Funds managed

| Model portfolio | Investment strategy | License |

| Large cap portfolio | Large Cap- Growth | PMS |

| Flexi cap portfolio | Multi-cap | PMS |

| Value portfolio | Multi-cap with a bias towards Mid-Caps | PMS |

| Contra portfolio | Contrarian | PMS |

| Infrastructure portfolio | Large cap and mid cap- closed to subscription | PMS |

| Export portfolio | Market cap agnostic- closed | PMS |

| Wellness portfolio | Market cap agnostic-closed | PMS |

| PIPE portfolio | Mid and small cap- closed | PMS |

| Absolute return portfolio | Market cap agnostic- closed | PMS |

| Enterprising India portfolio | Domestic cyclical and Indian manufacturing oriented businesses- Growth | PMS |

About the AMC

- ICICI Prudential Portfolio Management Services (PMS) enjoys a rich parentage of two large organisations ICICI Bank Ltd which is India’s largest private sector bank and Prudential Plc UK, an international financial services company, with significant operations in Asia, US and UK. ICICI Prudential AMC Limited was the first AMC to acquire a PMS license in 2000.

Key staff

- Parag N. Thakur- Portfolio Manager – Parag joined the AMC in December 2016. He has an overall work experience of more than 14 years, having worked with Quant Capital, BRICS Securities and Refco Sify Securities (Now Philips Capital). His previous stint has been with HDFC Securities where he worked as Head of Institutional Sales. He is a commerce graduate from Jai Hind College, Mumbai.

- Deviprasad Nair- Head Business Development PMS – Deviprasad joined IPAMC in July 2018. In his current role, Deviprasad is responsible for Sales & Business Development of ICICI Prudential Portfolio Management Services. Deviprasad is a seasoned financial services industry professional with over a decade of experience in Institutional/Retail Sales and in setting up strategic business units within the asset management industry in India. His previous major stints have been with Aditya Birla Sunlife Mutual Fund & HSBC Mutual Fund. He holds a Masters in Financial Markets & Investments from Skema Business School, France & also holds MBA in Marketing from CMRIT, Bangalore.

- Anand Sharma- Portfolio Manager – Anand joined IPAMC in April 2014. In his current role, Anand is a portfolio manager for two PMS Schemes – ICICI Prudential PMS Flexicap and ICICI Prudential PMS Wellness Portfolio. He has also covered pharmaceuticals, Healthcare, Metals, Mining, Sugar and Textiles space for research. He has a total work experience of 7 years. Prior to joining, he was associated with Oracle Financial Services Software Limited. Anand completed his Masters in Management Studies (MMS) in Finance from K.J. Somaiya Institute of Management Studies and Research, Mumbai and B.E. (Computers) from Thadomal Shahani Engineering College, Mumbai.

Investment Philosophy (for firm)

ICICI Prudential Portfolio Management Services (PMS) has a conviction led, long-term approach to investments. Our long-term focus is based on the belief that decision making focused on short-term outcomes often comes at the expense of long-term value creation.

- We believe meaningful performance can be generated for our clients over the medium to long term through active management.

- We seek to deploy capital in businesses which aims to generate high return on capital by creating and sustaining the competitive advantages in their respective industries.

- As a part of our investment process, we strive to develop a deep understanding of the companies in which we invest, through proprietary company specific research.

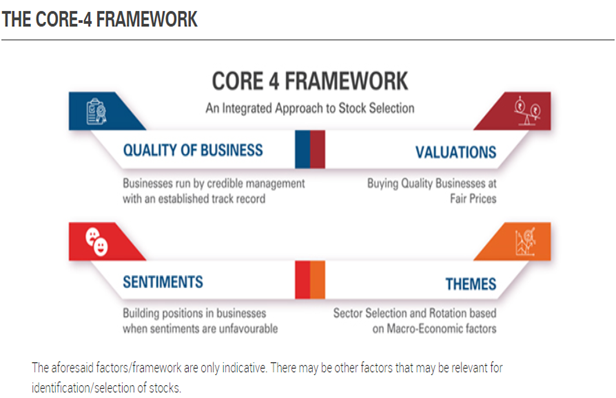

The AMC has therefore established a Core-4 Framework that is designed to identify potential wealth compounding stocks.

About the model portfolios:

Large cap portfolio:

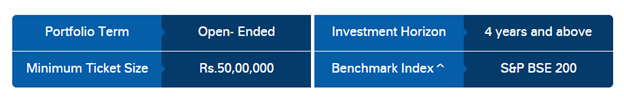

Investment Philosophy: ICICI Prudential PMS Large-Cap Portfolio (the Portfolio) is a diversified equity portfolio that endeavours to achieve long term capital appreciation by investing predominantly in large-cap companies.

Investment Strategy:The Portfolio aims to generate alpha by active sector rotation through a top-down approach.

The Portfolio intends to reduce concentration risk through diversification at the stock and sector levels.The Portfolio aims to follow a “buy and hold” approach. It aims to identify companies that offer reasonable potential for long-term growth.

https://arch.icicipruamc.com/download/pdf_links/PMS/Large_Cap.pdf

Flexi cap portfolio:

Investment Philosophy: ICICI Prudential PMS Flexi-Cap Portfolio (the Portfolio) is a diversified equity portfolio that endeavours to achieve long term capital appreciation and generate returns by investing across market cap.

