Funds managed

| Fund name | Asset Class | License |

| Large Cap Core Portfolio | Equity Large cap | PMS |

| Panther Portfolio | Equity | PMS |

| Leo Portfolio | Equity | PMS |

| Caterpillar Portfolio | Equity Mid & Small Cap Biased | PMS |

| Infrastructure Portfolio | Equity (Infrastructure related) | PMS |

| Sector Opportunities Portfolio | Equity (sector rotation) | PMS |

| Cash Management Portfolio | Units of debt/ Liquid schemes | PMS |

| Active Investment Portfolio | Equity/ Mutual fund units/ Cash | PMS |

| India R.I.S.E | Equity Mid & Small Cap Biased | PMS |

| India D.A.W.N | Equity Large Cap Biased | PMS |

Large Cap Core Portfolio- The investment objective of the portfolio is to generate steady capital appreciation by investing in companies that are fundamentally strong and are available at attractive valuations.

Number of Stocks: 15-25

Type of securities :

- Equity & equity related instruments, equity derivatives (80-100%)

- Cash & cash equivalents (0-20%)

Benchmark : Nifty 50

Panther Portfolio – The investment objective of the portfolio is to deliver superior returns by taking aggressive bets in companies which exhibit better growth prospects and momentum.

Number of Stocks: 15-25

Type of securities :

- Equity & equity related instruments, equity derivatives (50-100%)

- Cash & cash equivalents (0-50%)

No single stock having more than 15% exposure of the portfolio value and no single sector having more than 40% exposure of the portfolio value at time of investment.

Benchmark : S&P BSE 500

Leo Portfolio – The portfolio will aim to provide a balance between returns and safety by investing in a portfolio of companies which exhibit above average earnings growth.

Number of Stocks: 15-25

Type of securities :

- Equity & equity related instruments, equity derivatives (80-100%)

- Cash & cash equivalents (0-20%)

No single stock having more than 15% exposure of the portfolio value and no single sector having more than 40% exposure of the portfolio value at time of investment.

Benchmark : S&P BSE 500

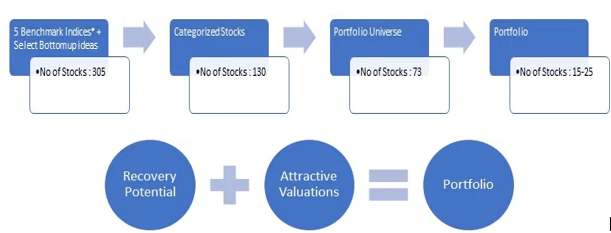

Caterpillar Portfolio – The Portfolio shall invest in mid and small cap stocks that can get re-rated either because of growth in earnings, change in business environment or companies that may have been overlooked or are out of favour.

Number of Stocks: 15-25

Type of securities :

- Equity & equity related instruments, equity derivatives (90-100%)

- Cash & cash equivalents (0-10%)

No single stock having more than 8% exposure of the portfolio value and no single sector having more than 40% exposure of the portfolio value at time of investment.

Benchmark : Nifty Midcap 100

Infrastructure Portfolio – The portfolio shall invest in companies in power, telecom, roads, airports and other companies which broadly satisfy the category infrastructure industries. The portfolio may also invest up to 35% of the portfolio in other sectors which are not related to the infrastructure sector. The portfolio shall invest in companies across all market capitalization.

Number of Stocks: 15-25

Type of securities :

- Equity & equity related instruments, equity derivatives (80-100%)

- Cash & cash equivalents (0-20%)

No single stock having more than 8% exposure of the portfolio value.

Benchmark : Nifty Infrastructure

Sector Opportunities Portfolio – The portfolio would aim to identify and invest in sectors which are expected to exhibit to deliver higher returns. The portfolio will adopt a sector rotation approach, with not more than 4 – 5 sectors at all times. The portfolio would adopt a concentrated portfolio construction approach, with focus on growth or value style of investing depending on the market conditions and relative valuations. The portfolio will use both top down and bottom up investment approach for stock selection without any market capitalistion bias

Number of Stocks: 15-25

Type of securities :

- Equity & equity related instruments, equity derivatives (60-100%)

- Cash & cash equivalents (0-40%)

No single stock having more than 15% exposure of the portfolio value and no single sector having more than 40% exposure of the portfolio value at time of investment

Benchmark : Nifty 50

Cash Management Portfolio – The portfolio would aim to identify and invest in SEBI registered mutual fund schemes which offers investors an opportunity to manage their cash asset better.

