About

Mirae Asset Investment Managers was incorporated in India in 2007. It is a subsidiary of Mirae Asset Financial Group headquartered in Seoul, South Korea.

According to the firm’s website, it manages assets worth INR 121,280 Crores (~ USD 15.16 Billion) as of April 30, 2023. It operates a network of 22 branches and over 57 lakh folios.

Mirae Asset was founded by Hyeon Joo Park in 1997 and introduced the very first mutual funds to Korean retail investors in 1998. Mirae Asset Global Investments was founded in Asia and now operates worldwide across 16 markets where they take a collaborative approach in managing a fully diversified investment platform. It is one of the largest independent financial groups in Asia.

Key figures from financial statements FY 21-22–

| Year | Total Income (INR crore) | Total Expenses (INR crore) | EBIT (INR crore) | EBIT (%) | Net Profit (INR crore) | Total Income (USD millions) | Total Expenses (USD millions) | Net Profit (USD millions) |

| 2021-22 | 446.454 | 169.689 | 276.77 | 62% | 212 | 55.801 | 21.21 | 26.5 |

Key staff

Swarup Anand Mohanty, CEO and Associate Director – He has over 27 years of experience in the field of financial services. He has also worked at Aditya Birla Sun Life AMC Ltd., Franklin Templeton Asset Management (India) Pvt. Ltd., Religare Asset Management Co. Ltd. & Kotak Mahindra Asset Management Company Ltd. He holds a postgraduate diploma in Business Management.

Neelesh Surana, CIO – He has over 26 years of experience in equity research and portfolio management. He joined the AMC in 2008. In his capacity as CIO, he heads the research and fund management functions. He has a graduate degree in engineering and an MBA in Finance.

Mahendra Kumar Jajoo, CIO – Fixed income – He has over 28 years of experience in the field of financial services including 14 years of experience in Fixed Income funds management. Prior to this role, he worked at Pramerica Asset Managers Pvt. Ltd., Tata Asset Management Ltd., ABN AMRO Asset Management Ltd and ICICI Group.

Investment Philosophy

The following has been taken from the firm’s website

https://www.miraeassetmf.co.in/investment-philosophy

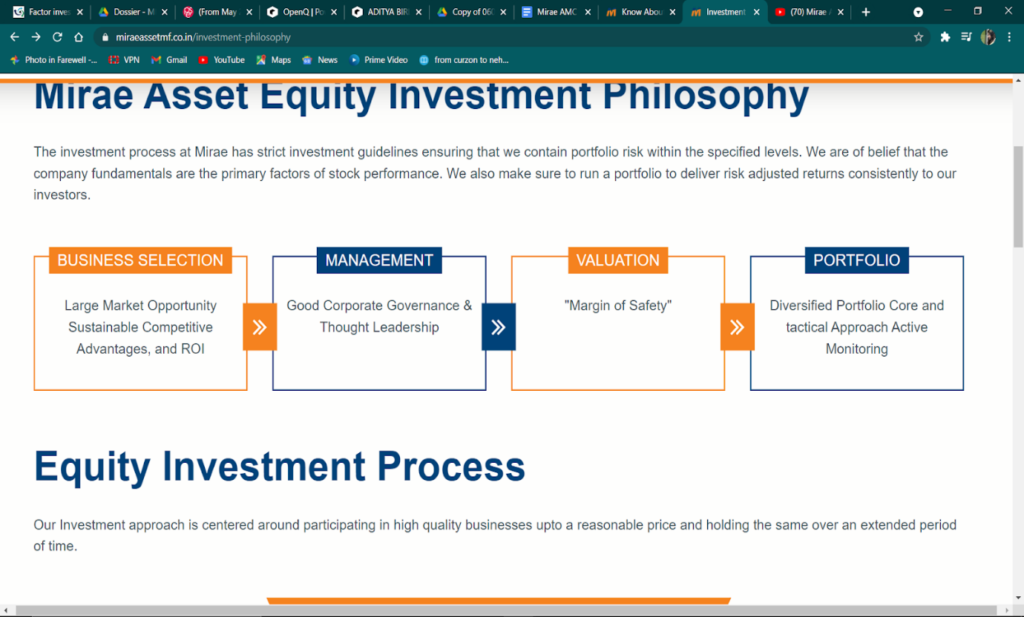

The investment process has strict investment guidelines ensuring that they contain portfolio risk within the specified levels and run a portfolio that delivers consistent risk-adjusted returns. They believe that company fundamentals are the primary factors of stock performance.

Investment principles

- Identification of sustainable competitive companies;

- Investment with a long-term perspective;

- Assessment of investment risks with expected returns;

- Follow a team-based approach to decision making.

