Funds managed

| Fund name | Asset Class | License |

| Aavishkaar Bharat Fund | Earlier and Late stage | SEBI AIF Cat 2 |

| Aavishkaar I | ||

| Aavishkaar Goodwell I | ||

| Aavishkaar Goodwell I | ||

| Aavishkaar Frontier Fund |

About the AMC

- The Aavishkaar Group is a global pioneer in taking an entrepreneurship-based approach towards development. The Group is focused on developing the impact ecosystem in the continents of Asia and Africa. Aavishkaar Group manages assets in excess of USD 1 Billion across Equity and Credit.

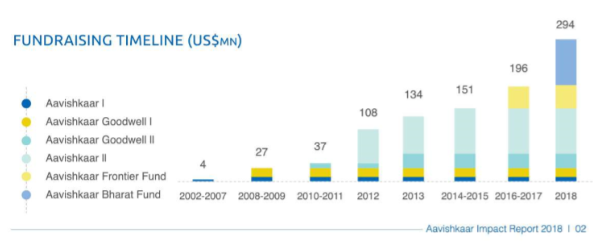

- Aavishkaar Capital pioneered the venture capital approach of investing in early-growth stage enterprises in India in 2001, with a focus on geographies and sectors that were often overlooked and challenging. Aavishkaar Capital has gone on to close 6 funds since then, with close to half a billion dollars in AUM today.

- Aavishkar is an investment firm with a vision to facilitate development in India’s underserved regions by backing promising entrepreneurs and startups that are working to build sustainable solutions. In addition to providing capital, the firm offers access to a well-connected network of resources to help enterprises scale up.

Key staff

- Vineet Rai, founder of The Aavishkar Group, Cofounder at Intellecap, CEO at Aavishakar Capital.

- Anurag Agarwal, Partner, Director at Arohan Financial Services ltd. , Director at IntelleGrow , Director at Intellecap.

Investment Philosophy (for firm)

- Along with its core objective of delivering commercial returns to its investors, Aavishkaar Capital creates livelihoods, reduces vulnerabilities, and provides access to essential products and services to the target population through its investments in ambitious and innovative entrepreneurs.

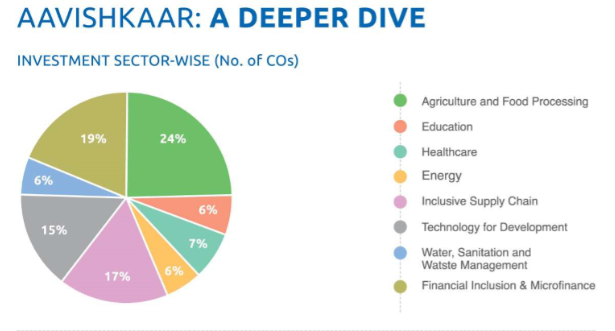

- Focus on investing in businesses across our 3 core sectors – Financial Inclusion, Food & Agriculture, and Essential Services.

- Aavishkaar Capital’s investment thesis is to leverage the confluence of consumption, financial inclusion and technology across emerging low and middle income populations to build sustainable, impactful and highly scalable businesses, which can create significant value for both the investors and the society.

- The Firm seeks to invest in businesses which meet the following criteria:

- Operations focused on the targeted demographics of the emerging 3 billion population.

- Business model with the potential to scale significantly within 4 to 5 years.

- Strong management team with the ability to capitalise on the market potential.

- To achieve its goals, Aavishkaar Capital follows a multi-stage ‘sow-tend-reap’ investment strategy which supports businesses across the growth spectrum, from seed to growth stages, while building a portfolio with a balanced risk return profile.

- With an active investment style, the Firm supports the investee companies in building their capacity for growth by advising on strategy, governance, operational processes, human resources, and fundraising.

- Actively contributing to 13 Sustainable Development Goals.

Aavishkaar Bharat Fund: An Overview

https://inc42.com/buzz/aavishkaar-bharat-fund-investment/

- Aavishkaar Bharat Fund plans to invest in early- and late-stage businesses in sectors that form the bedrock of India’s growth – like agriculture, financial services, education, healthcare, waste management and sanitation, renewable energy and logistics and supply chain.

