Funds managed

| Fund name | Asset Class | License |

| Master Funds | Infrastructure | SEBI AIF Cat 2 |

| Funds of Funds | PE & Infra | SEBI AIF Cat 2 |

| Strategic Fund | PE | SEBI AIF Cat 2 |

About

- National Investment and Infrastructure Fund (NIIF) is India’s first sovereign wealth fund that was set up by the Government of India in February 2015

- NIIF is a fund manager that invests in infrastructure and related sectors in India NIIF is a collaborative investment platform for international and Indian investors who are looking for investment opportunities in infrastructure and other high-growth sectors of the country.

- They manage over USD 4 billion of capital commitments across three funds, each with its distinct investment strategy.

The company manages three funds :-

- Master Funds – In line with its strategy to set up platform companies in partnership with leading strategic operators, the Master Fund has formed a USD 3 billion ports and logistics platform, Hindustan Infralog Private Limited (HIPL) in partnership with DP World. HIPL seeks to invest up to USD 3 billion of equity across the entire ports and logistics value chain. HIPL’s first investment is the acquisition of a controlling stake in Continental Warehousing Corporation (CWC), a leading multi-modal logistics company with a Pan-India presence.

- Funds of Fund– A fund focused on anchoring and investing in credible and reputed third party managers with a strong track record across diversified sectors within infrastructure services and allied sectors.following are three funds of funds :

- Green growth equity fund-The Green Growth Equity Fund (GGEF) is the first investment of NIIF’s Fund of Funds. NIIF and the UK Government have committed GBP 120 million each into the Fund. EverSource Capital, an equal joint venture between Everstone Group and Lightsource BP was selected as the fund manager for GGEF following an international selection process

- HDFC Capital Affordable Real Estate Fund 2 (H-CARE 2)- It is an investment platform managed by HDFC Capital Advisors, a wholly owned subsidiary of HDFC Ltd. H-CARE 2 is the second investment of NIIF’s Fund of Funds. H-CARE 2 has a total corpus of INR 42.9 billion of which INR 6.60 billion has been committed by NIIF. Other investors in the Fund include a wholly owned subsidiary of the Abu Dhabi Investment Authority (ADIA) and HDFC Ltd.

- Multiples Private Equity Fund III– It is a Category II AIF Mid-market growth equity fund managed by Mumbai based investment manager – Multiples Alternate Asset Management Pvt. Limited. NIIF has committed INR 8,780 million at first close of Fund III

- Strategic Fund- A fund focused on investing in strategic assets and projects with longer term horizon across various stages of development. The Strategic Fund is aimed at growth and development stage investments in projects/companies in a broad range of sectors that are of economic and commercial importance

Key staff

- Sujoy Gosh ( MD & CEO )- Sujoy has a rich multinational experience of over 25 years in International Finance Corporation (IFC), occupying multiple senior management positions along the way. Prior to joining NIIF, he was Director and Global Co-Head, Infrastructure and Natural Resources at IFC.

- Vinod Giri (Managing Partner, NIIF Master Fund)– Vinod has 16 years of professional experience spanning private equity and strategic consulting. Prior to joining NIIF, he spent ~13 years with IDFC Alternatives.

- Anand unnikrishnan (Managing Partner, NIIF Fund of Funds)- Anand has a total experience of 18 years, of which 9+ years is in infrastructure funds management in India. Prior to joining NIIF in March 2018, Anand worked for Macquarie Infrastructure and Real Assets (MIRA) in India, establishing MIRA’s funds management business in India.

- Krishna kumar (Partner – Strategic Opportunities Fund)- Krishna Kumar has over two decades of experience in the Indian financial services industry with investment expertise across sectors through Alternative Investment Funds.

- Nilesh shrivastava (Partner – Strategic Opportunities Fund)- Nilesh has over 20 years of experience across private equity, debt investments, banking and portfolio management.

Investment Philosophy (for firm)

NIIF would at all times remain focused on its economic and financial objectives. It shall invest in:

- Units of funds engaged mainly in infrastructure sectors and provide equity/quasi-equity or debt funding to listed/unlisted companies;

- Equity/quasi-equity in NBFCs and Financial Institutions that are engaged mainly in infrastructure financing; and

- Equity/ quasi-equity or debt to commercially viable projects, both greenfield and brownfield.

