Funds managed

| Fund name | Asset Class | License |

| ENAM India Core Equity (EICE) Portfolio | Equity Concentrated long only, high conviction portfolio | PMS |

| ENAM India Diversified Equity Advantage Portfolio (EIDEA) | Diversified Equity long only, high conviction portfolio | PMS |

Strategies:

- Large Cap Strategy

- Diversified Strategy

- Small – Mid Cap Strategy

About the AMC

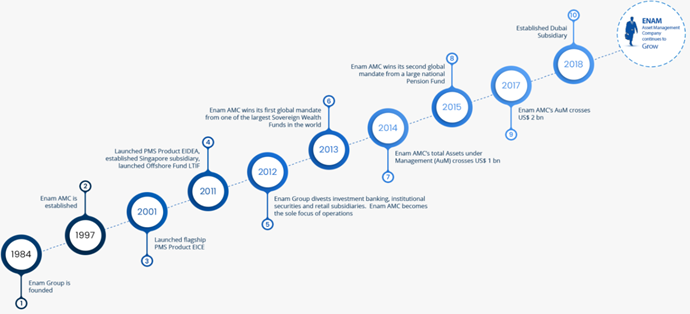

- Establishment year- 1997 (Registered as Portfolio Manager with SEBI since 1998)

- Two-pronged approaches that have been successfully employed for asset management:

- World-class research,

- Knowledge-based portfolio management. This has helped them over the years to become a premier choice by their clients for long-term wealth creation in the Indian financial market.

- AUM is over US$ 3 bn.

- Clients include “world’s most prestigious institutions, UHNIs, HNIs, Indian Corporates, NRIs, global family offices, and global institutional investors including Sovereign Wealth Funds and Pension Funds”. They have been there as results of the firm’s unmatched goodwill of trust and leadership in the PMS industry.

- Enam AMC is the 2nd largest PMS outfit in terms of funds/assets managed.

- Specialised for:

- Pedigree in equity management,

- A high degree of customization in portfolio,

- Focus on equities that are India-listed.

- Their focus- “one geography, one asset class, one strategy”

- Values deeply inculcated for Socially Responsible Investing (SRI).

Business Values:

- They believe in harnessing the power of capital markets for their clients through a value-driven and conscientious approach.

- Organization that believes:

- Integrity

- Conservativeness

- Long term vision

- A people-first approach

- Respect For nature

- Meaningful contribution for the society

- After being in the PMS industry for 2 decades, they believe to have built their processes, structures and philosophy to last.

Their beliefs:

- It is dedicated to trust-based partnerships with long-term and sustainable investments.

- Approach led to

- High retention rate of customer

- Word-of-mouth referrals

- Technology used for portfolio management, performing activities, delivering services, relation management and many more.

- An attitude of self-belief, tenacity and compassion for best service delivery to their clients.

- Integrity and teamwork to overcome hard times.

- Values and beliefs built keeping in mind longevity and adaptability.

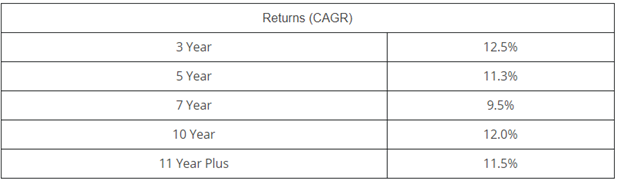

Firm’s PMS Returns / Performance:

Observation- From the last 3 years it has been giving returns higher than the market as well from its competitors in the industry. Apart from that they seem to have a consistent track record of returns@ 12% pa.

Their History:

Key staff

Mr. Vallabh Bhanshali (Founder and Chairman)

“Never forget that you don’t control success. What indeed there is, is a formula for excellence.”- Mr. Vallabh Bhanshali

- He is a CA and has a degree in law from Mumbai University.

- He is internationally renowned as “an investment banker, investor, venture capitalist as well as an expert “in Indian capital markets.

- Before he switched to securities market, he started his career as an accountant and then eventually co-founded Enam Group in the year 1984.

- He has served as a trustee of the BSE, the regional board of RBI, and now still continues to serve at various numerous Committees of SEBI.

- Apart from this, he had also been on board of various Public companies.

- He also has an honour of receiving citation of “Veteran Economist of the Capital Markets” from the Indian Council of Business.

- He has expressed his love for teaching and thus has conducted seminars on behavioural science.

- His articles have also been published in the reputed industry periodicals.

Mr. Nemish Shah (Founder)

“Don’t trade, do value investing for better gains.”

- He has been considered as a ”pioneer of modern Indian finance and investment research.”

- He has been said to bring the companies at the top in the IPO market within 6 months of its foundation.

- The firm’s investment research strategy has been developed under his guidance.

- He is considered to be a devoted philanthropist and a proponent of higher education.

- He has instituted the Foundation for Liberal and Management Education (FLAME) to elevenate the Indian value system.

- His portfolio has been observed to be diverse along with few risks.

- He seems to favor brick and mortar companies over new-age businesses that are in tech and finance fields.

- He “publicly holds 10 stocks with a net worth of over Rs. 814.1 Cr.”

Mr. Jiten Doshi (Founder and CIO)

“We believe that Reputation and Regulation are above everything else in business.”

- He possesses an experience of over 30 years in the capital markets.

- Possesses a degree in Commerce from Mumbai University.

- He looks into day-to-day matters along with the investments related activities in the company.

- He has served as an independent Director in various public companies.

- He very often speaks at global forums such as HORASIS and is considered as a trusted advisor to various management bodies on different issues such as “corporate governance, transparency, disclosure standards, and shareholder value creation.”

