Funds managed

| Fund name | Asset Class | License |

| Kedaara Capital I Limited | PE – Late stage | SEBI Cat II |

| Kedaara Capital Fund II LLP | PE – Late stage | SEBI Cat II |

| Kedara Capital Fund III | PE | IN/AIF2/21-22/0914 |

About

- Founded in 2011 by Manish Kejriwal, Sunish Sharma and Nishant Sharma.

- Kedaara Capital is an operationally oriented private equity firm pursuing control and minority investment opportunities in India.

- Kedaara Capital combines the strengths of a well-networked, highly experienced local investment advisor with the experience of our strategic partner, Clayton, Dubilier & Rice, a pioneering global private equity firm whose investment model blends financial skills with operating expertise.

- Kedaara capital Fund I (2013) – $540mil

- Kedaara capital Fund II (2017)- $750mil

- Sunish Sharma, Managing Partner. Prior work experience, he served as a Managing Director at the global private equity firm, General Atlantic, which he joined in 2004. He was a senior member of the India investment team and invested in technology, financial services, consumer and pharmaceutical businesses, amongst others. Before joining General Atlantic, Sunish worked with McKinsey and Company. In 2011, he was profiled as one of the “25 hottest young executives below 40 in India” by Business Today, the leading business magazine in India. He graduated with honors from Delhi University and holds an MBA from the Indian Institute of Management, Calcutta where he was a gold medallist.

Key staff

- Manish Kejriwal, Managing Partner– Prior experience ,he served as a Senior Managing Director of Temasek Holdings, Prior to joining Temasek, he was a Partner at McKinsey and Company. and had been a part of their New York, Cleveland and Mumbai offices. He has also worked at Goldman Sachs and at the World Bank. He is an active member of the Young Presidents’ Organization and was named a Young Global Leader (YGL) by the World Economic Forum in 2005. In 2007, he was profiled as one of the “25 hottest young executives in India” by Business Today. Manish is a graduate of Dartmouth College and holds an MBA from Harvard Business School, where he graduated as a Baker Scholar.

- Nishant Sharma, Partner– Prior work experience, Nishant served as a Principal at the global private equity firm, General Atlantic, which he joined in 2006. He was a senior member of the India investment team and focused on investments in various sectors, including business services, financial services, and healthcare. Previously, he has worked with McKinsey and Company, and the Bill and Melinda Gates Foundation. Nishant holds an MBA from the Harvard Business School, and a Masters and Bachelors in Biochemical Engineering and Biotechnology from Indian Institute of Technology, Delhi.

- Sunish Sharma, Managing Partner– Prior work experience, he served as a Managing Director at the global private equity firm, General Atlantic, which he joined in 2004. He was a senior member of the India investment team and invested in technology, financial services, consumer and pharmaceutical businesses, amongst others. Before joining General Atlantic, Sunish worked with McKinsey and Company. In 2011, he was profiled as one of the “25 hottest young executives below 40 in India” by Business Today, the leading business magazine in India. He graduated with honors from Delhi University and holds an MBA from the Indian Institute of Management, Calcutta where he was a gold medallist.

Investment Philosophy (for firm)

- Kedaara was founded on a simple premise: market leading businesses are built with a sound strategy, driven entrepreneurs, and commitment to operating excellence. Our investment approach blends skilled investment judgment with extensive operating experience. Many enterprises, CEOs and entrepreneurs have selected Kedaara as their partner because of our strong reputation for trustworthiness, collaborative working and operational leadership.

- We work with potential investee companies, primarily on an exclusive basis, to tailor transactions that address specific strategic and shareholder issues that matter most to them. What makes these transactions special is the flexibility, collaboration and sense of partnership that ensure each party’s needs are met and concerns addressed. Kedaara pursues control and minority investments in market leading Indian businesses where strategy, talent management, operational execution, and related business-building skills can drive significant value creation.

- Kedaara focuses on two transaction themes with a common underlying goal of investing in well-positioned market leaders that could benefit from Kedaara’s unique skills to realize their true potential:

Strategic Partnerships:

- Primarily exclusive transactions developed through privileged long-term relationships

- Typically acquire significant interest (>40%+) with strong support to shape the business going forward

- In most cases, the seller retains a meaningful ongoing interest in the business

- Commit significant time and effort of our team especially our Operating Partners to build long-term value

- Alignment on value maximizing path to exit and sharing rewards through strong financial incentives and substantial equity ownership for management/promoter

Emerging leaders:

- Typically acquire significant minority in a business in our focus sectors led by strong entrepreneurs/management teams

- Provide relevant operating and strategic guidance to scale the business through our Operating Partners involvement at the Board

- Robust governance rights and reward sharing to incentivize our management teams/entrepreneurs

- Likely exit through a public offering or a secondary sale

We believe that Kedaara is uniquely positioned in the Indian market given its robust operating platform, privileged network of long-term trust based relationships across corporate India, and proven expertise of nurturing successful private equity investments.

The Firm does not invest in seed or early stage companies or in businesses where the market is unproven.

More about Kedaara Capital:

https://www.crunchbase.com/organization/kedaara-capital#section-overview

Kedaara Capital Investment Managers Limited (“Kedaara”) is an operationally-focused private equity firm, formed in partnership with CD&R and further supported by a number of India’s most successful business leaders and family-backed conglomerates.