Type of securities :

- Units of debt/ Liquid schemes (0-100%)

Benchmark : CRISIL Liquid Fund Index

Active Investment Portfolio – The portfolio will seek to achieve a balance between risk and return by creating a well diversified portfolio comprising of equity and other asset classes.

Type of securities:

- Equity & Equity Related Instruments, Equity Derivative, Mutual Fund Units, Cash & Cash Equivalent. (0-100%)

Benchmark : Nifty 50

India R.I.S.E

Inception Date: 18 April 2016

Number of Stocks: 20-24

Fund Manager Name: Mr Amit Nigam

Type of securities :

- Equity & equity related instruments, equity derivatives (60-100%)

- Cash & cash equivalents (0-40%)

Portfolio Strategy

● The portfolio comprises of companies which benefit from revival in economic growth

● The portfolio focuses on companies that benefit from R.I.S.E in consumer discretionary spending.

● The portfolio favors companies that benefit from operating and financial leverage.

● The portfolio also includes companies where dividend yield is attractive

- R – Recovery in Demand & R.I.S.E in Discretionary Spending

- I – Idle Capacity – Potential for operating leverage & Interest cost to decline as financial leverage declines

- S – Superior Business models; healthy balance sheets & Suppressed Earnings; can spring back swiftly

- E – Earnings recovery on the back of operating, financial leverage & Expansion of Valuation can add to returns

Benchmark : S&P BSE 500

India D.A.W.N

Inception Date: 28 August 2017

Number of Stocks: 20-24

Fund Manager Name: Mr Amit Nigam

Type of securities :

- Equity & equity related instruments, equity derivatives (65-100%)

- Cash & cash equivalents (0-35%)

Portfolio Strategy:

• Focus on mean reversion & value style

• Exposure to under owned companies

• Focused strategy on earnings recovery

• Good quality management with sound corporate governance

• D – Demand recovery across cyclical & consumer discretionary sectors

• A – Attractive valuation to provide margin of safety

• W – Winning companies on the cusp of a new demand cycle leading to operating W & financial leverage efficiencies

• N – New credit & investment cycle to provide a boost to earnings recovery

Benchmark : S&P BSE 500

Other licenses could be:

- Offshore fund based in Mauritius/Singapore

- AIF Category 1/2/3

About the AMC

- One of the world’s leading independent global investment management firm, founded in 1935.

- USD 1,226.20 billion in assets under management around the globe. With an average asset base of over INR 66,451 crores USD 3421 million (for the quarter ending March 2020)

- Publicly traded on NYSE, S&P 500 constituent

Key staff

- Taher Badshah (CIO)

Joined: 2017, With Team: 3 Year, Experience: 26 years

Taher has over 26 years of experience in the Indian equity markets. In his role as Chief Investment Officer – Equities, Taher is responsible for the equity management function at the firm. He joined Invesco Asset Management, India from Motilal Oswal Asset Management where he was the Head of Equities, responsible for leading the equity investment team. In the past, he has also worked with companies like Kotak Mahindra Investment Advisors, ICICI Prudential Asset Management, Alliance Capital Asset Management, etc. Taher holds Masters in Management Studies (MMS), with specialization in finance from S.P. Jain Institute of Management and a B.E. degree in Electronics from the University of Mumbai.

● Amit Nigam (Fund Manager)

Total Exp – 17 Years, With Invesco – 1 Year

Mechanical Engineering Degree from Indian Institute of Technology Roorkee and a PGDBM from Indian Institute of Management, Indore.

Investment Philosophy (for firm)

We partner with entrepreneurs who are experiencing exponential growth

Equity

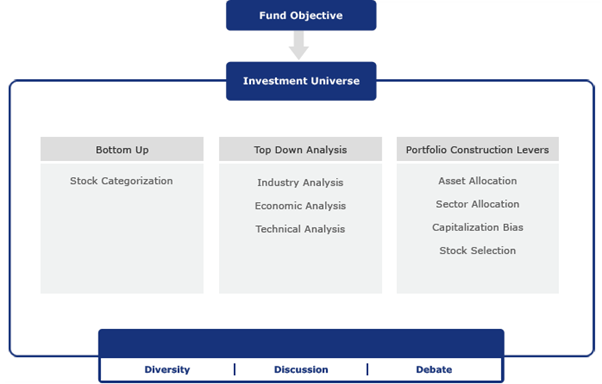

Our equity investment philosophy is centered on generating capital appreciation for the investor. The primary emphasis is on providing the investor with a degree of capital appreciation, superior to that of the returns from the equity class as represented by a market index over the longer term. Our core investment premise is that the equity markets are not completely efficient. A well-organized and thorough research effort combined with a disciplined portfolio management approach will enable out performance of the market index over time.