- Elaborating further, Rai added, “So, we are deploying capital in a very strategic manner wherever we are participating in early stage. But more importantly, more than half of our investments will actually not be in startups. Half the investments will be in early stage and the rest in more mature companies.”

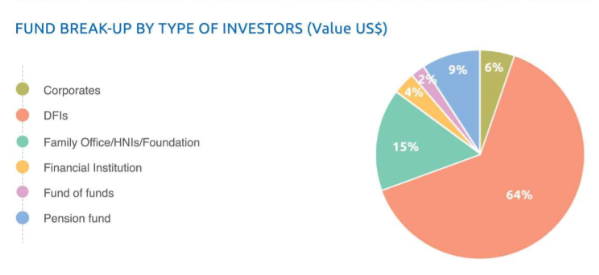

- When asked why Aavishkaar chose to raise nearly half of the fund’s first close from domestic investors, Rai explained, “We realized that India is no more seen as a developmental hub. The world today acknowledges India not as a country that is poor or developing. Generally, our investors have been development finance institutions (DFIs) and we realized that their interest has moved on to other developing countries or continents like Africa. So, we had to adjust our fundraising strategy and we made a significant focus on India and our old relationships.”

- By contrast, the VC firm’s earlier funds were raised with over 95% contribution from overseas backers, and only around 5% from Indian investors.

- Through the Aavishkaar Bharat Fund, the VC firm is looking to provide late-stage startups with the support and infrastructure needed to develop solutions that could help solve some of the country’s most crippling problems.

- The Bharat Fund is backed by institutional investors such as the UK’s development finance institution CDC, Small Industries Development Bank of India (Sidbi), National Bank for Agriculture and Rural Development (Nabard) and family offices such as Sunil Munjal of Hero Enterprise, said Rai.

http://www.aavishkaarcapital.in/our-impact/

Media

Title: Aavishkaar Makes First Close Of Bharat Fund At $95 Mn, Source: Inc42, Date: 2017

https://inc42.com/buzz/aavishkaar-bharat-fund-investment/

Aavishkaar Venture Management Services (AVMS), the social venture arm of Aavishkaar-Intellecap Group, has made the first close of its newest impact investment fund at $95 Mn (INR 620 Cr). As stated by Group founder Vineet Rai, the Aavishkaar Bharat Fund will focus on financial inclusion, employment, and promoting grassroots entrepreneurship.

Among the backers of the Aavishkaar Bharat Fund are large institutional investors like the UK government-run development finance institution CDC Group, Small Industries Development Bank of India (SIDBI), National Bank for Agriculture and Rural Development (NABARD) as well as family offices including that of Hero Enterprise Chairman Sunil Munjal, to a name a few.

Speaking about the fund, Rai said, “Generally, Aavishkaar has either been the first investor or has been the creator of the company. We used to make small investments, generally $306K (INR 2 Cr) to $1.5 Mn (INR 10 Cr). But from this fund, in the first three investments itself, we are making an investment of around $20 Mn (INR 130 Cr).”

So far, Aavishkaar has made more than 50 investments at various stages of growth. It has raised six funds, delivering commercial returns with a total of about $201 Mn (INR 1300 Cr) under management. The startups that have raised funding from Aavishkaar in the last few years include luxury lifestyle brand Mela Artisans (2014) and curated ecommerce platform Jaypore (2016), among others.

The firm made its international foray with Aavishkaar Frontier Fund, which was used to back up-and-coming businesses in the following countries: Indonesia, Sri Lanka, Bangladesh and Pakistan.

Analyst questions

- How is Aavishkaar Bharat Fund different from rest other funds managed by Aavishkaar?

- Being an impact investor your focus is in underserved areas, are you able to generate returns at par with other PE funds?

- You have been in the industry for two decades, how do you see the industry progressing? Have you seen a surge towards impact investing by other players in the market?

- What is your contribution in the investee company except for capital?

- Are there any challenges that you face while raising capital for these kinds of funds?

You must be logged in to post a comment.