Funds managed

| Fund name | Asset Class | License |

| Blume Ventures Fund I | Early stage | SEBI AIF Cat 1 |

| Blume Ventures Fund IA | Early stage(?) | SEBI AIF Cat 1 |

| Blume Ventures Fund II | Early stage(?) | SEBI AIF Cat 1 |

| Blume Ventures Opportunity Fund IIA | Later stage | SEBI AIF Cat 1 |

| Blume Ventures Fund III | Early stage | SEBI AIF Cat 1 |

About the AMC

- Blume Ventures was founded by Karthik Reddy and Sanjay Nath in 2010. It was established to bridge the gap between angel investors and the large institutional investors in the Indian market back then. It invests in early stage start-ups and backs them not just with funding but also with active mentoring.

- It looks for entrepreneurs that are willing to solve hard problems and create an impact in large markets.

- It has its portfolio presence in Mumbai (19%), Bengaluru (44%), Delhi (22%) & International (7%).

- Till date, Blume has invested in over 130+ startups across categories. It maintains a 60:40 ratio while investing in domestic and global startups.

- It currently manages capital worth $150 mn and has made over 22 exits so far.

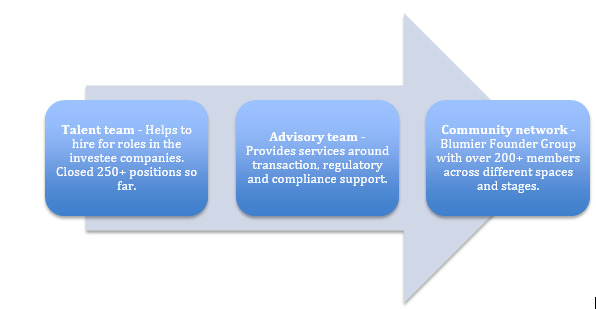

How they support startups

Apart from this, it has partnered with global financial & strategic later-stage investors. It is part of the Draper Venture Network, a global alliance of select venture firms. Also, it has a strong backing from industry and functional experts to counsel and guide founders through all aspects of the startup journey.

Key staff

- Karthik Reddy (Co-founder & Managing Partner)- Karthik Reddy founded Blume with Sanjay Nath in 2011. Karthik has shaped Blume’s investment approach and philosophy over the years, and in turn has overseen investments in some of Blume’s leading portfolio companies such as Servify, Belong, Exotel, Grey Orange Robotics, Unacademy, Healthifyme and Railyatri amongst other emerging stars. He is an alumnus of IIT Roorkee, IIM Bangalore and The Wharton School at University of Pennsylvania.

- Sanjay Nath (Co-founder & Managing Partner)- Sanjay oversees the broad B2B tech (or the built-in-India tech for global markets) space. He also manages investment and ecosystem partnerships at Blume. The spectrum of investments he covers within B2B space range from enterprise software/cloud/SaaS to hardware/IoT/robotics, AI/ML, data science and deep/hard tech areas. Sanjay is a board member on the Draper Venture Network (DVN), an affiliation of global venture firms. He also represents Blume as a founding partner-member of Arka Venture Labs, a cross-border B2B seed fund along with Benhamou Global Ventures (BGV) and Emergent Ventures. He has an MBA from UCLA’s Anderson Graduate School of Management and an engineering degree in information systems from BITS, Pilani.

Investment Philosophy (for firm)

- Philosophy – To invest in early stage startups that bring to the table revolutionary ideas, solutions to problems that are difficult to crack and the ones expected to cause an impact in large markets. It believes in investing for a long term (roughly 8-10 years). They also prefer startups with co-founders which according to them indicates soundness from business point of view.

Process:

- They usually prefer to invest in ventures with that are tech-led, i.e., businesses backed by code or intellectual property. They have an inclination for B2B businesses. They believe that building capital moats by themselves is a winning strategy.

- They believe that just providing capital is not the whole and sole purpose of helping startups, apart from the capital reserves and co-investment partners, they strongly believe in connecting these investee companies with their distinctive formal platforms and engagements. These include services partners Constellation Blu and Constellation Talent, in-house resources across growth capital, market development, operational best practices and community. They deliver value through resources and on-demand mentoring and assistance as and when required.

- They work very closely for the first few years with the founders. Then they elevate their focus to keep pace with the demands of their growth companies. (But, we also stick with, and support, our less successful ventures well beyond traditional venture norms dictated by power laws and portfolio concentration. We do this, not because power laws don’t apply to us, but because supporting and sticking by founders is second nature to them)

Media

Title: Founders Speak, Source: YouTube, Date: 29 October 2014

https://www.youtube.com/watch?v=JEOFwytqXh0

Founders of the investee companies come forward and share their experiences of Blume Ventures and in what way it has helped scale their businesses.

Title: Funding in the opportunity fund II A, Source: LiveMint, Date: 23 February 2020.

It talks about the $41 mn worth of money that Blume was able to raise for its II A fund that has helped in Series B to D funding rounds. It is one of the largest domestic opportunity funds that has invested in emerging winners over the years. It also talks briefly about fund III which will focus on early stage tech led startups.

Title: Fund II A, Source: YourStory, Date: 24 February 2020

https://yourstory.com/2020/02/blume-ventures-closes-opportunity-fund

Title: Sanjay Nath on COVID-19, Source: YourStory, Date: 23 April 2020

https://yourstory.com/2020/04/coronavirus-sanjay-nath-blume-ventures-startups-podcast

In a 100x Entrepreneur podcast Sanjay talks about how the VC firms, investee companies and investors should look at the repercussions caused by the pandemic.

Title: Karthik Reddy’s interview on 100x Entrepreneur podcast, Date: 28 May 2019

https://100xentrepreneur.com/podcasts/karthik-reddy-blume-ventures/

Title: Karthik Reddy in an interview with Forbes India, Date: 17 May 2019

Title: Karthik Reddy on tech investors and e-payment companies, Source: ET, Date: 7 June 2016.

https://m.economictimes.com/videoshow/52639778.cms?from=desktop

Title: Sanjay Nath at the Global Venture Capital Summit, Goa, Date: 2018

https://yourstory.com/video/sanjay-nath-RsoIQP5r

Title: Sanjay Nath in an interview with Viranindia Magazine, Date: 8 May 2019

https://www.youtube.com/watch?v=LKIxUWF8CPE

He talks briefly about what they see in startups before going for them. Also, how Blume has launched a fund that invests in founders that have built a business/product/service and has a proven record.

Analyst questions

- Do you think your investment philosophy has evolved since 2010, if yes, then what factors led to it?

- (Sanjay Nath) In an interview at the Global VC Summit you said, “In India global companies are willing to acquire Indian startups as opposed to 3-4 years ago when this didn’t happen as much”, what according to you has led to this shift?

- The philosophy section on the firm’s website talks about capital moats, can you elaborate on the same?

- I came across several articles about some of Blume’s offshoot funds (I A & II A) that were created in order to prevent total stock ownership dilution, can you explain the strategy behind it and also some examples of how it has worked out so far?

You must be logged in to post a comment.