Investment Strategy: The Investments are targeted at long-term capital appreciation and follows GARP (Growth at Reasonable Price) Philosophy.The investment strategy follows a mix of a top-down and a bottom-up approach.

The Portfolio aims to follow a buy and hold strategy with and aim to fully capitalise on the true underlying value of the business potential, which is expected to get unlocked over a period of time.

https://arch.icicipruamc.com/download/pdf_links/PMS/Flexi_Cap.pdf

Value portfolio:

Investment Philosophy: ICICI Prudential PMS Value Portfolio (the Portfolio) aims to follow a value investment style and intends to offer a diversified portfolio of stocks that have a high potential but are quoting at a discount to their fair/intrinsic value.

The Portfolio aims to follow a “buy and hold” strategy in order to fully capitalise on the true underlying value of the business potential which gets “unlocked” over a period of time. However, the portfolio may be actively managed to take advantage of certain market trends, with an endeavour to enhance returns.

Contra portfolio:

Investment Philosophy: ICICI Prudential PMS – Contra Portfolio (the Portfolio) seeks to generate capital appreciation by investing predominantly in Equity & Equity Related Instruments through contrarian investing. For defensive consideration, the Portfolio may invest in debt and money market mutual fund schemes.

https://arch.icicipruamc.com/download/pdf_links/PMS/Contra_Portfolio.pdf

Media

Title:Mr. Parag Thakkar – ICICI Pru PMS -“Perspective of the Portfolio Managers & strategies on COVID19”, Source: PMS Bazaar- youtube, Date:01 May 2020

https://www.youtube.com/watch?time_continue=17&v=IZkCf8VLlgY&feature=emb_title

In this pandemic they have increased their weights in pharma and telecom. Thakkar says, once the pandemic and the crude oil situation stabilizes, money will find its place in various asset classes. Low leverage, high dividend yields and a lot of cash flows are the companies where this money will go. Buy businesses where the fixed cost is low.

Title:PMS Corner – Episode 2 – Mr. Parag Thakkar, Portfolio Manager – PMS, ICICI Prudential, Source: PMS Bazaar- youtube, Date: 27th January 2020

https://www.youtube.com/watch?v=qoKQ0YbBkSY

Core philosophy of stock picking:

- Corporate governance

- Alignment of interest with the promoter

- Return ratios- above 15% ROE and ROCE

- Clean cash flow generation

- Net debt/EBITDA not more than 3.5x

Contra calls portfolio: Buying quality companies when it becomes cheap due to some temporary issue in the market or the sector. And general discussion about the market.

Analyst questions

- How is your PMS different from others, why should an investor bring their money to your table?

- In the Flexi cap portfolio you follow a bottom up as well as a top down approach. How and why?

- You said in one of your interviews you look at corporate governance, what specifically do you look for and how do you measure it?

Peer review and additional questions –

Parag Thakkar in an interview said that once the market recovers completely from the Covid-19 shock and the decreasing crude oil prices, the money will be invested in the right areas/ options. He said that the money will be invested in companies that have low leverage, good cash flow and good dividend yield. ICICI Prudential PMSs’ Contra portfolio follows this strategy. They invest in stocks of companies that are now available at a discounted price because people have divested their money due to Covid19 crisis.

The Value Portfolio identifies and analyzes the undervalued stocks in the market.

| Category | MULTI CAP | SMALL CAP | MULTI CAP | LARGE CAP | MULTI CAP | |

| Strategy | FLEXI CAP | PIPE Portfolio | CONTRA PORTFOLIO | LARGE CAP | VALUE PORTFOLIO | |

| Return (CAGR) | 1M | 5.43% | 13.06% | 1.98% | -0.28% | 4.78% |

| 3M | 18.50% | 34.69% | 15.55% | 12.43% | 12.72% | |

| 6M | -1.00% | 5.35% | 8.17% | 8.95% | 0.64% | |

| 1Y | 8.30% | NA | 6.88% | 3.48% | 2.53% | |

| 2Y | -0.50% | NA | NA | -1.70% | -4.54% | |

| 3Y | 3.10% | NA | NA | 4.02% | 0.37% | |

| 5Y | 7.60% | NA | NA | 6.30% | 4.75% | |

| SI | 11.70% | 6.25% | 3.46% | 9.84% | 12.47% | |

Inception | Dec, 2000 | Jan, 2000 | Sep, 2018 | Mar, 2009 | Jan, 2004 |

All the portfolios have given good returns since their inception.This shows how well and stably it grows during the years.The PIPE Portfolio that invests in small cap has given excellent CAGR as compared to others in a period of 3 months.

- Why does ICICI Prudential PMS have 4 different types of portfolio with the same objective – Long Term Capital Appreciation?

- Why do all their portfolios only concentrate on Pharma , FMCG and Telecom stocks and not on Banking and Finance?

- In a media interview Mr Parag Thakkar said that they have increased the weights in the telecom sector. Why the telecom sector and not Pharma? (considering that Pharma products are the most needed products during Covid crisis and the stock price of Pharma companies like Dr. Reddy, Alembic pharma etc. were increasing. )

- In a media interview , Mr Parag Thakkar was emphasizing on the recovery of crude oil prices. Why and how is it related to the PMS?

Prepared by Smriti Prabhu, May 2021

You must be logged in to post a comment.