Equity investment process

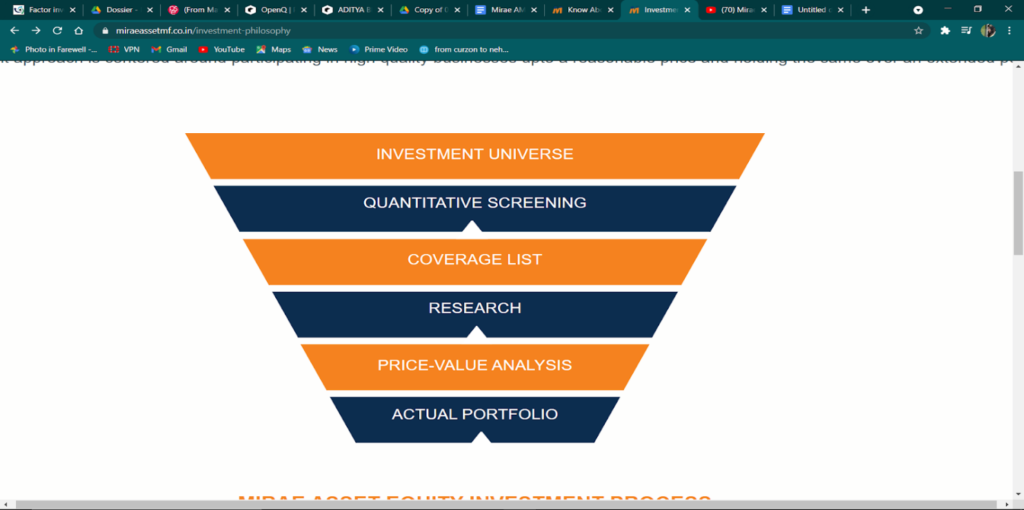

- From their investment universe, which has about top 500 stocks based on market capitalization, they do quantitative and qualitative screening and based on filters like liquidity, earnings, growth,and ROI, they create a Coverage List of about 250-300 stocks which are actively tracked.

- These stocks undergo a more comprehensive research process; analysis of company management meetings, dealer visits, meetings with industry experts

- The valuation screener investment team determines the value of stocks using various financial models which are supported by secondary brokerage and Industry reports.

- Stocks are handpicked by portfolio managers depending on the assessment of valuation, management and business selection.

- Business Selection analyzes companies with sustainable competitive advantage, ROI, strong earnings, growth and visibility.

- Management evaluation is important to check on intellect, thought leadership, and corporate governance track record.

- Portfolio managers study valuation to seek price value gap and a reasonable margin of safety.

- Risk Management scrutinizes portfolios and carries out performance analysis to improve fund performance.

- The investment process is a collaborative team-based approach where the fund management, research and risk team are actively involved.

Media

An Expert’s Market Strategy: Stay Invested with a goal in mind April, 14, 2022 https://www.livemint.com/money/personal-finance/dont-be-a-return-chaser-invest-with-a-goal-in-mind-11649958074835.html

Swarup Mohanty, the director & CEO of Mirae Asset Investment Managers (India), believes that staying invested in the markets during the post-COVID period has been the most effective strategy. According to him, this strategy has consistently proved its worth. His portfolio has become skewed towards equity, with 70% of his investments in equities and 25% in debt. The remaining portion of his portfolio consists of physical gold that he inherited from his family. Although he believes that the market conditions are favorable, he has been focusing on investing in debt instruments for his recent investments. He is actively working towards adjusting his equity-debt allocation to the intended target of 60:40.

Never say never and expect the unexpected in the market, says Mahendra Jajoo of Mirae Asset MF August 16, 2022 https://economictimes.indiatimes.com/mf/analysis/never-say-never-and-expect-the-unexpected-says-mahendra-jajoo-of-mirae-asset-mf/articleshow/93583290.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Mahendra Jajoo, the CIO – fixed income at Mirae Asset Investment Managers (India), is an experienced professional in the debt market. He acknowledges that in the past, debt markets used to be shallow, illiquid, and prone to periods of severe liquidity crunch and interest rate spikes. However, he highlights that the overall market conditions have significantly improved over time. Structural reforms implemented by regulators and the central bank’s accommodative policies, along with their sensitivity to any liquidity deficit, have brought about greater stability in the debt markets. Although there is still progress to be made, he emphasizes the positive changes that have occurred in recent years.

Neelesh Surana of Mirae Asset shares covid-proof mutual fund investment strategy

September 9, 2020

Neelesh Surana believes that a disciplined approach to investing with a focus on “quality up to a reasonable price” has helped them deliver a satisfactory track record. Their approach is team and process-oriented with performance results mainly driven by their research analyst team. They focus on stock selection, through a bottom-up approach in growth companies, available at a reasonable valuation. At an aggregate level, alpha generation has been from stock selection rather than sectoral calls.

“At an aggregate level, there is not much of a discount between valuation of mid caps Vs large caps. Our view is that only strong companies will become stronger.” In this context, companies with strong balance sheets, and thought leadership of management are important. Undeterred by the noise in the market, they believe that a lot of times the only action required is ‘nothing’ and with a disciplined asset allocation and planned diversification, meaningful returns can be expected.

Name- Only regret is dropping the original name – Mirae Asset India Equity Fund: Swarup Mohanty Platform- Economic Times Date- Apr 03, 2019

Summary- Conversion of Mirae Asset India Equity Fund which is a multi cap scheme into a large cap scheme because of re- categorization of mutual funds

Investors today are thinking that going large cap might mean cutting on returns. That is not the situation. Mirae Asset India Equity Fund has had a minimum 75 per cent allocation to large caps since inception. Being multi cap, we think we have the advantage of mid caps to boost returns. You should ask us how a large cap heavy scheme has outperformed the other mid cap heavy multi cap schemes. This contradicts the basic thought process. The fact is that more than theory, the practical market runs the practical market runs on good stock picking.

Name- Mirae Asset has no plans to exit India, to launch bond fund Platform- Financial Express Date- October 21, 2016 Link- https://www.financialexpress.com/market/mirae-asset-has-no-plans-to-exit-india-to-launch-bond-fund/425532/

Summary- After launching its first equity scheme in the year 2008, Mirae plans to launch bond funds withstanding the competition held by entrance of other foreign players.

Name- Sell India at your own risk: Mirae Asset CEO Platform- The Hindu business line Date- April 07, 2019

Summary- Due to volatility of markets the uncertainty of events was predicted and Mirae CEO Swarup Mohanty gave insights on the same. (Page needed subscription to read further)

Prepared by: Bhavna Mundhra, May 2021, updated by Rohini Pal, Dec 2022

Authors

Updated By: Tanvi Gandhi, June 2023

You must be logged in to post a comment.