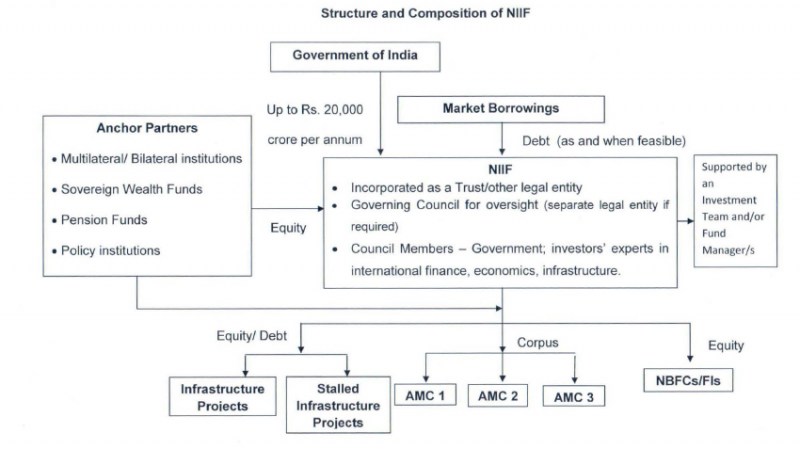

Structure

Media

NIIFL has announced a commitment of USD 100 million from the New Development Bank (NDB) into the NIIF Fund of Funds (‘FoF’). With NDB’s investment, the FoF has secured USD 800 million in commitments. NDB joins the Government of India (GoI), Asian Infrastructure Investment Bank (AIIB) and Asian Development Bank (ADB) as an investor in the FoF.

National Investment and Infrastructure Fund Limited (NIIFL) is pleased to announce an investment of INR 2,100 crore in Manipal Hospitals, one of India’s largest multi-speciality healthcare providers, through its NIIF Strategic Opportunities Fund (SOF), the direct private equity fund of NIIF. The transaction has been signed by both parties and the closing of the transaction is subject to receipt of certain approvals.

NIIF is pleased to announce acquisition of Essel Devanahalli Tollway and Essel Dichpally Tollway through the NIIF Master Fund. With this acquisition, NIIF has now entered in the Roads and Highways sector. These projects will be managed by Athaang Infrastructure. Essel Devanahalli Tollway is a strategic arterial 22 km six lane toll road in the state of Karnataka, connecting Bengaluru city and its airport. The road, part of NH44 (erstwhile NH7), with an operational history of over six years, is well poised to cater to the growing needs of Bengaluru City and the Airport and will benefit from the growth potential of Bengaluru as a metropolitan. Essel Dichpally Tollway is a 60 km four lane toll road in the state of Telangana. A mature asset, operational for over seven years, this road is an important link between two key industrial hubs, Hyderabad and Nagpur and serves long distance commercial traffic.

Topic/Title- Asian Development Bank (ADB) to invest USD 100 million through National Investment and Infrastructure Fund (NIIF), Source: Website, Date: 30 March 2020

National Investment and Infrastructure Fund (NIIF) of India and Asian Development Bank (ADB) today announced a commitment by ADB to invest USD 100 million equivalent into the NIIF Fund of Funds (‘FoF’). With ADB’s investment into the NIIF platform, the FoF has now secured USD 700 million in commitments. ADB will now join the Government of India (GOI) and Asian Infrastructure Investment Bank (AIIB) as an investor in the Fund.

Topic/Title- Canada Pension Plan Investment Board to invest up to US$600 million through National Investment and Infrastructure Fund (NIIF), Source: Website, Date: 5 December 2019

https://niifindia.in/wp-content/uploads/2019/12/Press-Release-NIIF-fourth-close-CPPIB.pdf

Mumbai, India / Toronto Canada (December 05, 2019): National Investment and Infrastructure Fund (NIIF) of India and Canada Pension Plan Investment Board (CPPIB) today announced an agreement for CPPIB to invest up to US$600 million through the NIIF Master Fund. The agreement includes a commitment of US$150 million in the NIIF Master Fund and co-investment rights of up to US$450 million in future opportunities to invest alongside the NIIF Master Fund. With CPPIB’s investment, NIIF Master Fund now has US$2.1 billion in commitments and has achieved its initially targeted fund size.

Topic/Title- DP World and National Investment and Infrastructure Fund (NIIF) to back future infrastructure projects, Source: Website, Press release, Date: 14 May 2017

https://niifindia.in/wp-content/uploads/2018/06/2017_05_04_DP_World_India_MoU_Eng.pdf

DP World announced at the time that it was seeking opportunities in the country worth over $1 billion over the next few years. This will be aimed at development of port infrastructure of the Sagarmala project, creation of the Delhi – Mumbai Industrial Corridor, river transportation and cold chain storage, investing in port-led special economic zones, free trade zones, ICDs and cruise terminals.

Analyst questions

- Because of the credibility involved of the Government, how do you think this fund is different from the other private players fund?

- Is it easy to attract the fund because of the backing of Government?

- Being a fund established for specific purpose like infrastructure or distressed NBFCs etc where the revenue streams are not very transparent, how do you manage to make returns on these investments?

- Are there any restrictions imposed by the government on the flexibility to choose where to invest?

You must be logged in to post a comment.