This summary helps to understand the passive investing landscape in India, the opportunities it offers, role and responsibilities of a fund manager and how to make a successful career in this space.

This topic was covered by Anil Ghelani,CFA, head of Passive Investments and Products, DSP investment managers and Vice chair CFA society, India.

Passive investing on the rise

The webinar gave a brief but detailed information about gaining fast popularity of passive investing in India, and how fund managers study various factors while preparing the portfolio and how one can build a career in this sector have been explained.

Rising trends in investments and expecting high returns within a specific period of time is increasing globally. While analysing all aspects and various factors while investing, India is seeing more shift towards passive investing. Active investing is a hands on approach with frequent buy-sell decisions based on information or fluctuations and passive investing is buying and holding those investments. The goal of active investing is to beat the market index whereas the goal of passive investing is to perform in line with the market.

An important question is will passive investing remain in the growth phase in upcoming years? In India still there is space for both passive investment and active investment in terms of outperforming the index i.e. generating alpha at same time. Degrowth of active funds is not possible, it will continue to rise but more push is towards passive investment. There are four factors which will be key drivers for growth of ETFs and passive funds in India, these factors are:

- Commodities- In India only one commodity in which ETFs are available is gold etfs. With changes in the regulatory framework by SEBI for commodities, in coming years there will be much more activity in commodity space and many more in ETFs rather than just gold ETFs in the market.

- Fixed income or bond ETFs- Indian mutual fund industry did not have any fixed income etfs except for liquid ETfs. But since the past one and half years of the launch of Bharat bond ETFs, there will be many more ETFs available.

- Government disinvestment mandates- ETF route was successful for 4-5 years both on the equity side and now on the bond side for the purpose of disinvestment targets and raising capital for PSUs, which will continue to grow. This has helped in ETFs in the retail market.

- Smart beta- Enhanced acceptance of smart beta will be helpful for the mutual fund industry in India.

Types of passive funds

Another CFA webinar discussing passive investments, mentioned that passive investment are of two types A) ETFs and B) Index funds. Broadly both are passive but the slight difference is ETFs are traded on the stock exchange, unlike index funds.

Passive funds are evaluated on tracking error. Passive funds is science which can be defined and it needs to follow a certain process.

Another aspect discussed the comparison of mutual funds, index funds and ETFs.

Some facts and figures experts discussed are showing how the world is moving towards passive investing between 2007- April 2021 global etf AUM has grown and reached 9 trillion, which was 5.37 trillion in 2020. A clear long term growth of 20% is seen typically in the Asia-Pacific region. It has grown around 27% CAGR while the US continues to dominate the industry with 69% CAGR.

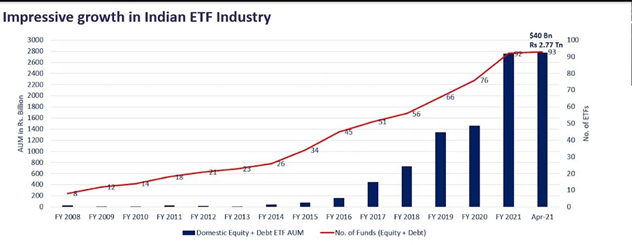

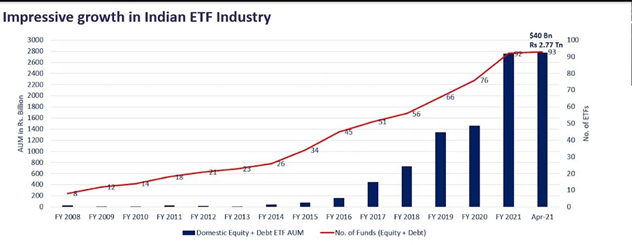

In this figure it is seen that 40 billion USD of AUM is set in 2021 with a growing rate of 43% over the last 13 years. In The last two financial years, the ETF AUM has seen a dramatic rise because there has been fresh inflows of about 1 lakh crore INR which is approx 14 billion USD. Active mutual funds which are equity oriented have witnessed inflow 58,000 crore INR which is approx 8 billion USD.

As seen, 14 billion USD in passive and 8 billion USD in active, hence it clearly shows that India is already inclined towards passive investing.

The webinar concluded by giving a few reasons as to why ETFs are becoming so popular in India. The factors include the low cost nature of passive funds in India. Equity ETFs have an asset weighted average expense ratio of 9 basis points i.e for every 100 rs of AUM, the person is paying 9 paise of total expense ratio.

Another reason passive funds are becoming popular is not very good performance of large cap active funds both globally and in India. Large cap active funds were not able to beat the benchmark consistently except for a few funds. Other drivers are increasing awareness amongst retail investors, after the launch of Bharat bond initiative by the Government of India, etfs has paved the way for growth of debt Etfs.

Roles and responsibilities of a passive fund manager

Role of a fund manager is very important in mutual fund companies. Though passive investment fund manager does not track individual company records or meet the management but there is requirement to have broad connectivity and ensure that the company is doing this in proper way, this comes from stewardship responsibility- it is very crucial role of fund manager to play irrespective of weather the investment style is active, passive or semi active, at the end of the day they are managing investor’s money.

Another aspect mentioned is that there is no human bias on a day to day basis but there is a lot of fundamental research analysis which goes behind initial selecting a particular investment theme. Daily routine of a fund manager in the passive side is not like algo trading, but there are a lot of aspects starting with tracking the flows, corporate actions,etc. If one has to make a career in this space, he/she needs to consider all these parameters, the responsibilities which one needs to handle and maintain a position in the company.

Career in passive investing

The Indian asset management industry has 40+ AMCs in which around 15 companies have their presence in passive investments, products under ETF funds. This means that other companies still need to get their position in the industry who currently don’t have this platform. On the other hand, growth of existing players, expansion of the team will be essential. Companies will be looking for both active and passive funds, so as market enhances and assets grow, the industry will need more dedicated fund managers hence hiring will grow.

One needs to have a bachelor’s degree in engineering, technology,commerce or masters degree in MBA finance or a professional CFA. A person needs to have deep knowledge about capital markets, dedication towards the work and analysing all industry and company factors will lead a person to be in a good position in a mutual fund company.

The webinar concluded his webinar by stating that growth of ETFs will lead to a good opportunity for financial professionals in this space. Index providers will need to set up more teams, more products as the size of the industry will grow. Stock exchanges will need to focus more on ETFs as size keeps increasing, and investors/brokers will play a crucial role. Securities lending will be an important factor and will act as good functioning in capital markets.

This summary was prepared by Ankita Joshi based on the webinar by Anil Ghelani at CFA institute.

https://www.cfainstitute.org/en/research/multimedia/2021/career-insights-passive-investing-in-india

Peer Reviewed by Anjana Nambiar

You must be logged in to post a comment.