- He has also co-founded the Listed Equities Managed Account Business which maintains accounts that are separately managed at Enam AMC.

Mr. Rajesh Khona (Head Group Director, Operations & Finance at ENAM)

- He is the PMS Fund Manager at Enam Asset Management

- Experience- Around 30 years of experience as a CA and a professional in the senior securities market.

- Qualification- B.com (Mumbai University), ACA (Merit Holder)

- AUM- Manages approx USD 2 billion with 793 clients.

- Consistent track record mainly because of stock selection process along with investment strategies used by him.

- Apart from core activities at EAM, he has also conceptualized as well as transformed the IT automation of their PMs along with looking into GIPS compliance procedure annually.

- Prior to this, he was the “Vice President (Operations and Finance) with IIT Investrust Ltd. (an IIT Group Company) and an Assistant Vice President with Indsec Share and Stockbroking Ltd. (an Essar Group Company).”

- He has done “Diploma in Information System Audit, a Broker’s Training Course at the Mumbai Stock Exchange, the National Stock Exchange’s Certification in Financial Markets, an ISO 9001:2000 Quality Management Auditor certification, as well as training in SAP R/3 ERP FICO and ORACLE.”

Investment Philosophy (for firm)

- Aims to deliver Alpha consistently over a long period of time.

- They possess in-depth knowledge of the industry through:

1. Primary research,

2. State-of-the-art technology,

3. In-house proprietary tools

- Manages risks through carefully developed risk management framework.

- PMS team includes portfolio managers along with research analysts.

- They conduct their own independent and bottom-up analysis, from the annual reports of the company to assess their strategic growth plans, so as to find the optimal stocks for their clients.

- They have started to publish their fund’s audited performance track record with an aim to adhere to Global Investment Performance Standards (GIPS).

- USP- “first company in the industry to conduct a GIPS audit; and be recognized as best-in-class on a global level.”

- Investment Objective:

1. Their investment process aims to identify and then invest into

- high-quality businesses at the valuations that are attractive,

- Structurally well-positioned,

- Have sustainable competitive advantages

- Have execution capabilities that produce consistent long-term growth.

2. They also aim to maintain long term ownership and build a concentrated portfolio according to the needs of their clients.

- Their 5 Pillar of Investment Philosophy while seeking opportunities that are value driven

Investment Process

Investment Philosophy (for Funds)

ENAM India Core Equity (EICE) Portfolio

- This fund was launched in April 2001.

- It is considered to be their flagship product for their fundamental Equities platform.

- Investment Objective:

- Capital appreciation by investmenting into equities for a long-term of time.

- This fund is a direct selling product where investments of client’s funds are done based on ‘Separately Managed Account’ (SMA).

- Clients of this fund are benefited from a customized portfolio along with a separate bank and demat account, brokerage and liquid mutual fund account.

- These services are provided by an experienced and dedicated relationship manager.

- Expected to provide return higher than the industry benchmarks and of their peers in the industry.

- They also follow effective risk management fundamentals to manage risk in order to preserve capital and value.

- It is a “long only, high conviction portfolio with approximately 20 stocks.”

- This portfolio has been developed only after reviewing its high-quality, structurally well-positioned businesses and execution capability.

- This has been done to provide consistent long-term growth to its clients along with acquiring the best of them at the valuations that are attractive.

ENAM India Diversified Equity Advantage Portfolio (EIDEA)

- This fund was launched in April 2011.

- Focus to cater to the “HNIs focused distribution fraternity”.

- This fund is successfully able to combine top-down economic research along with bottom-up analysis of fundamentals for effective and efficient PMS.

- It is a “long only, high conviction portfolio with approximately 20 stocks.”

- Investment Objective:

- Expected to provide return higher than the industry benchmarks and of their peers in the industry.

- They also follow effective risk management fundamentals to manage risk in order to preserve capital and value.

- This product is meant for distribution by channel partners which follows investments on the SMA basis.

- Their clients have benefited from having an individual and separate bank account along with a demat account.

- They also benefited from their experienced channel marketing team.

- In addition to this, they are also subjected to the aggregation of purchases/ sales for economies of scale and the brokerage A/c is at a pool level. “Further the trades will be executed as aggregate and will be allocated to individual accounts after execution.”

- This portfolio has been developed only after reviewing its high-quality, structurally well-positioned businesses and execution capability.

- This has been done to provide consistent long-term growth to its clients along with acquiring the best of them at the valuations that are attractive.

Fund fees & charges

Commissions

Analyst questions

- The firm is said to have a risk management framework. Could you elaborate on that?

- You have been the first one to conduct a GIPS audit. Why do you think other firms are not performing the same as they may install a sense of trust among the respective clients of their companies?

- How does SMA help you in managing investments effectively?

- What are the matrices based on which you decide the best securities to choose along with their valuation level?

- The firm’s ENAM India Diversified Equity Advantage Portfolio (EIDEA) is said to combine top-down economic research along with bottom-up analysis of fundamentals for providing better PMS. What could be the research strategy for ENAM India Core Equity (EICE) Portfolio?

- The company is said to extensively use technology for delivering various PMS services. Does it impact understanding behavioural science?

Additional questions by peer reviewer –

- What does state of the art technology in investment philosophy mean in simple words?

- Why are there three PMS shown in disclaimer on the website and two PMS are out on the website page?

- What exactly are prudent risk management measures?

- Does the EIDEA portfolio affect in any way if it is focused only for HNIs?

You must be logged in to post a comment.