why and which companies to be included in the portfolio.

Title: Portfolio Managers debate on value vs growth, Source: BloombergQuint, Date: January 2020

https://www.facebook.com/bloombergquint/videos/2326562550969470/

Reliance Nippon’s fund manager Varun Goyal talks about sustainable growth being the most important, he says a stock can underperform for 3-5 months, maybe even a year but quality stocks are important because they will eventually pickup and provide returns in the longer term. The quality is judged by sector, some tail wins company is going through as long as there is a runway for growth which is more than normal level, because we are in slow growth phase, so any company which can give you double digit return will be expensive.

Analyst questions

- What is your take on investing approach, while markets are uncertain? What has worked for you momentum strategy or the contrarian?

- What risk metrics do you use?

- Given the strategy being benchmark agnostic(does it just means not sticking to benchmark weights or it means not following a benchmark at all) how do you measure under/out performance, how do you compare alphas and betas? (to be discussed amongst) – if just weights aren’t restricted, then it simply can be called as an active strategy

- What is the AUM?

Peer review and additional questions –

- Which industries are likely to perform well in the next 3-5 years and why?

- Which portfolio has high chances of performing well in the next 5 years?

- How long do you suggest investors remain invested?

- How do you minimise the risks?

- How do you suggest a portfolio to your client?

- How and why do you use the top down and bottom up approach together in the “Must 5 framework”?

Prepared by Smriti Prabhu

You must be logged in to post a comment.