The firm targets two distinct types of investment opportunities in India:

- Corporate divestitures of under managed and/or non-core business units locked within large Indian-family conglomerates and have limited or no strategic value to their existing parent company; and

- Emerging leaders competing in selected sectors reaching critical mass in India, such as consumer, financial and business services, pharmaceuticals/healthcare and agriculture/resources.

Media

kedara capital exit Vijaya diagnostic through ofs

kedara capital exit vedant fashion through ofs

Title: Fund Scan: Can Kedaara Capital stay the course as coronavirus shakes portfolio firms? Date: April 2020

Last month, private equity firm Kedaara Capital added a non-bank lender to its portfolio.

Title: PE Funds Advent, Kedaara in discussions to acquire Sequent, Date: 7th May 2019

Private equity investors, including US-based Advent International and home-grown fund Kedaara Capital, are in initial talks to acquire Sequent NSE 0.06 % Scientific Ltd, India’s largest animal healthcare company. In this proposed deal, which is expected in the range of Rs 2,500 crore ($350 million), promoters and an existing private equity investor will exit, two people aware of the development said.

Title: Exclusive: Kedaara in talks to back lending startup Aye Finance

Homegrown private equity fund Kedaara Capital is in early discussions to invest about Rs 300 crore ($39.57 mil) in small-business lender Aye Finance, valuing it at about Rs 2,200 crore ($290.18million).

Title: Homegrown private equity fund Kedaara Capital cashes in on fast exits

When Kedaara Capital recently divested its entire stake in packaging company Manjushree Technopack to US-based Advent International, financial details of the deal were not known.

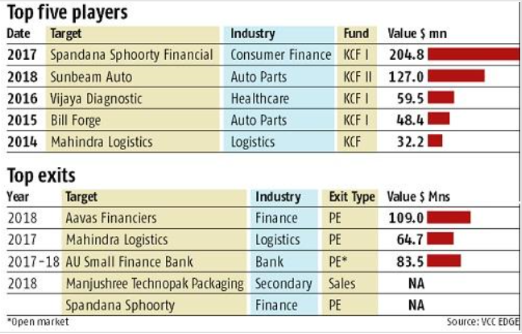

Examples include the Mahindra Logistics IPO in which Kedaara invested Rs 2 billion and generated a 3.5 x return and AU Small Finance Bank, which saw a partial IPO exit by the PE firm after it made 5.5 times on capital. Then there’s BillForge, which saw an investment by Kedaara in 2015 for $48 million and a complete exit in 2016 through sale to M&M CIE Auto for $200 million. Here, Kedaara netted a 2x return in a year.

“Kedaara is an operationally-oriented private equity firm pursuing control and minority investment opportunities focused on India.” It’s an approach that has helped the firm drive 2.5 x returns on its first fund.

The firm’s first fund closed at $560 million and the second one raised $790 million, Kedaara officials confirmed.

Kedaara has been able to do deals in restricted sectors such as retail very well, like Vishal Mega Mart, said Girish Vanvari, founder of boutique advisory firm Transaction Square. “It used the regulatory landscape to its advantage,” he added.

Topic: Kedaara Capital raising second fund, gets IFC backing, Date: 2017

https://www.vccircle.com/kedaara-capital-to-float-second-fund-gets-ifc-backing/

The PE firm recently added a new offshore limited partner (LP) for the second fund. “Kedaara Capital has received commitment of up to $10 million (Rs 64 crore) from Portfolio Advisors LLC, a US-based private markets-focused investment firm, for the new fund,”.

Title: Canada’s CDPQ, Allianz invest in Kedaara Capital’s $750 million fund. Source: Mint, Date:2017

Private equity (PE) firm Kedaara Capital Advisors Ltd, co-founded by PE veteran Manish Kejriwal, has hit its hard cap of $750 million for its second fund, two people aware of the development said.

“While all the existing LPs re-upped in the new fund, the new outing also saw commitments from some new investors. According to the second person mentioned above, the fund-raising witnessed strong demand due to the exit track record demonstrated by Kedaara. In May, Mint reported that Kedaara had managed to generate a 75% IRR (internal rate of return) in Au Financiers exit and about 55% IRR in its Bill Forge exit.

Title: Kedaara Capital picks up 23% stake in Mahindra Logistics. Source: mint, Date: 2014

https://www.youtube.com/watch?v=csVHhvqppM8

Discussed operative model wherein they hire ex-CEO’s as partners, they work with the company to enhance the company’s capability, increase the sales and revenue targets of the company.

Title: Kedaara Capital set to raise $500M maiden PE fund, Date: 2013

https://www.vccircle.com/kedaara-capital-set-raise-500m-maiden-pe-fund/

“The fund will invest in late-stage growth capital and buy controlling stakes”. Kedaara Capital, co-founded by Singapore-based sovereign fund Temasek Holdings’ former India head, is set to raise about $500 million

Analyst questions

- How does the strategic partnership with CD&R help you while investing in India? What is their contribution? How do you benefit with such a partnership?

- You said you add value through operations, can you explain how?

- Why should anyone invest in India, India is known for corruption?

- Why should anyone invest in PE (unlisted) market in India, what returns does it provide?

- Why should anyone invest in your fund? What return should an investor expect while making an investment?

- Most of your investment is in traditional form of businesses, why is it so? Why not booming tech (consumertech, fintech) sectors?

- You invest in business led by strong management / entrepreneur, how do you measure it?

You must be logged in to post a comment.