A key pillar of our disciplined approach is to stay true to the mandate of the specific fund as specified in the offer document under all circumstances. This is key to generating superior performance over time even though there could be times when staying true to the mandate may result in short-term underperformance. Our investment philosophy is a matrix framework of Company, Industry, Economic and Technical analysis. The equity team will provide many of the inputs for this framework, but we will also use inputs from external sources as and when required. This open framework is combined with an environment that encourages regular and constant debate; which we believe leads to superior decision making.

| Stock Category | Descriptions (eg.) | Growth Prospects (eg.) | Company Attribute (eg.) | Financial Parameter (eg.) |

| Star | Young companies | High growth | Entrepreneur vision, scalability | Operating Leverage |

| Leader | Established companies | In line or better than industry | Track record of leadership, globally competitive | Industry leading margin / ROE |

| Warrior | Young / established companies | Better than industry | Unique proposition and / or right place, right time | Margin & ROE expansion |

| Diamond | Company with valuable assets | Low growth | Management intent to unlock value | Value of asset / business |

| Frog Prince | Company in a turnaround situation | Back to growth | Intrinsic strengths in core business | P2P, ROE expansion |

| Shotgun | Opportunistic investment | Positive surprise | Corporate event, restructuring, earnings news | Event visibility |

| Commodities | Call on the cycle is paramount | Positive | Integration, cost efficiency, globally competitive | Profit leverage |

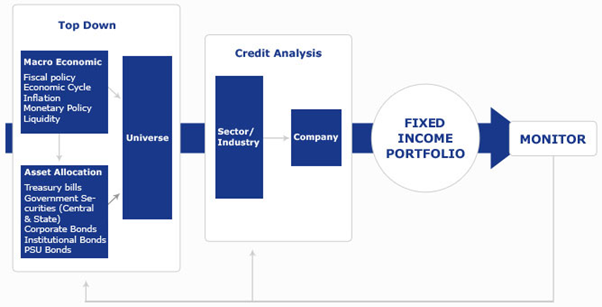

Fixed Income

The philosophy for managing fixed income portfolios revolves around optimizing risk adjusted returns for the investor by investing in high quality credit assets, managing interest rate risk and minimizing liquidity risk.Strive to generate optimized risk adjusted returns by providing for safety of capital, liquidity of funds and investment income for the investors. The portfolios are actively managed for both the interest rate risk, credit and liquidity risk. The interest rate risk is managed across duration buckets and portfolio composition is managed through active asset allocation across credits and the liquidity risk through a well-diversified portfolio.

The credit risk assessment constitutes an integral part of the investment process and is carried out across sectors covering manufacturing, finance and services. By applying the credit model, we determine and monitor the credit worthiness of an issuer and assess the credit exposure limit. Our internal credit rating acts as a powerful risk containment tool that allow the fund manager to narrow down select credits to match the credit strategies of individual funds.

Media

Title:Panel Discussion Keynote Interview – PMS & AIF SUMMIT 2018,Source: PMS Bazar,Date: 13 Nov 2018

Taher Badshah (CIO) talks about they following more or less same investment philosophy for both mutual fund and PMS, then talking about how their investment philosophy make them stick to mandate and giving them sell signals because they buy appropriate but sometimes fail to sell at the right time.

Then he talks about the PMS strategy R.I.S.E., wherein investing in the companies who have operational and financial margins.

Title: Fire side chat between Taher Badshah – CIO, Invesco AMC & Keyur Mehta – Chairman & CIO,Source: Mehta Fincon,Global Investor’s Conference,Date: 28th Jan 2019

https://www.youtube.com/watch?v=7xkdunOg7Is

Firstly, he clears a myth about mutual funds and PMS being similar, he says mutual funds are good for beginners with no experience in investing and PMS is suitable for investors who have at least some knowledge of markets, stocks etc. PMS have more flexibility as compared to mutual funds on the regulations front. Investors with risk taking ability should go for PMS’s. Flexibility from any theme point of view with PMS’s.

Analyst questions

- Can you give examples of stocks you were wrong on? What were the scenarios where your strategy didn’t work?

- How have your thought process about investment philosophy evolved since years?

- Have sticking to the mandate ever backfired?

- As mentioned, the investment strategy gives signals to sell particular stock, can you talk us through that?

- While all of your portfolios have cash as asset class ranging between 0-40%, do you actually consider this range, or just stick to around 5%?

You must be logged in to post a comment.